by Tom Konrad Ph.D., CFA

Four weeks ago, I predicted that the 12% market correction we had seen would turn into a true bear market. Bear markets are often defined as a decline of more than 20% for the major market indexes, but I find it more useful to focus on long term changes in investor sentiment.

What I did not predict was just how severe the effect of the coronovirus shutdown would be on the economy. I thought we would need the combined of the effect of the shutdown and investors re-assessing their risk tolerance to bring us into full bear market territory. Now, a month later, it seems clear to me that the economic effects alone are enough to justify a 20% decline.

I still believe that the current period of uncertainty will have a long term effect on investor risk tolerance. That means that even when we have the economy functioning back at 2019 levels (which I don’t expect until 2022) the stock market will probably be trading at a lower valuation than it was in January 2020.

Readers, mark your calendars with a note to check if the S&P 500 is trading above its peak of 3,393 in January 2020. If it goes above that, do me the favor of calling me on it… I’ll write a mea culpa, and hopefully will be able to draw some lessons that will let all of us learn from my mistakes.

First Quarter Performance

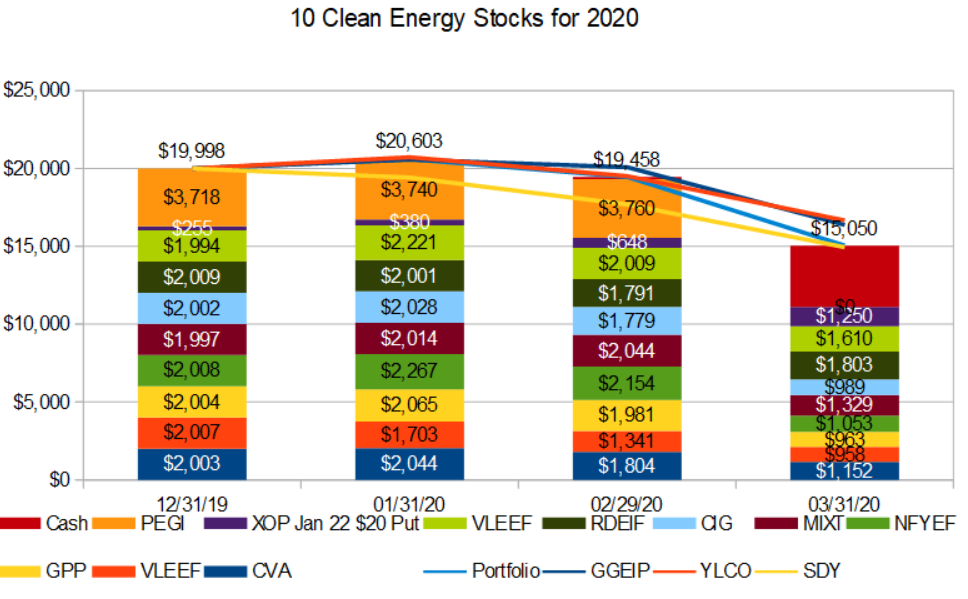

Despite a successful hedging strategy, my Ten Clean Energy Stocks for 2020 model portfolio has now lost almost 25% of its value since the start of the year. This is better than its broad market benchmark (SDY), which is down a little over 25%, but it is well below the rather resilient performance of its clean energy income stock benchmark, the Yieldco ETF YLCO.

My real money managed portfolio, the Green Global Equity Income Portfolio (GGEIP) has done almost as well as YLCO, and is down 18% for the year to date.

Keeping Perspective

The losses all around are large, and when you are looking at a portfolio that’s down 20% to 30% year to date, it’s easy to get overwhelmed. This interferes with good decision making. In order to maintain my perspective, I also like to look a longer time periods. Fortunately, 2019 was a blockbuster year for my portfolios, so zooming out a longer time period can be comforting. Here are the returns for the portfolios and benchmarks over the last 12 months and since January 2019:

| First Quarter 2020 | last 12 months | 1/1/19 to 3/31/20 | |

| 10 Clean Energy Stocks | -24.7% | -7.7% | +10.2% |

| GGEIP | -18.1% | -0.9% | +15.8% |

| SDY | -25.3% | -17.5% | -7.1% |

| YLCO | -16.7% | -1.3% | +14.5% |

It’s a little easier to think about the next move when you think of your account as up 10% to 15% since the start of 2019 (like both clean energy income strategies and their clean energy benchmark) as opposed to thinking of it as down by one sixth to one quarter since the start of the year.

What’s Next?

Now that we have reassured ourselves that, despite the ongoing bear market, we’ve still made money by investing in clean energy income stocks since the start of 2019, it’s a little easier take the long term view going forward, rather than focusing on “making up” for recent losses.

The sharp rally we have seen in the stock market since the recent low on March 23rd is most likely driven by people who are worried about missing out on the recovery and focused on “recovering” recent losses. I think many are rushing in too quickly.

If the stock market were only reacting to the Covid-19 shut down, the 25% decline in SDY so far this year is probably enough to compensate for the lost earnings. But if I am correct that this downturn will cause investors to re-evaluate their overall risk tolerance, the bear market bottom is still somewhere in our future.

How the Bear Might Play Out

I expect that as investors grapple with the new reality, the market will remain volatile for months to come. We will see multiple sharp rallies (like the one since March 23rd) and declines. The March 23rd lows will be broken for many stocks, and likely for stock market indexes as well. I expect the final market lows to be ten to twenty percent below most stock indexes’ current level. When the true bull market finally begins, the continuing high volatility will likely mask the increase. There will be continued sharp declines, but successive bottoms will not quite reach the previous lows, and the long term rise will only be clear in retrospect.

All of the above are simply my best guesses. With any prediction so complex, I will almost certainly be wrong about parts of it. While that is what I expect, I also expect to be surprised.

Trades

Although I do not think we have reached the bottom, the incredible decline in fossil fuel stocks leads me to believe that the risks and rewards of owning the January 2022 $20 Put on XOP have changed. For the purpose of the model portfolio, I am selling it at $12.50, netting $1,250 cash for the portfolio to reinvest. This is the midpoint of the bid and the ask price at the close on March 31st. As I write on April 1st, XOP is down $1.46 from last night, so readers may be able to get a little more for it.

I will also note that the buyout of Pattern Energy Group was completed in March, meaning that we did not collect the expected $0.422 dividend which would have been awarded on March 31st, but the portfolio did collect $26.75 per share in cash. Combined with dividends from other holdings so far this year, the portfolio has $5,193 available to invest.

Given that volatility remains high, and I expect further sharp declines followed by sharp rallies, selling cash covered puts is likely to be a profitable strategy in the coming months. So rather than selling at current market prices, I will sell using good-til-canceled limit orders. If the market does not hit my limit prices, the portfolio will still have the cash. If it does, we will have one or two new positions.

Here are the orders I will be using for the model portfolio:

Sell to Open 1 HASI Oct 16 2020 $20 Put, at a limit price of $4 or better. (This will reqiure $1,600 in cash to secure the put – $2,000 minus the $400 premium.)

Sell to Open 1 EBAY Jan 15 2021 $28 Put, at a limit price of $3.60 or better. (This will require $2,440 to secure the put.)

Sell to Open 1 CVA Sep 18 2020 $7.50 Put, at a limit price of $1 or better. ($650 required to secure the put.)

If the limit prices above are reached, I will add the puts to the portfolio in the next monthly update.

Stock notes

I will discuss why I like Hannon Armstrong (HASI), Ebay (EBAY) and Covanta (CVA) for selling cash-covered puts at the current prices in another update over the next few days. For now, I want to get you these trades as quickly as possible. Stay Tuned!

Disclosure: Long CVA, GPP, GPRE, VLEEF, NFYEF, MIXT, CIG, RDEIF, VEOEF, HASI, EBAY.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Some of us bought Put options on S&P and/or other indices (CAC 40, etc.), not being able to do the same for XOP. (Note: thank you and thank goodness!) Should we sell some on the next dip, or should we wait until indices collapse to a more serious extent?

I would use a GTC limit order to sell at a little higher than the current market price… it’s less about when you sell than for how much. I did the same for my XOP puts a week ago, but I’m trying to keep the trades in the model portfolio simple. (And it turned out that my selling price of $12.50 was the same as the current bid-ask midpoint anyway.)

But, if we have enough cash lying around (because, say, we have sold other positions not in your portfolio taking advantage of the current lull), should we sell any Put options on indices at all?

The decision to sell the XOP puts had more to do with profit taking than freeing up cash for new investment. For non-oil index puts I would wait a little longer than for oil related puts for these… you pretty much want to sell (or let them expire) near the market bottom for that particular index to maximize the gain. But I feel like the hedging purpose of the puts has basically been served… it’s really kind of a six of one half dozen of the other. I chose to sell the XOP puts now in part because I wanted to do all the trades at the same time. but next month or the month after will probably be fine times to sell as well.

Also: if for some reason we are unable to Sell to Open Put calls, should we simply buy some of the stock you mention if it dips below a certain level? “A certain level” here would have to mean not the prices you’ve mentioned ($20, $28, $7.50) but a little below – say, the break-even point: $16, $24.4, $6.5, if I’ve got this correctly.

It’s hard to get the same risk reward profile of a put option with the common stock, but yes, I would buy a smaller amount of the same stocks probably halfway between the break even point and the strike price. So with HASI $20 Puts sold for $4, I’d put in a limit order to buy 50 shares at $18. I was planing on talking about this in the follow-up article. So much to write, so little time. Or if you have commission-free trades, you could hedge your bets more, and put in GTC limit orders for even smaller quantities. So instead of an EBAY $28 put sold for $3.6, you could put in limit orders to buy 10 shares at each starting at the strike price with 50 cents between the orders: so you would have GTC limits for 10 shares each at $27.50, $27, … , $23. If EBAY drops to $23.50 you will end up with $100 shares at an average purchase price of $25 plus some dividends, while the put seller would get 100 shares at $24.40. If it falls less, you wil get less than 100 shares at a higher average price, but you will have more upside than the put seller- especially if the stock is above $28 in Jan $2021, since the put seller will only get the $360 option premium, and you will have say 50 shares bought at an average price of around $26.50 which are now trading for $30 or more, plus the dividends paid since you bought.

Buying stock is always a more bullish trade than selling cash covered puts. Buying stock is a bet that the stock will rise. Buying puts is a bet that the stock won’t fall very much.

Understood. And (as I was about to say) obviously you are right that “a certain level” should be between the break even point and the strike price – buying stock at the break even point would make selling the cash covered put into a superated strategy.

If you can sell covered calls, a cash covered short put is almost exactly the same thing as owning the underlying stock and selling a covered call.

Also, does it matter whether the calls are “American-style” (=redeemable at any point before the due date) or “European-style”?

American v European style does make a difference in terms of what you are buying and selling, but not very much…

I think many of us would be very interested in your thoughts about HASI. 2008 was a good year for this company. Could they pull something similar off? They’re offering an 8% dividend right now.

Or are we better off investing in tried and true utilities like BEP?

My answer on HASI vs BEP is that you should probably own some of both. I think HASI has the better valuation right now, which is why I picked it.

Thanks for this, Tom. What do you think about selling a put on AY (Atlantic Yield) at a strike price of 17.50?

I think that’s reasonable if you don’t own a lot. CWEN/A is another I’mm selling puts on, but for the purpose of this list I had to keep it to 2.

I’ll keep most of my powder dry.