by Daryl Roberts

In a previous article I investigated the question of whether private sector capital was being stimulated sufficiently enough to build out renewable infrastructure on pace to reach climate goals. I found that on the upper end, giant institutional funds were only mobilizing a tiny fraction of their total Assets Under Management, due to regulatory constraints and uncompetitive yields. On the lower end, smaller scale funding seemed to be growing, with facilitation from intermediaries, fintech aggregation services, and increased access at lower levels to complicated derisking strategies.

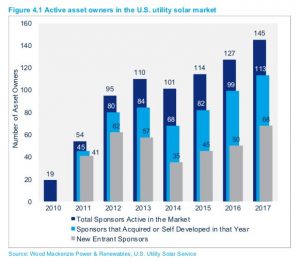

But I now find reporting that capital is over-mobilized, that solar may be in a “finance bubble” – at least temporarily, for the mid-range funds. Too much money is chasing too few infrastructure development projects, at least with regard to the largest utility scale projects and corporate procurement, which have the most appeal to large asset holders seeking stable PPA’s. Richard Matsui, CEO at kWh Analytics comments in this article that aggressive investors with lower costs of capital are able to accept deals with lower returns, on the premise that solar is long term & hence a stable investment. This means that investment funds are overpaying for assets, which in turn raises the risk profile.

Shorter PPA’s are becoming more common, which results in relying more on profit from post-PPA “residual value” of merchant pricing. The whole point of doing longer term PPA’s is to mitigate the risk of gambling on forecasts for wholesale prices 20 yrs out, but instead, investments are modeling returns using wider, riskier spreads assumptions between high-to-low merchant prices.

Simpler 2-way grid structure will accommodate more Projects

The bottleneck however may in fact be that the limited availability of infrastructure development assets is a symptom of grid architecture itself, as explored in detail in this extended piece by David Roberts: Clean energy technologies threaten to overwhelm the grid. Here’s how it can adapt .

This wholistic reconception of grid architecture proposes a shift away from one-way power flows from centralized power plants toward a decentralized structure that can accommodate massive proliferation of smaller scale Distributed Energy Resources (DERs) situated locally, closer to the end users, at the edge of the grid.

Under the current regulatory regime utilities are often hostile toward DERs, because they threaten existing and future investments. So the utilities show exactly as much support for DERs as is mandated by legislators, and no more. Alternatively they seek approvals from regulators to impose fees on DERs, that cripple their competitiveness, which disincentivizes adding renewable generation to the mix, at a time when more are needed, if we ever hope to reach climate mitigation goals.

The author walks the reader through an accessible explanation of the complex landscape of grid architecture, and then describes the two primary options for future grid expansion. The main contention is that a bottom-up paradigm would “unlock the full potential of clean energy technologies to decarbonize the electricity sector, and meet new demand coming from electrification of transportation & buildings”.

- The current structure is a 2-level hierarchy: central power plants supply power through Transmission-Distribution (TD) Interfaces, into Local Distribution Areas (LDAs).

About 65% of utilities have been restructured, splitting off generation and leaving the utilities as distribution service entities only. They purchase power from separate generating facilities, which sell power at auction into a wholesale markets, administered by a TSO under FERC rules, and then they maintain the distribution network.

- TSOs (Transmission System Operators) are the 1st level transmission systems – either an ISO (Independent System Operator) or RTO (Regional Transmission Organization). Their networks cross state lines and hence are under Federal jurisdiction, through FERC.

- DSOs (Distribution System Operators) are the 2nd level distribution networks – utilities that do not cross state lines, and are under state jurisdiction by state public utility commissions (PUCs).

Power exported to the grid by DERs conflicts with the 1-way flow design of the primary TSO architecture. Currently DERs have limited access to sell into the wholesale markets. Local generation from DERs & Virtual Power Plants (VPPs) aggregations from DERs & microgrids, storage, & demand response systems, affect this TSO/DSO structure by increasing complexity and the need for flexibility. Mismatches between supply & demand due to intermittency, demand congestion & DER excesses that produce the “duck curve” require sophisticated technology to manage “shape risks”, and trigger peak shaving solutions. The TSO architecture wrestles with not just engineering integrations but with putting a fair value on not just the power generated by DERs but also for ancillary grid services, including voltage, capacity & frequency regulation, synthetic inertia, and enhanced resiliency.

The generalized schematic is depicted in the article as a 2-level architecture showing

- downward flow from the TSO, through the Interface, into of the Local Distribution Area (LDA) with blue lines – managed by the DSO,

- and red lines showing energy flowing back from the DERs and microgrids at grid edge, back into the central TSO wholesale markets, but not through the Interface.

The two primary alternatives for updated grid designs for handling the proliferation of DERS are mapped out in an industry study – “A Tale of Two Visions: Designing a Decentralized Transactive Electric System,” published in 2016 in IEEE Power and Energy Magazine by Kristov (CAISO), De Martini (CalTech), and Taft (Pacific NW Nat Lab grid architecture center):

- Grand Central model, in which TSO’s would increasingly manage 2-way transactions involved in dispatching DER generation, & DSO’s would continue to maintain distribution, without involvement in the transactions from grid edge. But this risks “tier bypassing” conflicts in instructions from both the TSO & the DSO, as well as compliance requirements with both FERC & state regulatory policies. The 2nd problem is the sheer complexity & computational bulk with visibility & information down to the lowest level of end-use and new rules & enforcement mechanisms, as the TSO’s will soon have to handle an increase in participants, growing as DERs proliferate from a few dozen currently to thousands.

- LDO model (Layered Decentralized Optimization) shifts the management to the DSO level, & would limit the interaction between the TSO & the DSO to a single interface point. Supply & demand would be balanced within the Local Distribution Area, and net remaining supply or demand would be aggregated into a single bid to the TSO, as either a buy or sell offer. DSOs would be assigned new responsibilities for reliability as well.

Perhaps the biggest advantage of this “LDO” architecture is scalability, in its ability to handle proliferation of DERS, both horizontally across many types & participants, but also vertically (or fractally) with further replication of this “decomposition” downward through several layers of DERs, & microgrids, each with their own subsidiary DER networks, etc. Each layer is responsible for itself and interacts with the level above it through a single point of contact. It would also decompose responsibility for electrical power downward to local level controls, with the lowest level at the smart controller, coordinating behind the meter resources, maximizing self-reliance, before requesting power from the next tier up. Central power supply becomes the last resort, not the first.

Depicted graphically the LDO architecture is shown as the last illustration in the article, showing a simplified hierarchy, with more orderly energy flows from bottom up & top down.

The LDO structure short-circuits the debate between advocates for big grid with their fears of grid defection by empowering self-sufficient local grids without a downside to the TSO’s. Cities and regions would be full partners in optimizing resilience and decarbonizing energy, as they address their unique needs (EV charging, building electrification codes, unique vulnerabilities, etc) with locally integrated DER resources.

Innovation would be unleashed, because each DER or aggregation, each layer, would have financial incentive to optimize its own resources and maximize its own self-sufficiency — to consume as little as possible and produce as much power as necessary. That would create enormous demand-side pull for DER innovation in ICT-managed demand response, peak shaving & storage. Because DERs are smaller and more connected, iteration & learning time would be shorter, and capital barriers would be lower.

This last point is relevant to the asset bubble in the capital markets for renewable investments. This anticipated increase in clean energy projects would rise to meet the increasing availability of capital chasing renewable projects. They would be smaller, hence there would need to be more aggregations to meet the investment goals of larger funds. There is a growing number of intermediary fintech platforms providing aggregation services between developers and offtakers, and between projects and capital (to be enumerated under another title).

Other Benefits of Decentralization

Several other benefits of decentralizing grid structure would likely follow, or perhaps contribute to the incentives to pursue this big shift:

a) Interconnection is currently also one of the primary barriers to development. Decentralizing would not only remove disincentives for TSO’s to expedite interconnection approvals & executions, but more localized authority would relieve the backed up queues and staffing shortages. Reductions in installed costs for solar would be substantially reduced if reforms for simplifying permitting emulated the reforms implemented in Australia, which in turn would likely increase adoption.

b) Fire risks associated with O&M risks for high tension wires with associated of fire hazard would potentially be reduced. The recent bankruptcy filing by PG&E after findings of liability for more than thousands of fires has focused attention on deficient inspection & maintenance practices. Decentralization could a) shifting these responsibilities to the DSO level, and b) by reducing the need to draw from central TSO supply, potentially minimize the need for more large high tension lines. PG&E declared in US District Court that it would cost $75B to perform inspections & vegetation removal for its 100,000 miles of lines….$750,000 per mile. This seems extravagant, and although average costs for maintenance may perhaps be too low, surely there is a value for maintenance that would fall somewhere in between a high of $750,000 and an insufficiently low average, that would still represent a monetizable value to the a decentralized grid.

c) Resiliency is a key feature in selling microgrids, and off grid, behind the meter generating & storage. Additional potentials for capital investment may emerge as resiliency itself is more adequately valued. A NYSERDA report by Justin Gundlach entitled “Microgrids and Resilience to Climate-Driven Impacts on Public Health” contends that microgrids can protect public health, but there is currently no established value stream for resilience. He calls for policymakers to identify & measure the benefits & costs of resilience. NYSERDA has developed such a provisional tool, but this needs to be evaluated for national adoption by federal agencies, such as the National Academies of Sciences, or experts convened by the DOE. This value could then be monetized along with ancillary services, as value streams that can attract capital.

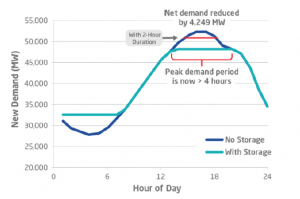

d) Peaking requirements would likely be lower in such a decentralized environment with proliferating grid edge DERs, and the potential for renewable storage to replace the need for gas peaking plants would likely be adopted more aggressively. NY state is conducting a full inventory of peakers to identify the dirtiest that can be retired, and new proposed gas peakers are being closely compared to battery alternatives.

Scaling into replacement can be achieved by disaggregating a peak demand shape into duration layers of 2hr increments that can be met with a “duration portfolio” of storage. NREL found that gas peaker plants run less than 10% of the year, rarely for more than 4hrs at time. A battery system with 4-hour capacity would be far more cost effective and lower carbon profile than operating (or building) a gas fired peaker. The need for new peakers could be virtually eliminated, even if existing fleet of gas peakers remained on standby until retired.

A “Clean Peak Standard” (CPS) has been proposed, that follows the framework of the Renewable Portfolio Standard (RPS) which requires retail electric suppliers to provide a minimum percentage of sales from clean peak resources. The concept was discussed at a conference hosted by Bloomberg New Energy Finance, with contributors from 8minutenergy Renewables, Invenergy, Fluence, NREL, Wood Mackenzie and Lon Huber, director at Navigant who is credited with originating the concept, and is consulting with state PUC’s where such plans are under consideration, in MA, NY & AZ.

This vision of restructuring grid architecture holds the promise of catalyzing the level of capital reallocation needed in order to meet climate goals, from the current levels of climate & transition investment of $300B/yr to the Clean $1 Trillion targeted by Ceres, IEA, OECD, CPI, Grantham, Paris, RMI, NewClimateEconomy, IMF, IRENA, G20, etc.

What will it take for this transition to be realized? The market is already making strides, as seen in the growth of microgrids, and the creative approach to proposing replacement of peakers with storage technology. But the most significant changes will require far reaching legislation, starting at the state level, with PUC regulators and legislative committee action, and with action on federal agency proposals, from FERC, DOE and congressional committees. Conceivably as a political process, there could be some unexpected synergies between stakeholders including TSO’s interested in divesting some of their current responsibilities, capital interests focused on seeking a broader range of asset offerings, and climate activists.

Outstanding article. Filled in a lot of gaps in my knowledge.