Tag: MIXT

Ten Clean Energy Stocks For 2018: Oddballs Spring Back

After a stormy winter for the broad market and clean energy stocks, including my picks, March and April brought relative calm. Better yet, my model portfolio has rebounded from its February lows, although its benchmarks (SDY for the broad market of income stocks and YLCO for clean energy income stocks) have mostly been treading water.

The gains were led by two of my less conventional clean energy picks, Seaspan (SSW) and InfraREIT (HIFR). Seaspan owns (mostly very efficient) container-ships, which most people would not associate with clean energy, but which I include because they they are much less energy intensive...

Ten Clean Energy Stocks For 2017: Taking Profits

By Tom Konrad Ph.D., CFA

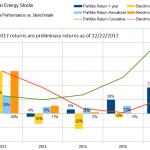

2017 is turning into a second banner year in a row for my “Ten Clean Energy Stocks” model portfolio. I expected at best to make high single digit returns after the impressive 20% (while my benchmark fell 4%). Instead, the portfolio produced a 36.8% total return while its benchmark is up 19.5% with only four trading days left in the year.

Such returns are obviously cause for celebration, and also for profit taking. I plan to replace at least five of this year's list with new stocks in the 2018 (tenth annual) “Clean Energy Stocks” model...

Ten Clean Energy Stocks For 2017: Fall Forward

Tom Konrad Ph.D., CFA

Yieldco Buyouts

A Canadian Yieldco Invasion sent clean energy stocks running up in October and November. My Ten Clean Energy Stocks model portfolio benefited from the purchase of 25% of Yieldco Atlantica Yield (NASD:ABY) by Canadian utility and renewable power generation conglomerate Algonquin Power and Utilities (TSX:AQN or OTC AQUNF), which was one of my Ten Clean Energy Stocks for 2009.

Rumors had circulated that the Atlantica stake would be purchased by Brookfield (NYSE:BAM) and its Yieldco Brookfield Renewable (NYSE:BEP). If there were discussions, Brookfield must have decided that it had enough on its plate with the recently...

Ten Clean Energy Stocks For 2016: Just The Numbers (9-1 to 10-11-16)

Tom Konrad, Ph.D., CFA I missed my regular monthly update of my Ten Clean Energy Stocks for 2016 model portfolio at the start of October due to vacation. This mini-update will just give the numbers through October 11th, without the regular discussion of company events. I'll follow up in early November covering highlights for the full two months. As you can see from the chart below, the portfolio and all sub-portfolios did very well by outperforming their benchmarks by 3% to 12% for the six week period. See the May...