I missed my regular monthly update in early June because of vacation.

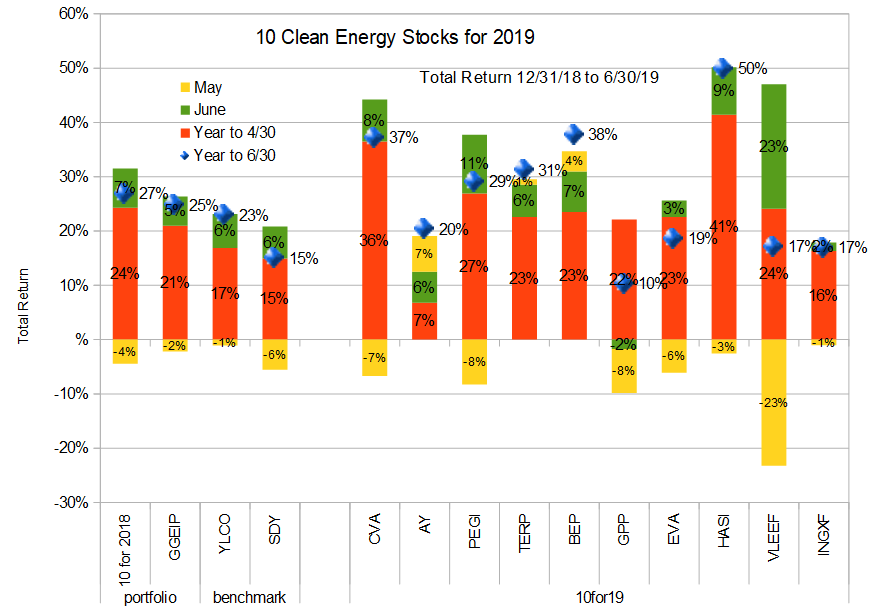

In hindsight, early June looks like it was a good buying opportunity. The broad market of dividend stocks (represented by my benchmark SDY) falling six percent in May, only to rebound a similar amount in June. At the time, I would have continued to advise caution: “Sell the peaks” rather than “Buy the dips.”

Particularly volatile stocks like European autoparts supplier Valeo (FR.PA) from this list would have generated even greater short term gains. But it would take more than a six percent market decline to transform this bear into a bull. As I have been writing for the last few months, I feel the risks in this market are high, and if or when they manifest, the decline will be a lot more serious than we saw in May.

Readers should take May as a warning, or a preview of what is possibly to come, and use the June bounce back to take some gains and increase their cash positions. This is precisely what I have been doing in my real-money managed strategy, GGEIP, and is (at least in part) why GGEIP fell less in May than the 10 Clean Energy Stocks model portfolio.

For May, GGEIP fell 2.2% compared to 4.5% for the model portfolio. It also gained less in June: 5.5% compared to 7.2% for the model portfolio. Although their clean energy income benchmark YLCO had a larger net gain over the two months, both the real and model portfolios remain well ahead of their benchmarks for the first half of the year.

More importantly, you can see that GGEIP is less volatile than either the Ten Clean Energy Stocks model portfolio or the benchmarks. Low volatility will be at a premium in any potential stock market decline.

Regarding individual stocks, May started with first quarter earnings from most of the stocks in the list, but these earnings did not contain many surprises. For the most part, the companies continue to invest and progress as planned.

Given my concerns about the stock market in general, I am not actively buying anything right now. Instead I am increasing portfolio allocations to cash and bonds. In terms of valuation, I feel Green Plains Partners (GPP) is the most attractive security in the list because rising oil prices caused by our stand-off with Iran and falling grain prices caused by President Trump’s trade war with China. These should help the ethanol market recover from the damage done to it by the administrations systematic undermining of the Renewable Fuel Standard. The current depressed price of GPP stock also provides some protection from a general market decline.

Disclosure: Long PEGI, CVA, AY, TERP, BEP, EVA, GPP. INGXF, HASI, VLEEF.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.