Eamon Keane

With the focus on the size of the ECB’s balance sheet and eurozone bond auctions, it can be difficult to see the big picture of where this is going. Concerns about oil and climate change have taken a backseat to the foreboding sense of doom. To see the implications for energy it requires a look at the direction of the financial system.

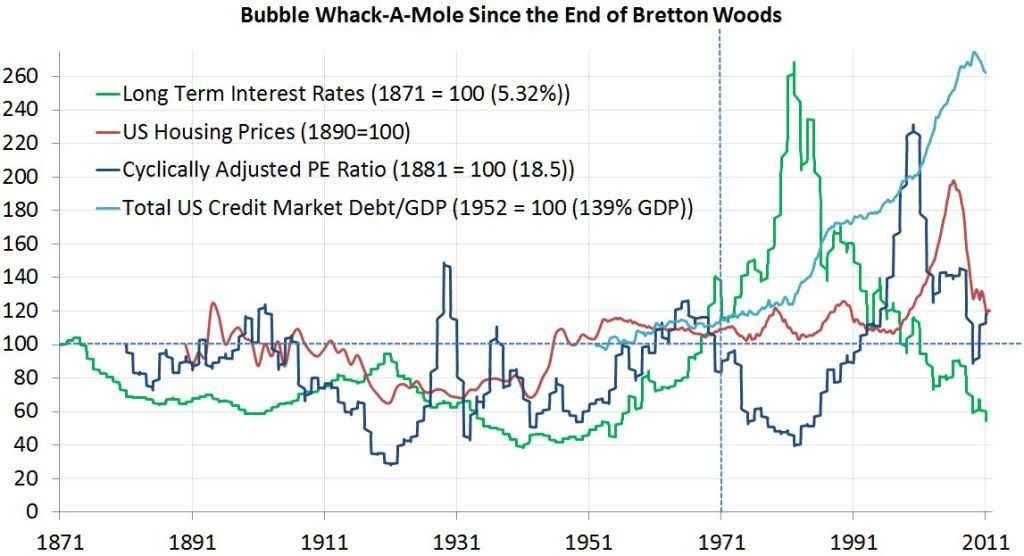

In recent times every 40 years or so there has been an upheaval in the monetary system, as Philip Coggan explains in his excellent new book Paper Promises. The gold standard broke up during WWI, an attempt was made to reinstall it in the inter-war period, and then in 1944 the Bretton Woods system was introduced. America, as principal creditor, designed the system (although Keynes had some input). Bretton Woods broke down in 1971 due to America’s trade imbalance when Germany, France and Switzerland demanded to convert their money into gold. For the past 40 years money (debt) creation has exploded, with the initial result epic inflation, followed by a stupid stock market bubble and a ridiculous housing boom, with debt increasing all the time as shown below:

Sources: Housing prices, CAPE, Interest rates: Robert Shiller; US Credit Market Debt – Fed flow of funds L1.

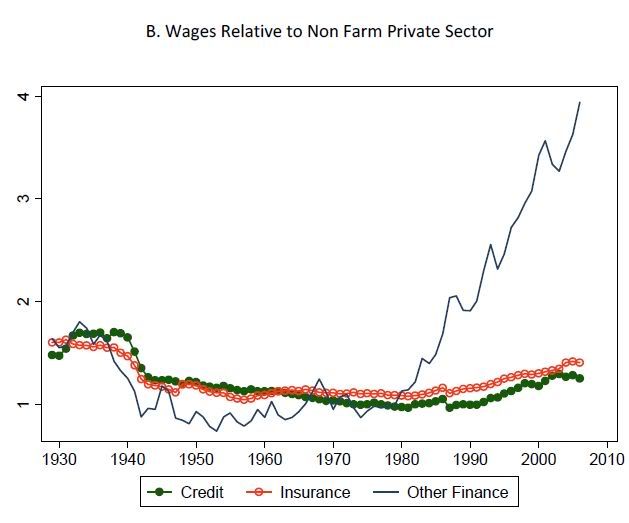

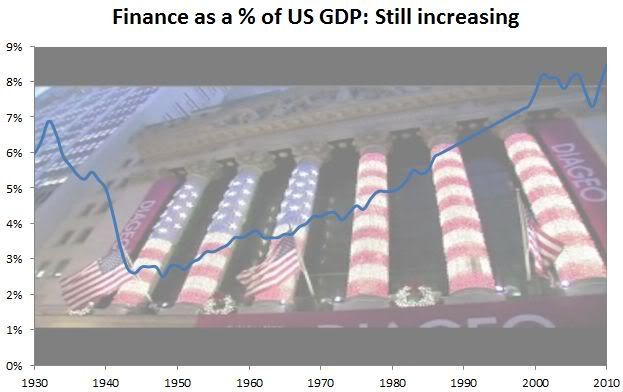

The music stops when American long term interest rates return to some semblance of normality due to a buyer’s strike by external creditors. China, as principal creditor this time round, will get to call the shots for the new monetary system. This is likely to include capital controls, fixed exchange rates, and limits on current account imbalances. This will do away with much of Wall St. and the City. Not before time, you might say, with the bankers still unrepentant. The staff at Irish banks, which have cost Ireland 50% of GNP (American equivalent $7.5 trillion), have still not taken a pay cut. Contingent banking liabilities which the state has assumed are a further 129% GNP. The following two graphs show just how out of control the finance industry has gotten:

Source: Thomas Philippon (2008)

Source: Thomas Philippon (2011); Historical Statistics of the United States p24; BEA (.xls)

In case you’re wondering who we’ve bailed out, it’s these:

http://www.youtube.com/watch?feature=player_embedded&v=La84mwsCH-A

Based on deleveraging of global debt coupled with malinvestment in ghost estates/cities from Ireland to America to China and very poor GDP weighted demographics (Germany, China, Japan, Korea, Italy etc.) a period of painful deflation may be in store. Global debt is now over three times GDP:

Source: Business Insider

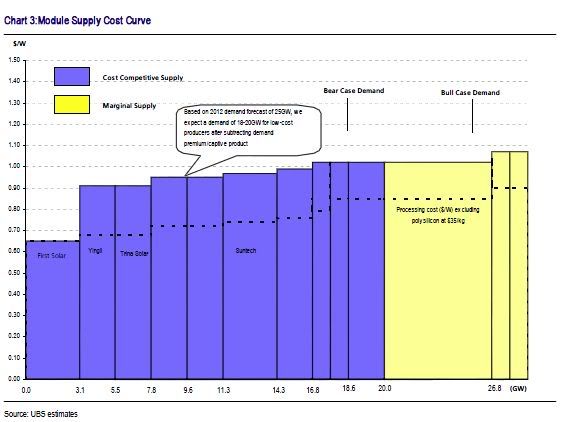

With this backdrop, the outlook for the energy industry has to be bleak. UBS estimates the current wind turbine industry is only operating at a 60-65% factory utilization rate. The solar industry is significantly oversupplied also:

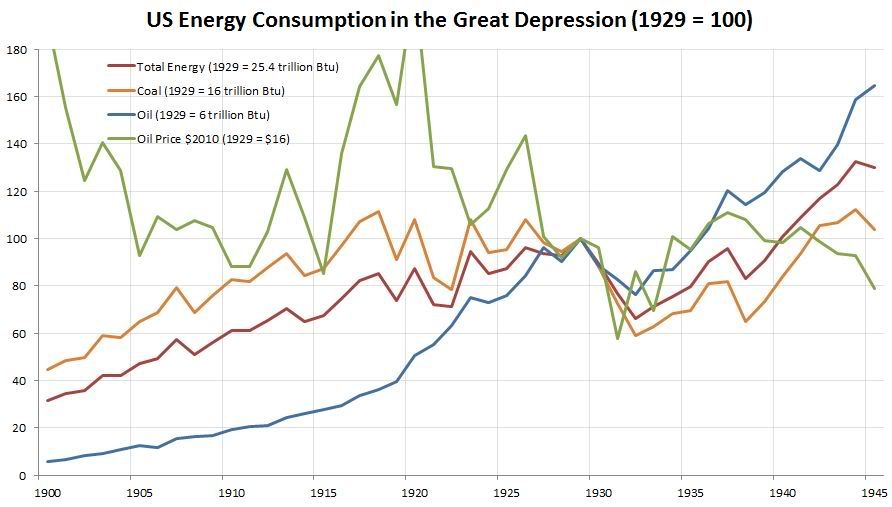

G-Pap had designs for €35 bn of renewable energy investment in Greece, but the IMF looks set to put paid to that. Levelised cost of energy calcluations are very sensitive to the discount rate – when interest rates normalise, projects will become significantly more expensive. Getting to the title of the piece, with a great depression II no longer out of the question, the effect on energy demand is likely to be profound. The data from the first great depression are shown below:

Source: Historical Statistics of the United States p165; BP Statistical Review of World Energy 2011 (.xls)

The difference this time is that during the great depression 95% of America’s oil was domestically produced, while in 2010 60% was imported (11.8 mb/d). This time round global oil industry costs are structurally much higher. A 40% drop in the oil price like in the 1930s, to $60/bbl, is possible but not sustainable given the oil production cost curve. 75% of currently produced oil was discovered before 1980, leaving the potential for declines from mature fields. Overall US energy demand dropped by 34% between 1929 and 1932. The beneficiaries in such a scenario are those energy solutions which have a low upfront and low running costs like bicycles, ebikes and small, efficient cars.