“The global economy likely faces an economic crash of horrible proportions in 2020, not for want of a nail but want of low-sulfur diesel fuel,” writes renowned energy analyst Phil Verleger in a note this month titled “$200 Crude, the Economic Crisis of 2020, and Policies to Prevent Catastrophe”. Not good timing for a White House re-election effort if, as expected, the blame falls on lack of preparedness in the 2017-2020 run-up to the projected crisis..

It’s a dire scenario but there’s hard data behind it, and though few go as far as Verleger, almost every expert is warning of a low-sulfur diesel; refining capacity crunch. You can read the Verleger note in full here.

The root cause? A rule agreed by the International Maritime Organization in 2008 and confirmed in 2016 to reduce sulphur content in marine fuels from 3.5 percent to 0.5 percent beginning in January 2020.

The proximate cause? Neither shipping owners nor oil refiners found a way to comply either through fuel-switching, crude-switching to bring in less sulphur-laden “sour” crudes, or to add enough refinery equipment to remove sulphur.

What’s driving prices? The need to ncrease ULS diesel supply, as this Verleger chart analyzed.

As the National Biodiesel Board’s Technical Director Scott Fenwick told The Digest:

The IMO (International Maritime Organization) has set new sulfur specifications for all marine fuels to not exceed 0.50% sulfur by the year 2020. Right now, vessels are able to use high sulfur fuels in international waters but must use the same fuels within coastal waters (up to 200 mile radius) in what are called ECA (Emission Control Areas). Typically, marine vessels use the dirtiest fuels available. In order for ships to meet these new criteria, significant amounts of ULSD (ultra-low sulfur diesel fuel) will be need to be used for blending or in place of typical marine fuels. Biodiesel is another option for blending.

NEXANT’s Ron Cascone added:

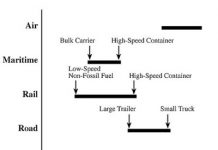

Instead of “playing checkers” with refinery modifications or scrubbers for a short term fix, we should be “playing chess” with low-sulfur, low NOx, and low-carbon solutions like biofuels or methanol, LNG, or DME, which can be bio-based. The stakeholders needing to examine strategies in this area include, besides the refiners, fuel brokers, and ship owners, also companies that use ocean shipping (that is, nearly all manufacturers, retailers, etc.) and have commitments to lowering carbon footprint (that is, many companies).

Why were refiners and shipping companies caught flatfooted?

There was an expectation that everyone would kick the can down the road, and extend the deadline to 2022. But the deadline was not extended.

Why can’t the US and others simply frack their way out of a supply problem, as in the past?

It’s not something you can frack your way out of. It’s not only about crude inventories but about low-sulphur refining capacity.

Tough timing for a shortage

The shift in demand — 2 million barrels per day — comes at a time when global diesel demand for road transport and other uses is on the rise. The resulting shortage of low-sulphur diesel leads to the bid-up in “light sweet” crudes and a shift to producing more diesel and less gasoline from those crudes — and the price increase that facilitates this supply and demand shift is in the $160 to $200 range. Enough to tip the global economy into recession or depression, says Verleger.

As Verleger points out, there’s already a world commodity except perhaps wine that has so much variance, and especially so in sulphur content. As Verleger notes, “the diesel fuel produced from Nigeria’s best crude oil has a sulfur content of 0.13 percent when refined, while the diesel refined from Middle East light crude oil, one of the most common crudes, contains 0.53 percent. The Arab Heavy crude that generally upticks in supply to meet demand increases contains between 1.8 and two percent sulfur. Shale oil from fracking operations is loaded with sulphur — so it is not a case where fracking operations will necessarily save the day.

So, the swing producer necessary to moderate prices when demand shifts is going to be hard to find, despite the fact that, as Verleger notes, “the public-health arguments for the IMO 2020 rule are incontestable and compelling,” and the refiners and shipping owners have had 12 years to make ready.

The impact?

Verleger writes: “The crude price rise will send all product prices higher. Diesel prices will lead, but gasoline and jet fuel will follow. US consumers could pay as much as $6 per gallon for gasoline and $8 or $9 per gallon for diesel fuel.”

Verleger included this striking analysis of the short-term impacts of marine diesel rule changes, compared to other oil price events from history.

Will compliance be forgotten? Can the world simply embrace sulphur-laden marine fuel forever?

IMO’s secretary-general Kitack Lim told Platts recently: “At this point, the regulation which brings into force the 0.5% limit in sulfur in fuel oil from January 1, 2020 cannot be changed from a legal perspective, so there is no possibility of delay.” As far as individual countries simply ignoring the requirements for operating with low-sulphur fuels, it’s worth noting that the predictions for $200 oil do not relate to low-sulphur oil, but all oil.

Mitigation steps that might be taken

There are several options, although installing equipment faster at global refineries does not appear to be one of them. Fuel-switching to liquid natural gas is one. Adding sulphur-scrubbing equipment to ships is another (unlikely). Re-visiting the rule is a third, and very unlikely — the IMO recently voted 171-3 to reduce greenhouse gas emissions. The US could release light sweet crude from the Strategic Petroleum Reserve. Non-compliance is a risky option — shippers that violate the rule are likely to have their insurance invalidated, based on recent IMO moves.

The biofuels option: biorefining capacity eases the oil refining strain

As Fenwick told The Digest. “Biodiesel will play a role, whether it is on the ship, or backfilling the low-sulphur road transport volumes that are diverted from traditional oil refineries to serve the new demand for low-sulphur marine fuel.” Already biodiesel and renewable diesel have extended the global refining capacity and fuel supply by 4-4/12 percent. There’s an opportunity to step up here to supply more low-sulphur fuel, and it is estimated that one billion gallons per year could be added to the supply of low-sulphur fuels./

As we reported in March 2017, the International Standards Organization has created the new F class of marine fuels that allows for blending of up to 7% of FAME biodiesel, allowing for more 10 ppm sulfur automotive fossil diesel to be used in the marine fuel pool. Adding Cloud Point and CFPP (Cold Filter Plugging Point) to the specifications are meant to help increase the uptake of biodiesel in marine fuels by letting operators know when fuels need to be heated.

Fenwick commented, “A few years ago there were no grades. Those grades are minimal demand right now as shippers become used to them. I expect they will become significant in the next two years.”

And, there’s renewable diesel. Although production quantities are small, so far, in the context of the global marine trade, $160-$200 per barrel low-sulphur crude prices will shine more attention on sulphur-free biodiesel and renewable diesel. For example, a 7 percent biodiesel blend with Middle East light crude oil (0.53 percent sulphur), brings that fuel into compliance. And there’s reason to cheer on that score.

An an Exxon Mobil found in a study on marine biodiesel:

The results obtained during the biodiesel trial have shown no negative impacts. Biodiesel has been used for many years in similar engines in land-based applications with no adverse effects. Biodiesel blends (B5 and B7) can be utilized in the marine environment onboard a properly operated and maintained vessel with a diesel engine. As with any fuel, proper storage and handling are key in maintaining fuel quality to ensure trouble-free operation.

How much excess capacity is available?

The estimates we have received suggest that as much as 1 billion gallons per year in excess capacity is in place around the world — or 65,000 barrels per day. Enough to support 7 percent blends of one million barrels per day. And, when you think about it, global biodiesel and renewable diesel could all be put to use in supporting a transition to low-sulphur fuels — and with as much as 4 billion gallons of capacity, there’s enough to support the 2 million barrels per day volumes that analysts say are needed — at 14 percent blends. That supports compliance via all that Arab Heavy .

Combined with some fuel switching to LNG, and targeting the right crudes for expanded diesel supply — we might find that global recession might well be averted. And, should actions not be taken to bring a supply of biodiesel and renewable diesel into marine fuels — we might find that $9 per gallon US fuel prices might well provide the incentive necessary to re-invigorate the discussions around alternatives.

Who is impacted?

Companies like REG [REGI], World Energy, Diamond Green (the Valero-Darling [DAR] Joint Venture), Ensyn, Gevo [GEVO], Fulcrum BioEnergy, Red Rock Biofuels — all of these are in the conversation when it comes to expanding diesel capacity. And a host of smaller biodiesel producers in the US, across the Americas and in Europe and Asia. Also, think DME – such as Oberon Fuels.

What can Congress do?

Distribution of this Verleger report on Capitol Hill might help. Experts tell us that ‘anything that educates the Congress that petroleum is a global market with a global price is a good thing. Also, the US government might well mandate more biodiesel to make sure those backfilling volumes of ULS diesel is available for road transport.

NBB’s Scott Fenwick observed, “Congress did create the RFS to extend and expand the nation’s refining capacity – and with low carbon, low sulphur technology in mind. They could not have foreseen this particular supply crunch but they did prepare us for a crunch with the RFS

Further reading

Here’s a relatiovely definitive report on the topic from NEXANT:

PERP 2017S7: Technologies to Meet New Bunker Fuel Specifications.

Bio-methanol is covered, along with other feasible bio-bunkers in Nexant’s recent report, Biorenewable Insights: Biofuels for Land and Sea. This report presents technoeconomics for a very wide range of land and marine biofuels . The TOC is here and the abstract is here.

And, could bio-methanol be a significant player in marine fuels in the future? The Methanol Insitute believs so, and here’s their latest deck exploring the options and opportunities.

In addition, for Nexant’s somewhat more conservative counter-view to Verleger’s, see the TOC for Petroleum and Petrochemical Dynamics, Refined Products, December 2017.

What (if any) will the impact be on electricity prices be in the US? Will these sharply rise too?

I’d expect it to be minimal… there is very little connection between the oil market and the electricity market in the continental US. The exception would be islands like HI and PR (esp PR)… they get a large portion of their electricity from diesel.