Eamon Keane

This is Part Three of a three part series based on a rare earth elements (REE) review which is available for download at slideshare, where references can be viewed.

Part 1 is an introduction to REEs. Part 2 analyzes REE consumption and refining and Part 3 looks at how REEs might affect the green economy.

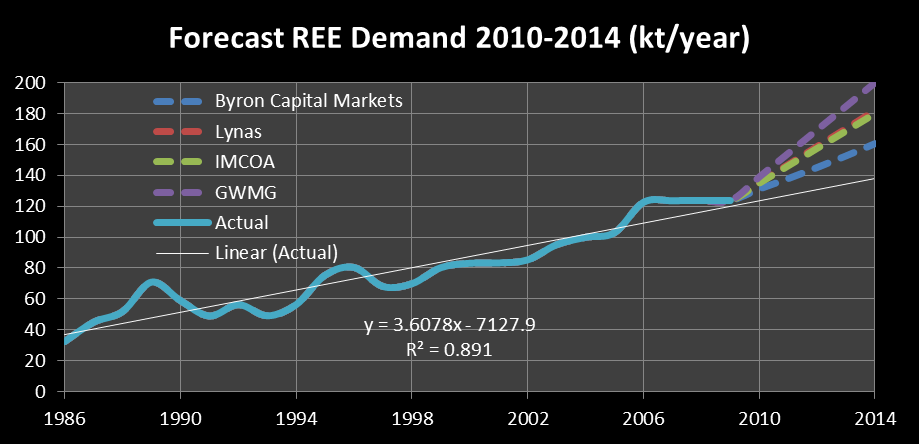

There have been several forecasts made for future demand. Approximate data was derived from Byron Capital Market’s own estimate [18] and the data contained in Oakdene Hollins’ May 2010 report “Lanthanide Resources and Alternatives” for others [34]. Figure 15 displays these demand forecasts in the context of historic demand, using global mine production as a proxy.

Figure 15: Forecast Global REE Demand 2010-2014

From Figure 15 it can be observed that while the range of projections is 160-200kt/year, if demand follows its historic pattern, it would only reach 140kt/year. Faster demand growth is expected principally due to the requirements of the “green economy”.

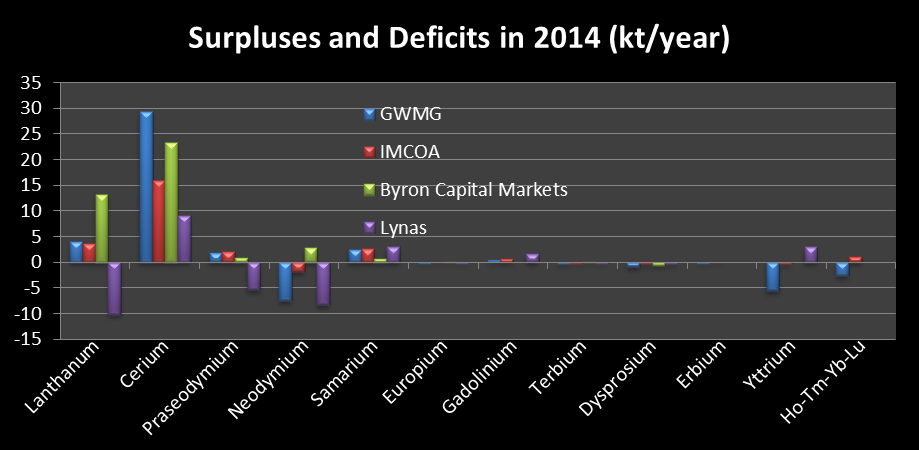

Based on their respective assumptions about which mines became operational, and those mines’ constituents, Figure 16 shows the respective surpluses and deficits forecast.

Figure 16: Surpluses and Deficits by Element in 2014

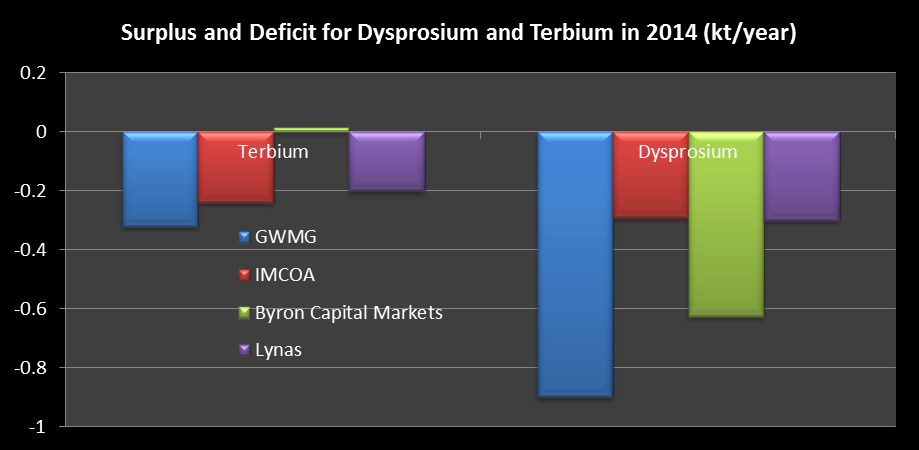

Terbium and dysprosium are displayed on their own in Figure 17 for clarity.

Figure 17: Surplus and Deficit for Dysprosium and Terbium in 2014

From Figure 16, it can be seen that one element about which hands need not be wrung is cerium. This is good news for, from Figure 9, glass additives, automotive catalysts and polishing powder. In all but Lynas’ conjecture, lanthanum will be fine also. This is reassuring for NiMH batteries, mischmetal for flint and ceramics.

But what about those pesky elements terbium and dysprosium? GWMG, for example, forecasts a deficit of 800 tonnes for dysprosium, or half what is consumed currently. IMCOA projects a deficit of 200 tonnes of terbium, or 67% of 2010 demand. Will they strangle the green economy in its crib?

6. Will the shortfall strangle the green economy?

6.1. Dysprosium

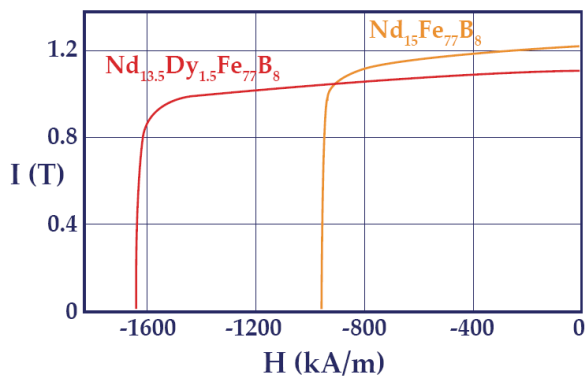

Dysprosium is essential to give neodymium magnets resistance to demagnetisation at high (120-180°C) service temperatures. The seminal 1984 paper announcing neo magnets was recently republished [40]. Figure 18 shows the demagnetisation curve contained in [40]. The effect of dysprosium is to weaken the magnet slightly (y axis), but to increase its intrinsic coercivity significantly (x axis). In enclosed spaces where it is difficult to cool – such as motors in cars – this is very important. However there is still uncertainty as to the mechanism by which dysprosium imparts this higher intrinsic coercivity [48], and a greater understanding may allow for reduced use of dysprosium.

Figure 18: Demagnetisation Curve With and Without Dysprosium

6.2. Rare Earths and Wind

Vestas, which had a 36% market share of the European 2010 H1 offshore installations [49], is stated by the New York Times to use dysprosium in its upcoming direct drive model [50]. However this is likely a design oversight, because in an excellent article at renewable energy world [51], it is stated of wind generators:“operating temperatures inside the generator rotor must be limited to a maximum of 80°C in order to retain magnetic properties”. Dysprosium will boost this range to 120-180°C, and thus the article implies that other operators do not require dysprosium, indicating that Vestas can adapt.

Direct drive generators increase the reliability of turbines as they reduce the number of parts by up to 50% [52]. This is very useful for offshore turbines where maintenance is costly and there are narrow weather windows for servicing. Whether Permanent Magnet Generators (PMGs) increase power efficiency is debatable. Adolfo Robello of Indgar’s study comparing traditional DFIGs with the permanent magnet variety concluded [51]: “The study was performed for a client and results clearly indicated that the DFIG combination showed superior total efficiency performance over the entire speed range.” Nevertheless, PMGs as an engineering solution are very elegant and more compact than their counterparts. The Chief Technology Officer of Siemens thinks they are “the future” [52]. However wind companies are all fully aware of supply issues, and are reluctant to move to China as they would be forced to partner with a Chinese company.

There are many figures quoted regarding how much neodymium a wind turbine contains. I am going to go with what renewable energy world [51] says:

“Industry sources quote, for instance, that the 60 kW fast speed electric motor fitted in a Toyota Prius hybrid vehicle contains at least 0.5 kg of NdFeB magnet material. For a PM-type generator fitted in a 5 MW direct drive wind turbine, these same sources quote a figure of up to 200 kg of NdFeB per MW power rating, around one tonne per machine. This is a much higher quantity compared to the relatively light and compact fast speed systems.”

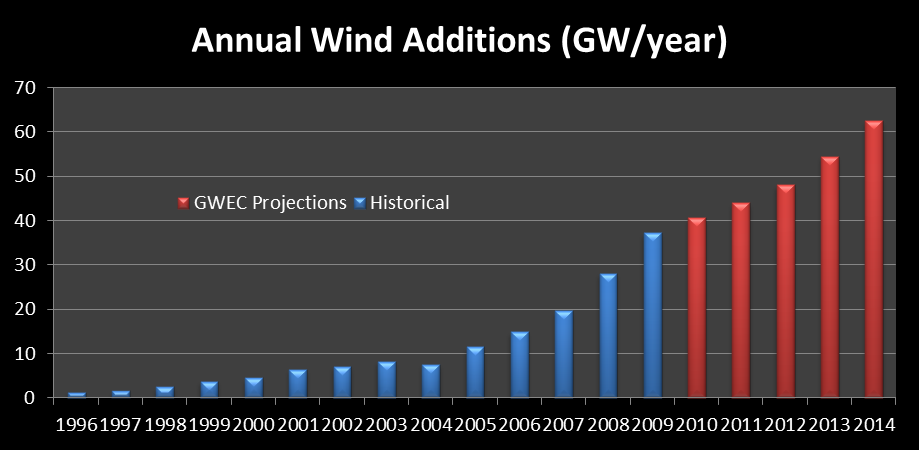

Two-hundred kg NdFeB per MW translates into approximately 70kg Nd2O3/MW, or 70 tonnes per GW. Up until now, very few turbines have used permanent magnets, with demand of only 3 or 4 tonnes [17], suggesting present demand of less than 100MW per year. Figure 19 shows the historical and projected wind turbine additions [53, 54]. In 2014, if half the wind turbines were PMG, a requirement of 2.1kt/yr of neodymium oxide would be required (70*30). From Figure 9, this is 10% of current neodymium production capacity. Wind turbine demand for neodymium is highly unlikely to have a 50% market share by 2014, as it takes time to build factories and road test the technology. 20% may be a realistic figure, which only entails a requirement of about 1kt/yr. Furthermore, there is always a backstop technology – the traditional DFIG – which can, and I argue will, step in should any shortfall in neodymium appear.

Figure 19: Annual Wind Additions

6.3. Rare Earths and Hybrid/Electric Cars

From the quote above [51], electric vehicles require “at least 0.5kg NdFeB” for a 60kW motor. Using 0.6kg NdFeB for a 60kW motor, this translates to a requirement of 10g NdFeB/kW, or 3.5gNd2O3/kW. The limiting material here will be dysprosium, which is added at about 5% by weig

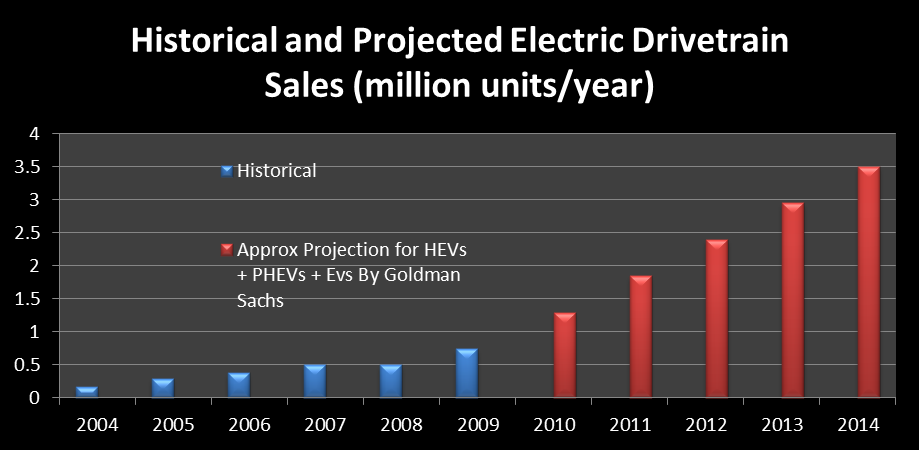

ht [55]. Hence this translates to a requirement of 0.5g Dy2O3 /kW (600*0.05/60). 2009 production capacity of 1.6kt dysprosium would hence allow for approximately 3.2billion kW of motor (1.6*1000*1000*1000/0.5). A million cars, at an average 70kW motor, require 0.07bn kW, or 2% of dysprosium supply. Figure 20 shows the historical sales of hybrid electric vehicles [56]. In 2014, electric sales of 3.5m vehicles may require 7% of dysprosium production capacity.

Figure 20: Historical and Projected Electric Drivetrain Sales

Furthermore, Hitachi, on September 10th 2010, announced they have developed an alternative motor with ferrite which “works at almost the same performance level – but with power consumption running at 10 percent lower” [57]. It still has to be scaled up to the 50kW size, but in time it will. Additionally, there is the same technology that was used in the EV-1 and is used in the Tesla Roadster [58] – the humble AC motor.

6.4. Rare Earths and Energy Efficient Lighting

In fluorescent light bulbs, the red, green and blue phosphors contain rare earths. The red phosphor is almost entirely yttrium and europium. The green phosphor contains approximately 10% terbium, while the blue phosphor contains less than 5% europium [6]. The DOE has introduced a standard for fluorescent lightbulbs. Its analysis shows that at most 11% of global terbium, europium and yttrium supply would be required to meet the standard in the United States in 2012 [6].

This is a significant amount, in the region of 30 tonnes terbium and 30 tonnes europium, which will clearly be in short supply if Figure 17 is correct. A more detailed analysis of what sector has the greatest utility for a short supply is required. From Figure 9, it can be seen that fluorescent lamps account for half of phosphor REE demand, with the rest being screens. It thus seems very likely that energy efficient lighting will have to curtail its projected rapid growth, at least until a mine with high enough terbium and europium is found. Neo Materials’ CEO suggests they have found just such a mine, with “very high concentrates of terbium and dysprosium” [59].

7. Conclusion

A brief survey of the rare earth landscape was undertaken. Following this it is shown that concern over rare earths limiting the development of wind and electric vehicles is overdone because there are clear alternatives to neodymium magnets. A shortfall of terbium and europium, however, may slow adoption of energy efficient lighting.

Comments and corrections are welcome.

References are available here.