by Tom Konrad Ph.D., CFA

2019 has become another blockbuster year for the Ten Clean Energy Stocks model portfolio and, to a lesser extent clean energy stocks and the broad stock market as well. I’m frankly surprised to see the party continuing. The continued spiking of the metaphorical punch bowl by the Federal Reserve with interest rate cuts certainly has a lot to do with it. I had expected those cuts to be both fewer and less effective.

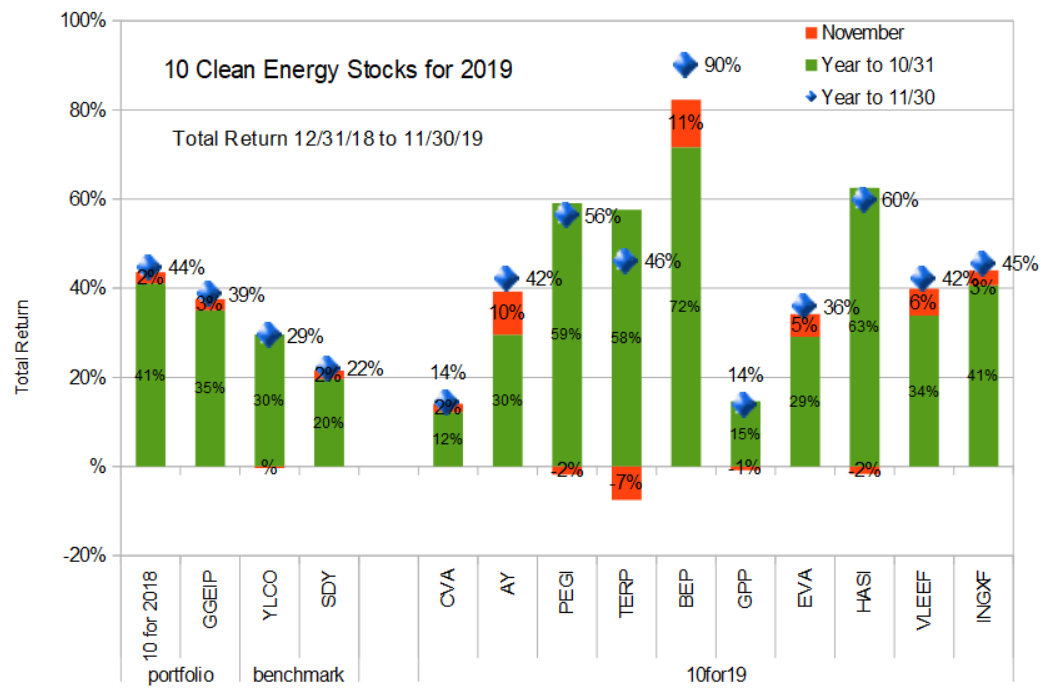

Which all goes to show that it’s always a good idea to hedge one’s bets in the stock market. At least in part because of this hedging, my real money Global Green Equity Income Portfolio GGEIP has somewhat underperformed the 10 Clean Energy Stocks model portfolio, up 38.5% and 44.5% for the year, respectively. Both remain well ahead of their benchmarks, however, with the clean energy income stock benchmark YLCO up 29.3% and the broad income stock benchmark SDY up a still respectable 21.9%.

Will the party continue with a blowout Santa Claus rally? Only Santa knows, but I’m going to continue with caution in case he decides to show up with a lump of coal (have you seen coal stocks recently?) instead of nicer gifts.

Individual Stocks

Last month I warned,

Hannon Armstrong HASI, Terraform Power (TERP), and Brookfield Renewable Energy Partners (BEP) are all stocks in which readers should be considering taking some profits, if they have not already. I continue to think these three stocks are all ripe for price corrections.

Terraform saw that price correction, down 10% on a secondary offering of 14.9 million shares of stock at approximately $16.84 a share. This is business as usual for Yieldcos, which sell shares when prices are high to finance the purchase of income producing clean energy investments. As long as such investments can be had at prices which expand per share cash available for distribution, such secondary offerings are good for long term shareholders. I generally consider the one or two months following a secondary offering as the best time to invest in Yieldco stocks, although Terraform’s valuation even after the recent dip is not making me rush in with any buy orders. But it’s certainly less overvalued than last month.

Brookfield Renewable Energy Partners announced a stock distribution and the creation of a new corporation, Brookfield Renewable Corporation (BEPC). This will allow investors who are not able to invest in limited partnerships like BEP to also invest in the stock, which is designed to have identical distributions to BEP and will be exchangeable for BEP units. The stock price of BEP has been climbing since the announcement in anticipation of the new demand for shares from this new potential class of buyers. After the split, investors should not be surprised if BEP takes advantage of its new, lofty stock price to raise cash in its own secondary offering, bringing the stock price back down from its temporarily lofty level.

Although I think the formation of BEPC will be good for existing investors, I continue to trim my holdings of BEP in anticipation for such a decline.

French autoparts maker Valeo SA (FR.PA, VLEEF) reported strong 3rd quarter sales at the end of October, and the stock has been rising since. Sales were up 8% despite an ongoing contraction in auto sales overall. The company’s excellent performance is largely due to the start of production on projects including vehicle electrification, cameras, and lighting. All-in-all, the company’s plan to leverage its R&D efforts to get its products into more new vehicle models seems to be paying off. Barring a broad market sell-off, I would expect the stock to continue to advance. Given the large increases in most of the stocks in this year’s list, I am going to be searching for a large number of new stocks to add to the 2020 list as I drop the ones that have climbed the most since they are no longer offer compelling valuations. Unless it advances significantly more in December, Valeo seems likely to stay.

Another big winner was Atlantica Yield (AY). Investors generally liked the 3rd quarter earnings report and 1 cent increase in its quarterly dividend to $0.41 at the start of November. Revenue and Cash Available For Distribution (CAFD) continue to advance at a 6-7% rate through the company’s investment in new projects, such as the ATN Expansion 2 transmission project which it closed on during the quarter.

One thing I like about Atlantica compared to other Yieldcos is its diversification into electricity transmission and water. Owning both of these asset classes is rare in the industry, but transmission in particular is essential to the clean energy transition, and having expertise in different asset classes means that Atlantica can look at different types of investment opportunities when traditional Yieldco assets like solar and wind are relatively expensive. Because of its Spanish roots, Atlantica also has a more diverse geographic profile than other Yieldcos.

Conclusion

The year isn’t over, but I can confidently say that, at least as far as my stock picks go, it far exceeded my expectations. With all the price rises, I’m going to have trouble finding ten clean energy stocks that I think are good investments at the end of December. I’m seriously considering including one or two short positions in the portfolio, something I have done only once before, in 2008 when I include a short of First Solar (FSLR). It was a timely choice, since First Solar fell 50% that year, helped along by the financial crisis. Alternatively, given the new accessibility of option strategies for the small investor, perhaps I should include option hedging or positions in the portfolio.

What do readers think? Would a short, option hedging, or just sticking to long-only (with the continued caveat that readers should have a large allocation to cash or a hedging strategy) be the most useful to you in the Ten Clean Energy Stocks for 2020 model portfolio? Let me know in the comments.

Disclosure: Long PEGI, CVA, AY, TERP, BEP, EVA, GPP. INGXF, HASI, FR.PA/VLEEF, CWEN-A.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Tom, thank you for your many insights and excellent advice. I’m an options trader so would welcome your ideas. Options make it easy to take short positions in IRAs, and offer juicy leverage, bombproof limits to risk, etc.

Downsides might include the vigilance needed to avoid short-call assignment prior to ex-dividend dates especially for high-dividend sticks, and the general complexity of options that might intimidate stocks-only investors.

Thanks for asking for comments,

Doug

2020 – here is 3 big gainers coming

Greenlane Renewables

Nano One Technologies

Exro Technologies

I would not touch any of these with a 10-foot pole, but I did add Greenlane and Nano One to my Waste-to-Energy and Battery stock lists. I found Exro a little harder to categorize… what would you say its role in alternative energy is? How does ” Dynamic Power Management (DPM) technology and system architecture for rotating electrical machines” apply? Is it an energy saving tech, or useful in wind or electric vehicles? Or all of the above?

Thanks Tom, I would welcome your suggestions on shorts or options.

Thanks as always for the portfolio updates, Tom. I think you’re right on the valuations of HASI and TERP, and I took some profits there last week. More broadly, I think you’re right (and have been for years) about the viability of “green investing,” as your portfolio performance for this year demonstrates.

A question: are you tempted to get back into New Flyer (NFYEF) at these prices, or do you think there’s still indigestion from eating MCI and Alexander Dennis, and too much concern about government transit purchases in this late-cycle economy? I bought a half-position yesterday at $19.80 USD.

@mickelsson- I’ve been buying NFYEF, but it definitely could have more to fall. Since I never know, I just slowly increase my allocation to a stock as it becomes a better value. My allocation to any stock through new purchases ranges up to about 7% (and I sell part of any holding to keep appreciation from taking it over 10%), right now NFYEF is in the 1-2% range. I’m hoping for the fall to continue, and will continue buying if it does. NFYEF is a leading candidate for 10 Clean Energy Stocks for 2020.

Thanks as always. Recommendations on short positions and/or options would be greatly appreciated. How to hedge/manage risk, how to think about and what expectations we should have for short positions and options (especially as they get closer to expiry).

Thanks, Arthur. Good to hear from you as always. If I don’t formally include shorts, I’ll make sure to at least write about some concrete examples of covered calls.

I would prefer if the model portfolio remains all long positions. For one, I find it more helpful to find well priced stocks to hold for long time horizons and without the need for frequent transactions. Perhaps more importantly, I wouldn’t take the time to maintain a green energy focused portfolio if it weren’t for the environmental benefit of such companies succeeding. As such, I have no interest in holding short positions in renewable energy even if they may be more profitable than available long positions at the moment. Thanks for your insights as always!

Thanks for the feedback, Randy. Would your opinion change if the shorts were brown companies? I was thinking Oil and gas, most likely gas.

Hello Tom, why not focus on companies that are in the process of converting their business to clean/green energy? Those might be pretty cash rich and therefore could trigger some M&A? Also I do like your recommendations especially for companies that continue to grow their dividend. Keep up the great work! Very much appreciated!

Lieven,

I guess the main reason I don’t look at conversions to green companies is that none come to mind. There’s a lot of greenwashing among big companies, especially oil, but that clearly does not count. The only “conversion” I can think of that I take seriously is Eqinor (EQNR) but even they seem to still be investing in oil. I wouldn’t touch a company unless there is more new investment going into green than into brown, and the same for existing operations. I’m not sure, but Equinor does not seem to qualify. Do you have any particular stocks in mind?

Thank you for your response. Is there a specific reason why MLP’s couldn’t be considered?

MLPs are considered. GPP and EVA have both been in the list for multiple years, and they are MLPs. BEP also has a partnership structure as well, although I would not call it an MLP.

+1 for shorting brown securities. I’ll admit that when I’ve looked into options (hell, just the options input screen on E*trade) I feel a sudden urge to take a nap. I’d be happy with an 8 long, 2 short breakdown. Your analysis (imo) represents some of the best free green-investing advice on the web, so I’d be happy with whatever you decide to do.

Thanks for all the great advice.

You mention that you think TERP is still overvalued after its recent decline. What price would you purchase shares again? What about AY and HASI?

I tend to focus on CAFD yield and CAFD growth for valuation purposes. I’d like to see CAFD yields of at least 6% for TERP and AY, and Core Earnings yield of at least 5% for HASI. This could be achieved either by increasing CAFD or falling stock price. I also look at expected future CAFD yield based on the current share price and 2 years forward CAFD per share as a way to account for growth. Most of these are now growing CAFD in the single digit percentages per year, so growth is not a gigantic valuation boost of any of them.