With the market’s rapid rebound from March lows and the Nasdaq Composite stock index closing higher than it was at the end of last year, many of us are probably asking ourselves:

Did I miss my chance to buy at the lows?

or:

Will I ever make up for my losses?

These questions point to dangerous emotions for stock market investors. Fear of missing out often leads to investment mistakes. This is why investment advisors always tell their clients that they are better off not looking at their portfolios in a downturn.

A big loss makes some people want to sell everything, for fear of losing more. Others make increasingly risky bets in order to try to win back what they have lost. Both tactics are likely to be wrong-headed for the simple reason that they are motivated by information that has nothing to do with the market’s future trend: namely, an investor’s personal experience. As Kai Ryssdal puts it, “The market doesn’t care if you live or die.”

What the market cares about is companies’ future prospects, and investors’ future willingness to buy stocks. Your personal past investing experience is irrelevant, except as a pointer to other investors’ past experience, and the mistakes they might be likely to make. How much money you have to invest matters, but how much you had at the start of the year is irrelevant.

Almost all of us have losses since the start of the year, and we all wish those losses were smaller. Since we’re not emotionless Vulcans, we need tricks to ensure that our very real emotions don’t cloud our judgement.

Here are a few of mine:

A little at a time: When making any investment decision, I don’t go all in. When I first think a stock is a good buy, I buy a little. If the stock shoots up immediately, I at least have some… it’s much easier to deal with the regret that I should have bought more than if I had considered buying and not bought any at all. My April 10th call on Ebay (EBAY) is a prime example. If the stock goes down, I can buy more at a better price, assuming my opinion about the stock has not been changed by events. I do the same with selling, slowly lowering my allocation to a stock as it rises.

I didn’t go all in on Ebay in April, and of course I would be happier if I had, considering it is up over 35 percent in a month. But if Ebay had continued to fall, I would have had the opportunity to buy more at an even better price… by taking things a little at a time, I guaranteed that my moves would not be perfect, but also that I had something to be happy about.

Know the whys for your decisions. If I research a stock and decide not to buy, or choose not to research a stock at all, I am very clear with myself as to why. I never buy stocks that I consider to be the flavor of the moment, or stocks that are not environmentally responsible enough for my taste. Batteries are driving demand for lithium and cobalt, which is potentially good news for many mining companies. But I don’t invest in the sector because it usually entails significant environmental damage, even when it is done with care. Mining may be necessary to bring about the clean energy transition, but necessity does not mean it has to be part of my portfolio. And I’m OK with that. If I hear about a lithium mining stock, and I later find out that it just increased five-fold, I have no regret that I did not buy. If I had bought, I would have had to compromise my principles, and I would have spent valuable research time looking in to a company that I had mixed feelings about owning. Better to spend that same research time (and potential capital) on companies which do not require that I make moral compromises.

Blogging also helps with this. It gives me a written record of the reasons behind both my successes and failures. Being able to go back and review those mistakes in black and white is a valuable tool to help learn from them.

Change your framing. If I find myself obsessing on recent losses or gains, it can helpful to look at the same numbers with a wide frame. Last month, I wrote about how looking at returns since the start of 2019 or year over year was helpful to keep the losses so far this year in perspective. Looking at the last month’s gain, or even focusing on individual stocks can help alleviate the feeling that everything always goes badly.

The same is true for success. If everything seems to be going your way, it can be helpful to remind yourself of past losses, or the one stock in your portfolio that is down. Investors are only as good as our next decision, and if we let our emotions tell us that we will always win or always lose no matter what we do, we will stop making good decisions.

Today’s market

How does this apply to today’s market, where many of us likely feel as if we missed an opportunity to buy at the March lows, and may be worrying that we’ll never “make back” our recent losses?

First of all, if you feel you didn’t buy enough at the bottom, you were already following the “a little at a time” rule above. You also didn’t miss out on the opportunity altogether. The stock market was a very scary place in late March. Change your perspective and congratulate yourself on having the courage to buy anything at all in the face of that fear.

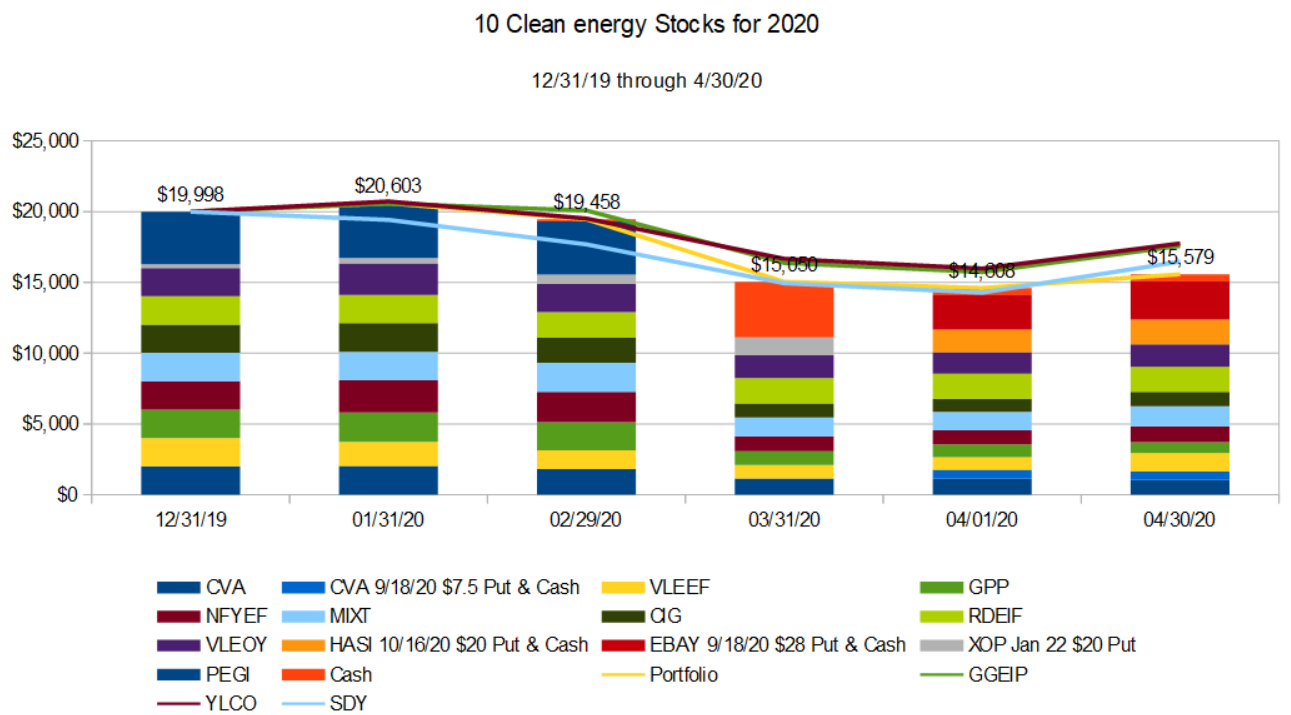

For my own part, I cautiously added three cash covered puts to the 10 Clean Energy Stocks model portfolio, Ebay (EBAY), Hannon Armstrong (HASI) and Covanta (CVA). Although all three are showing gains, the model portfolio is now significantly trailing its benchmarks. If only I’d been less conservative and used the same money to buy the same stocks rather than sell cash covered puts, it would have done much to bridge the gap.

“If only” is a dangerous game for a stock market investor. The market doesn’t care if I live or die, and EBAY at $41 is a much less attractive stock than it was at $30 a month ago. Better to turn my attention to looking for the next bargain, than to worry about not buying enough of the last one.

The market as a whole is up much more than I ever expected a month ago. This is in large part due to the extraordinary measures the Federal Reserve has taken to step in as a buyer of last resort in credit markets where it did not even venture during the depths of the 2008 financial crisis.

Seasoned investors say to “never fight the Fed.” This means that when the Federal Reserve is working to support the stock market, it is a very risky move to bet that the market will fall.

The stock market has spent the last month demonstrating that it is not the economy. While the economic situation is more dire than it has ever been since the Great Depression, the market seems to be saying that the fortunes of listed stocks (especially the largest Nasdaq stocks like Apple (AAPL), Alphabet (GOOG) and Amazon (AMZN)) are bright.

That’s probably true for the Internet stocks that help us socially distance. But the prospects for the rest of the economy are far less certain.

Given the lack of adequate safety precautions and testing, the parts of the country that are now opening up will soon be seeing rapid increases in conronavirus cases, and people travelling between states will make it even more difficult for the states that are being more cautious to open up when they are ready to do so.

Until we have a vaccine or a very effective treatment for the coronavirus, the US economy is going to be limping along as social distancing adds costs to all economic activity, and periodic outbreaks cause new stay at home orders. Meanwhile, most people with savings will find them seriously depleted, and an increasingly small slice of the population will have the money to do any form of discretionary spending. State and local governments will find themselves running up against balanced budget requirements and start laying off staff into a job market with the highest unemployment rate seen since the Great Depression.

While stock market investors should not be fighting the Fed, the economy is certainly doing so. The Fed will do everything it can (and it has shown that it can do a lot) to prevent the economy from collapsing, but will it create new economic activity to replace the jobs that have disappeared? I doubt it.

I expect that we are in the beginning of a multi-year recession. “Depression” is a term that does not have an agreed upon definition among economists, but many colloquial definitions will apply to the current downturn.

The Fed has the ability to print money and prop up the entire stock market even through a depression. I doubt that it will choose to do so. Although many of the stocks you would like to buy will never go back to their March lows, others will not ignore economic reality forever. They will fall.

When they do, we will again have buying opportunities. Buy some when you think you see an opportunity.

If your stock bounces back up, you will regret not having bought more, but that regret is not as bad as going all-in on a stock that just keeps falling and falling.

Disclosure: Long HASI, EBAY, CVA.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Have you ever looked at Avantium, a Dutch company working on plant based “plastic” intended to produce bottles for water and other beverages that will break down rather quickly if left in the environment? Sounds like a great solution to plastic pollution. But I don’t know how to analyze it financially.

Yes, sounds like interesting tech, but no, it’s not something I would look at since I focus on profitable companies. I personally also find it very hard to predict which unprofitable companies will make it to profitability and eventually become successful, so I generally just avoid the category as a whole.

And that, by the way, is an example of one of the rules I talked about in the article: Know the whys for your decisions. If Avantium becomes the next Amazon, I will have no regret despite the fact that you brought my attention to it because I have a very clear reason for not researching it, and it is a rule that has served me well since I adopted it. Most of my mistakes prior to adopting the rule were investments in unprofitable companies of one type or another.

I really value your blogging and I understand your hesitancy to mining stocks and a lot of ‘heavy industry’ but I thought you might be interested in the ‘Hybrit’ initiative that several Swedish companies are working on to develop and industrialize processes to produce ‘fossil-free’ steel. The development is very real and quite impressive. Unfortunately for the investing public only one of the companies (SSAB) has stock that is available for purchase. The other two companies (LKAB and Vattenfall) in the initiative are wholly owned by the Swedidh state.

Sounds like it’s not very invest-able, but in general I also avoid investing in companies that are developing an interesting technology. My favored steel play is recycling and recycled steel. I currently own Schnitzer Steel in this space. SCHN.