by Debra Fiakas

Saudi Arabia plans to build 17.8 gigawatts of nuclear capacity by 2032, requiring about sixteen reactors. It is an ambitious plan and one that could have a significant impact on the nuclear power construction industry. Now the Saudi government is moving forward with a bidding process with nuclear power plant construction companies. Bids are expected before the end of 2018 and signing of contracts will be sometime in 2019.

Our review of possible bidders began with Toshiba’s (6502: Tokyo) Westinghouse Electric Company and Russia’s Rosatom Group. The last two posts, “Saudi Arabia Goes Nuclear” on January 16th and “Answering Saudi Arabia Request for Nuclear Proposals” on January 19th discussed their prospects. There are more players around the world who might like to get a taste of Saudi Arabia’s nuclear dreams.

The most obvious is France’s Areva, SA (AREVA: PA), which has been a leader in the nuclear power industry since the 1950s. Majority owned by the French government, the company specializes in renewable energy and nuclear power technologies. Areva has strong Middle East connections. Its second largest shareholder after the French government is the Kuwait Investment Authority.

It is just that by the time the bids need to be submitted control of Areva’s nuclear reactor design and manufacturing interests will have been sold to the French electricity provider, EDF, SA. (EDF: FR). In December 2017, EDF agreed to buy 75% of Areva’s nuclear reactor unit. EDF has been under pressure to diversify into renewable energy sources and has already made significant investments in photovoltaic technology and solutions.

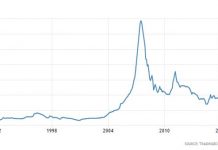

Areva has been on the skids for the past several years. Its troubles are not unique as the historic nuclear industry leaders have all been impacted by weakened interest in nuclear power since the Fukushima disaster. Weakened order books have put stress on balance sheets. Additionally, the rise of Russian, Korean and Chinese competition has been felt around the world. Areva has had some technological problems as well. Most recently the company has been under fire for faulty fuel rods sold in Areva’s nuclear fuel division.

The company reported net losses in 2014 and 2015, and was reportedly near bankruptcy as 2016 came to a close with yet another loss. However, at the beginning of 2017, the French government signaled a willingness to back the company contingent on a major restructuring. The sale of the nuclear reactor unit to EDF is a part of that effort.

Areva has a portfolio of three reactor units: the EPR, ATMEA1 and KERENA. These are modern versions of the pressurized and boiling water reactor technologies. The company makes the three designs available in range of 1,100 megawatt to 1,650 megawatt electric output. Areva also offers low power reactors in a range of 2 to 100 megawatt hours, which are sometimes used by plant operators preparing for implementation of a nuclear power program.

There are at least 100 Areva reactors installed and working around the world. Three new ones are under construction in Finland, China and France. The installed base and Areva’s longevity in nuclear power should be enough to it a serious contender with Saudi decision makers.

Two upstarts in Asia could give Areva and the others some competition. Korea Electric Power Corporation (KEP: NYSE) (KEPCO) is already working in the Middle East building what will be the largest operational nuclear power plant in the world. The project is largely completed and appears to be on schedule. KEPCO is building four of its APR-1400 reactors for the United Arab Emirates. The plant is the UAE’s first nuclear power installation and will have a capacity of 5,600 megawatts of electricity.

KEPCO’s APR-1400 is a pressurized water nuclear reactor design that is a refined version of the older OPR-1000 design. The company has one APR-1400 in operation and another seven under construction, including the four in the UAE. KEPCO’s portfolio and installed base may seem insignificant against Areva and Westinghouse, but its few successes are creating a big impression in the Middle East.

KEPCO also stands out against the other nuclear reactor companies because it is profitable. In the twelve months ending September 2017, the company reported $2.8 billion in net income on $55.5 billion in total sales. That represents a net margin of 5%. Of course, the company’s electricity sales contribute significantly to the bottom line. For a potential customer concerned about the ability of a construction company to see a project to a successful completion, the source of cash flows and cash resources may not matter.

China is also in the running through its China Nuclear Engineering and Construction Group (CNECC). The company has been at the center of China’s nuclear power program, playing a large role in making China the largest nuclear power producer in the world. Mainland China has 38 nuclear power reactors in operation and another 20 under construction. While China built its own nuclear power plants, the country has drawn nuclear technology from France, Germany, Russia and the U.S. The State Nuclear Power Technology Corporation made the Westinghouse AP-1000 the main basis of technology for the immediate future. This is evident in the CAP-1400 and CAP-1000 designs now in use in China.

While China has understandably been focused on solving its own environmental and power problems, it also exports nuclear power designs. China’s own Hualong One third generation pressurized water reactor design has become the cornerstone of its export efforts. There are now four projects under construction in China and two in Pakistan.

Shares of CNECC trade on the Singapore exchange under the symbol 601611. The stock is currently priced at a trailing price-earnings ratio is 35.2 and 30.5 times forward earnings. The current price is just above the 52-week low price, suggesting investors are less than enamored with recent performance.

The Saudi’s will not be worried as much about recent earnings or stock price multiple as they are about how well China’s reactors function. Most likely China Nuclear Engineering will have a chance to submit bids for the first two Saudi reactors. However, its limited track record outside China’s own nuclear power program may also limits its prospects.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.

The article makes the common mistake of labeling the Fukushima tsunami a “nuclear disaster.”

The damage done at Fukushima was done by huge tsunami tidal wave, not anything originating with the nuclear electricity producing reactors.

To try to label the event as a nuclear disaster would be like titling it an agricultural disaster. The utilities were victims of the tsunami just like agriculture was.

Titling Fukushima was a nuclear disaster is undoubtedly done to help the fossil fuel industry, the industry most threatened competitively by nuclear.

By the way, the U.N. investigators found the reactor breakdown neither injured or killed a single human. The tsunami killed about 15,000 human beings and injured many more.