by Debra Fiakas CFA

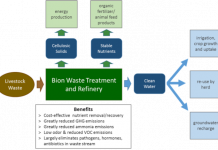

My last post outlined how Bion Environmental Technologies, Inc. (BNET: OTC/QB) is transforming livestock waste into organic fertilizer. Bion is not the only aspiring fertilizer producer. BioNitrogen Holdings Corp. (BION: OTC/PK) was recently patent protection for a process to produce urea from stranded natural gas. Instead of burning off the unwanted gases, oil and gas operators can turn it into an economically viable by-product.

There is more than just cash flow at stake for oil and gas producers. Burning off stranded gas increases harmful emission that can lead to penalties in the future. Gas flares in the Eagle Ford oil and natural gas patch releases over 25,000 tons of air pollution each year. The U.S. Environmental Protection Agency (EPA) has proposed regulations to eliminate flaring and venting during the well completion phase. Importantly, the new rules would apply to natural gas well and not oil wells, which are more prevalent in Eagle Ford. Nonetheless, there is movement in the U.S. gas patch toward eliminating pollution from burning off stranded gases.

Gas producers have some options to reduce the emission of methane and volatile organic compounds from their wells. There is available leak detection equipment and a menu of fixes to keep equipment in good working order. Bionitrogen is hoping its patented process will pique gas producer interest because it could deliver a high return on investment.

Whether investors can get a similar return on BION is another question. The stock is priced in pennies, making it more like a lottery ticket than a stock. Investors in BION will be frustrated in following the company’s progress by the fact that the company is not up to date in financial filings with the SEC.

BioNitrogen has had its problems, including the indictment of its chief financial officer for grand theft. While the criminal charges were later dropped, the news left BioNitrogen reeling from the scandal. An internal investigation into the officer’s misconduct is ongoing, but preliminarily legal counsel indeed found misconduct. The officer subsequently resigned. The company has since added new directors to the board and a new auditor has been appointed.

As appealing as BioNitrogen’s urea process might be in a world beset by climate change due to harmful emissions, BION has its risks. It seems logical that there is value in the technology, in as much as the availability of stranded natural gas as feedstock is without question. Furthermore, there are strong economic incentives for gas well owners to consider the BioNitrogen option. Unfortunately, this is a management team that has to prove its ability to execute and re-establish its reputation.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.