Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive market. Market Research Nest, an industry research firm, estimates the global ammonium bicarbonate market was valued at $1.4 billion in 2017. China is the largest producer of ammonium bicarbonate, with a market share near 90% worldwide. Shandong ShunTian Chemical Anhul Jinhu leads the China producers. BASF is a leader in the U.S. and European markets.

The market for ammonium bicarbonate has actually been shrinking in recent years because of environmental concerns. It decomposes into ammonia, carbon dioxide and water. In a closed area the ammonia can be toxic. It is the feedstock source for production that is worrisome for the environment.

Conventional processes for ammonium bicarbonate fertilizer are based on proven technologies and have been well optimized over decades of production. Typically carbon dioxide is captured from gases obtained while gasifying coal. The CO2 is absorbed into a carbonated water solution until crystals form. The crystals are then separated from the solution by filtration or centrifugation.

Crop producers cannot claim an organic crop when using ammonium biocarbonate created by conventional methods since it is a by-product fossil fuel production. This is one factor in the dwindling market for conventional fertilizers. Bion anticipates that its organic-qualified ammonium bicarbonate can regain interest among farmers trying to upgrade their crops to organic status.

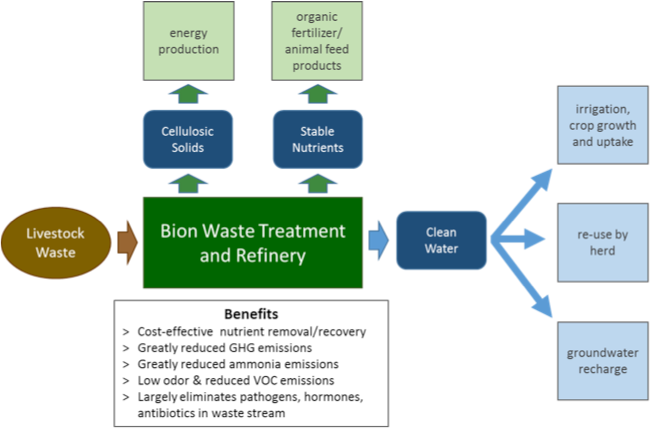

Bion’s patented process is also expected to have environmental appeal for livestock producers, whether dairy, beef or swine. Livestock production is responsible for as much as 20% of greenhouse gases on the planet. Bion pledges to configure its system to the particular needs of the location and help in meeting nutrient reduction mandates imposed by the U.S. Environmental Protection Agency. Under testing at pilot plants the systems removed as much as 95% of the nutrients in livestock effluent and reduced greenhouse gases by 90%.

Bion has not yet produced revenue from its technologies. The company uses about $1.5 million in cash each year to support operations. Management has been selling common stock and borrowing to raise capital. As of the end of March 2018, Bion had $12.5 million in liabilities outstanding and had raised $107.8 million in equity. At that time the company had only $40,403 in cash in the bank. Since then Bion has raised modest sums through the sale of common stock.

When Bion finally puts its ammonia bicarbonate systems into the market, management expects to make strong appeal to livestock producers. Bion’s CEO has touted the system’s attractive installation price and operating costs. The company will earn revenue from the sale of fertilizer and receive payments from renewable energy and greenhouse gas credits under the U.S. Renewable Fuel Standard and Low Carbon Fuel Standard.

Bion has had some setbacks with earlier versions of its system. Bion had an agreement with Kreider Farms in Pennsylvania to treat dairy waste streams, and received a loan from an infrastructure investment agency in that state. The system was commissioned in 2012, but the nutrient credit market in Pennsylvania has yet to produce meaningful revenue streams. The dairy system remains in limited operation. Bion has also moved forward with a system for Kreider’s poultry operation also in Pennsylvania.

Investors will need to wade through Bion’s murky explanation in its SEC filings of its relationship with Kreider. The debt taken on to pursue that project looms large on Bion’s balance. Additionally, prospects for realizing expected revenue seems worrisome. There may be some need to reconfigure the business model for more certain revenue streams.

Lack of transparency by a small company with little money is always a red flag. However, the market opportunity is compelling. Livestock producers are keen to find solutions to keep in good standing with the EPA and Bion has a viable solution at least from a technology standpoint.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries. Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

This is an exemplary piece of investment journalism. Thank you.