by Debra Fiakas CFA

Near the close of 2014, Nuvera Fuel Cells was acquired by NACCO, an operating company of Hyster-Yale Materials Handling, Inc. (HY: NYSE). Nuvera sells a proprietary fuel cell stack under the brand name Orion for industrial mobility, automotive and aerospace applications. The company also sells its PowerTap Hydrogen Station for on-site hydrogen generation (see image below). The purchase price was not disclosed and Hyster-Yale has not provided guidance on how the deal will impact its sales and earnings in 2015.

Apparently, Nuvera’s sales and earnings are not material to Hyster-Yale in the greater scheme of things. Hyster-Yale reported $2.8 billion in total sales in the twelve months ending September 2014, providing $109.1 million in net income or $6.59 per share. The company’s operations generated $105.3 million in cash during the same period.

As an investment opportunity Hyster-Yale has a mixed profile. The stock currently trades at 0.41 times sales and 10.5 times trailing earnings. Those multiples look very interesting given that Hyster-Yale has achieved a 24.6% return on equity. A forward dividend yield of 1.6% puts icing on the cake. However, one of the few sell-side firms that follow HY recently downgraded the stock from speculative buy to neutral.

A closer look at a few technical indicators should give investors some help. Money has been flowing out of HY for several months and the stock is beginning to look oversold according to both the relative strength index and commodity channel index. Hence the depressed stock price and nominal price multiples to sales and earnings. Contrarian investors might find those circumstances perfect for an entrance to a bull case scenario in the stock. The stock has a beta of 0.80, suggesting it would be among the least volatile stocks in a contrarian’s portfolio during the wait for the stock to pass through the current down cycle.

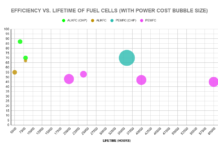

While fascinating for contrarian investors, those who want to take a position in the fuel cell industry may find HY less than appealing. Hyster-Yale has invested in another quiver for its portfolio of products aimed industrial customers. The company is one of the main suppliers of lift trucks in the U.S. and has a sizable market share worldwide. Adding the hydrogen fuel cell products to its line helps keep Hyster-Yale at the leading edge of technologies in materials handling. Although investors might never see the details, we would expect the new parent to jump start sales of Nuvera’s fuel cells stacks and power station by loading the new products into its worldwide sales network.

Hyster-Yale does not have the glamour of Alibaba (BABA: Nasdaq), the supply chain company from China that made a big splash on the U.S. equity market in 2014. However, the need for efficiency in materials handling for all the suppliers and manufacturers that participate in Alibaba’s network makes Hyster-Yale’s lift trucks an important link in the supply chain. Thus, Hyster-Yale provides an interesting vehicle to invest in the transformation of the world supply chain to alternative energy technologies.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. Nuvera Fuel Cells is included in the Fuel Cell Group of Crystal Equity Research’s Mothers of Invention Index of innovative alternative energy developers.