Energy Storage as Transmission Explained

by Blackridge Research

The latest trend is that power transmission companies around the world are increasingly looking at energy storage technology to defer or replace transmission system upgrades. How this works is energy storage is placed along a transmission line and operated to inject or absorb power, mimicking transmission line flows. Going with names like “virtual transmission” in Australia and “GridBooster” in Germany, projects totaling over 3 GW of capacity are poised to increase system efficiency and reliability across the world.

Storage as transmission offers an array of benefits over traditional transmission infrastructure. They are faster to deploy, have smaller footprint,...

Marrone Bio Innovations: Answers for Agricultural Angst

by Debra Fiakas, CFA

The world needs more food. At least more of the food produced in the world’s fields needs to end up in the mouths of humans and their animal friends. According to the United Nations, the world’s farmers produce enough food to feed everyone, yet over 800 million people routinely go hungry. This is due in part to the ancient and ongoing practice of selecting plants for high yield. The consequence is a selection of highly homogenous food crops. There are thousands of edible plants growing on Planet Earth, but only a dozen crops account for 75% of all human calories. Lack of...

Water Stocks in the Americas

by Debra Fiakas, CFA

The post “Water: Invisible Crisis” introduced a new series on water supply in Latin America, describing the lack of access to quality water despite a bountiful supply of rainfall and snow melt. As the series has unfolded we have learned that water supply in Latin America is largely a local government undertaking. Investment opportunities are limited to water management companies that sign on to operate government-owned infrastructure or water treatment solution providers.

Water supply to the north has inched further into the commercial realm. A discussion of water investment would not be completed without a look at private water suppliers in the...

Impossible Foods Launches Impossible Pork

by Helena Tavares Kennedy

It began with beef without the cow, even leather without the cow, and now we wave goodbye to pork from the pig with the news that Impossible Foods has launched pork made from plants.

Not only that, but Impossible Foods is going beyond the Impossible Whopper and expanding their work with Burger King in a new Impossible Croissan’which using Impossible Sausage made from plants as well. That will be available in only some Burger King locations starting in late January.

What’s in it?

Impossible Foods says their new pork protein is mostly made with soy protein, coconut oil, sunflower oil....

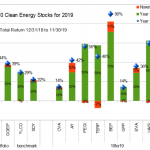

2020 Hindsight: Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Sometimes it's good to be wrong.

When I published the Ten Clean Energy Stocks For 2019 model portfolio on New Year's Day 2019, I thought we were likely in the beginning of a bear market. With 20/20 hindsight, that was obviously wrong.

I made the following predictions and observations:

"he clean energy income stocks which are my focus should outperform riskier growth stocks."

"eep value investors will put a floor under the stock prices of these ten stocks."

"I could also be wrong about the future course of this market."

"I have a history...

Ten Clean Energy Stocks for 2020

by Tom Konrad, Ph.D., CFA

If it's tough to follow a winner, 2020 is going to be an especially tough year for my Ten Clean Energy Stocks model portfolio.

I've been publishing lists of ten clean energy stocks that I think will do well in the year to come since 2008. With a 46 percent total return, the 2019 list has had its best year since 2009, when it managed a 57 percent return by catching the rebound off the 2008 crash. This year's returns were also achieved in the context of full- to over-valuation of most of the clean energy...

10 for 2020 Preview

by Tom Konrad, Ph.D., CFA

Over the last couple years, I've given paying subscribers a chance to see my annual list one trading day early. I did not get it organized this year, but I just got an email from a past participant who was interested. I initially said no, I'd rather be fair to all readers but then I thought maybe there are others who can benefit.

I currently have a list of 11 stocks, which I will be narrowing down to 10 after the close on Dec 31st. Anyone who forwards me (tom@thiswebsite.com) an email confirming a donation in...

Trading Options and Foreign Stocks: When Low Trading Volume Is Not Illiquid

Tom Konrad, Ph.D., CFA

As usual, I am putting together my Ten Clean Energy Stocks for 2020 model portfolio for publication on January 1st or 2nd next year. As I wrote in November, expensive valuations for the US clean energy income stocks I specialize in mean that the 2020 model portfolio will contain more than the usual number of foreign stocks, and I am also planning on including a little hedging with options.

Why option strategies are now affordable

I have never included options in the model portfolio before because the commission structure did not make it cost effective for small investors...

Biofuel Industry Reacts To EPA New Renewable Fuel Standard

Yay or Nay for EPA? RFS Volumes out for 2020, Biodiesel for 2021 – What’s the reaction from industry?

by Jim Lane

What’s the reaction from industry? Coal for Christmas?

Should Santa bring coal for EPA’s stocking this year? Do the biofuels and agriculture industries think the EPA just put coal in their stocking? Is it thumbs up or thumbs down from biofuel industry advocates on last week’s U.S. Environmental Protection Agency renewable fuel volumes? What about the exempted volumes?

The Ruling – Rotten or Respectable?

First, a bit on the EPA ruling that establishes the required renewable volumes under the Renewable Fuel Standard (RFS) program for...

Water Supply with a Latin Twist

by Debra Fiakas, CFA

Depending upon how you string the words together, it is possible to make Latin America sound like the world’s water fountain or the location of a putrid pond out of which hapless citizens ladle their drinking water.

Try these lofty words.

Four the world’s largest rivers and four of the world’s largest freshwater lakes can be found in the Latin America region with a run-off area encompassing 5,470 cubic miles. The rainwater and snowmelt running into these water bodies represents 20% of the world’s run-off. By itself Brazil is home to 20% of the water resources of the entire world.

Here...

Water Treatment With a Latin Beat

by Debra Fiakas, CFA

The post “Water: Invisible Crisis” on December 6th highlighted the building problem of inadequate supplies of quality water in Latin America. The World Water Council’s Comision Nacional Del Agua reports that As much as one-third of the Latin America population lacks access to safe water. Unabated pollution and lack of water treatment have been identified as culprits. In South America, for example, 40% to 60% of water comes from aquifers that are subject to increasing pollution from untreated run-off from mining and agriculture operations.

Our survey of Latin America water sector in South America found an interesting mix of pollution abatement and water treatment...

Ten Clean Energy Stocks For 2019: Still Party Time

by Tom Konrad Ph.D., CFA

2019 has become another blockbuster year for the Ten Clean Energy Stocks model portfolio and, to a lesser extent clean energy stocks and the broad stock market as well. I'm frankly surprised to see the party continuing. The continued spiking of the metaphorical punch bowl by the Federal Reserve with interest rate cuts certainly has a lot to do with it. I had expected those cuts to be both fewer and less effective.

Which all goes to show that it's always a good idea to hedge one's bets in the stock market. At least in part...

How Free Commissions Change The Game For Small Investors

Why Free Commissions are a Game-Changer For Small Investors

by Tom Konrad, Ph.D. CFA

Last month, Charles Schwab (SCHW), E-Trade (ETFC), and Ameritrade (AMTD) all dropped their commissions for online stock trades to $0. They also dropped commissions on options contract to $0.65 per contract.

The change opens up cost-effective individual stock investing to even the smallest investor, and also allows many more investors to use option strategies. For those wondering if there is a catch, and how these brokers will make money with $0 commissions, see here. The short version is that they make money on your cash deposits, and from...

Aviation Biofuel Overview

by Debra Fiakas, CFA

The aviation industry contributes about $2.7 trillion to the world’s gross domestic product. It may seem like a big number, but that is only 3.6% of the world’s wealth. Aviation may be a minor player in terms of creating wealth, it is a big culprit in climate change. Flying around the world accounts for as much as 9% of humankind’s climate change impact. Indeed, compared to other modes of transportation, flight has the greatest climate impact.

The negative impact of carbon emitted by aircraft is made even worse by the fact that the emissions point is mostly at cruising altitudes high...

North American Outlook on Biofuels Challenges and Opportunities

Challenges and Opportunities in Biofuels

By Steve Hartig, Former VP of Technology Development at ICM

The North American biofuels market can be split into three main segments all of which have major dynamics. What I would like to do is give a high-level overview of what I see as some of both the challenges and opportunities across these.

Ethanol which is a produced from corn and sorghum in about 200 plants mainly across the Midwest and blended at about 10% with gas. Majors such as POET, Green Plains, Flint Hills, Valero, ADM and Cargill do a bit more than half of the 16...

Ten Clean Energy Stocks For 2019: Pattern Buyout, Analyst Downgrades

by Tom Konrad Ph.D., CFA

Although valuations and political uncertainty have me spooked, October was another strong month for the stock market in general and clean energy income stocks in particular.

While my broad income stock benchmark SDY added 1.6% for a year to date total gain of 19.6%. My clean energy income stock benchmark YLCO did even better, 2.7% for October and 29.7% year to date. The 10 Clean Energy Stocks model portfolio fell somewhere in between for the month (up 1.8%) but remains unchallenged for the year to date (40.7%). My real-money managed strategy, GGEIP, lagged as I reduce...