by Paula Mints

Every day the solar industry’s maturity is announced in company meetings, at conferences, in articles, and on Twitter, among other means, and through various media. The industry’s presumed maturity is held as a badge of its success by most and used as a PR message by many.

The assumption of the industry’s maturity, primarily based on its size, low module prices, and low tender bidding, things that taken either individually or as a whole does not indicate ma-turity. Teenagers, after all, exhibit growth spurts even as their brains continue to develop through their early twenties.

Teenagers also declare their independence, overestimate their abilities, occasionally act rationally, and go through emotional turmoil. For most people, these behaviors decrease over time.

The solar industry is still in its adolescence, still experiencing strong growth spurts, periods of painful consolidation, all while trying to figure out what it wants to be when it grows up. In its journey through normal teenage angst, it has pigeonholed itself as a commodity, mired itself in narrow margins, proclaimed the need for basic research passé, sometimes ignored quality issues, and turned away from calling out poor working conditions in countries such as Malay-sia, Thailand, India, Vietnam, and China.

On a positive note, the primary mission of the global solar industry is now and has always been to change the way the world sources its electricity and to contribute to the fight against global warming.

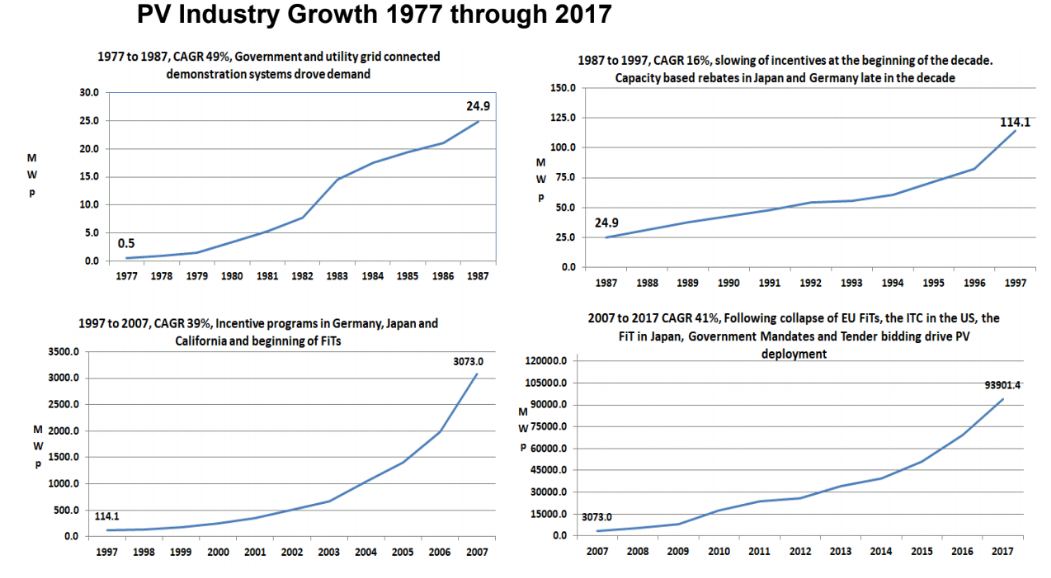

Much has been written about industry stages of growth, with all descriptions similar to the human lifecycle from infancy through adolescence, adulthood, and decline. An industry in its growth stage experiences strong growth spurts and/or sustained periods of growth. A mature industry sees its growth slowing, and declining industry, well, embraces the status quo as better than its demise.

When will the solar industry’s adolescence end?

The growth phase of an industry’s lifecycle does not require an >30% upward trajectory.

Typically, there will be some volatility, some vulnerability to shocks, and even some down years. Industries may skip right over maturity to decline. Sub-industries within the primary category will experience their own phases. For example, amorphous silicon went through a startup phase, growth, before leapfrogging over maturing straight to its decline phase.

In the case of the solar industry, its mature phase will be apparent once it begins displacing

conventional energy as an electricity source. That is, the industry will be mature when its primary competition is other renewable energy technologies, and when replacements are a significant percentage of annual shipments. The industry is at least a decade away from the beginning of its mature phase. Figure 4 offers a forecast to 2023. Given the rapid turnaround of China’s Central Government concerning its domestic solar industry, as well as growth in some European and Middle Eastern countries, accelerated growth is possible for 2019, potentially into 2020. For accelerated growth to be possible through 2023, significant additions of poly, wafer, and cell (including thin film) capacity are required.

Maturity often requires sacrifice – does the PV industry want to mature?

For the PV industry to make a reasonable claim of its maturity, it would need healthy (or at least sufficient) margins all along the value chain. It would need to be firmly established as an electricity choice consumers make for economic and energy stability reasons. Climate change is an energy stability reason to choose solar as an electricity source.

For the solar industry to mature the electricity transmission and distribution infrastructure –

globally – needs revamping. The electricity-using public needs educating and needs to value and practice conservation. The current utility structure (globally) needs to change – think local and learn from off-grid. Storage technologies need to mature.

The industry will need a variety of more-or-less evenly distributed markets. It cannot mature with one market absorbing ~50% of its product.

Maturity will mean an investment in educating end users to expect prices to rise in support of higher quality and future product development. Supporting healthier margins (>30%) will cost some demand in the short run, but it will also allow for needed technology development that brings down costs even further in the future.

Maturing industries are on the edge of decline and fight against the newer technologies that will someday displace them. Conventional energy is mature and on the edge of decline. Solar and other renewable technologies are poised to push oil, gas, and coal over the decline edge.

Solar can help supplant conventional energy, and eventually, it arrives at its mature phase. When this happens maybe it can rewrite the rulebook so that it does not face decline when some upstart, whippersnapper new technology hits its growth stride, or, when oil, natural gas, or even coal attempt to displace it and reclaim share.

Paula Mints is founder of SPV Market Research, a classic solar market research practice focused on gathering data through primary research and providing analyses of the global solar industry. You can find her on Twitter @PaulaMints1 and read her blog here.

This article was written for SPV Reaserch’s monthly newsletter, the Solar Flare, and is republished with permission.