Tag: VEOEF

10 Clean Energy Stocks for 2022-2023: The List

By Tom Konrad, Ph.D., CFA

With the launch of my (green dividend income focused) hedge fund early this year, I had to take a hiatus from publishing my annual list of 10 Clean Energy Stocks that I feel will do well in the coming year. Since my duty to clients takes precedence over readers, I could not tell people about stocks I liked before buying them for the fund.

As we complete the first half of the year, the fund is now largely invested, although I am still keeping some buying power back in anticipation that the overall market could easily...

Buying Foreign Stocks: To ADR or Not To ADR

by Tom Konrad, Ph.D., CFA

Since my 10 Clean Energy Stocks for 2021 list contains 5 foreign stocks this year, a reader asked about the relative merits of buying a foreign stock compared to a US ADR. Here is a summary of the relative merits (for US investors) of buying a foreign stock directly compared to buying the American Depository Receipt (ADR).

First, let’s look at the tickers for the five foreign stocks in the list. There are four types of ticker in the list this year:

The stock on its home exchange in the local currency. These have the form...

Four Picks and Shovels Stocks

by Tom Konrad, Ph.D., CFA

The last three months of 2020 brought an explosion in clean energy stock prices.

Solar stocks (as measured by the Invesco Solar ETF (TAN), nearly tripled. So did the Invesco Wilderhill Clean Energy ETF (PBW), which includes a broader spectrum of companies. Wind stock rose 61%, and even the relatively sedate Yieldcos were up 32%. The stars of the last half of 2020 was undoubtedly Tesla (TSLA, up 246%) and other electric vehicle stocks.

Money Flows Out of Fossil Fuels and Into Clean Energy

I believe that the cause of the current rise in stock prices is largely...

Ten Clean Energy Stocks for 2021: The List

by Tom Konrad, Ph.D., CFA

An annual tradition, here is my Ten Clean Energy Stocks for 2021, which is also the new model portfolio for the year, with equal dollar values of each stock using closing prices on 12/29/2020.

Returning Stocks

Mix Telematics (MIXT)

Green Plains Partners (GPP)

Covanta Holding (CVA)

Red Electrica (REE.MC, RDEIF, RDEIY)

Valeo, SA (FR.PA, VLEEF, VLEEY)

Veolia (VIE.PA, VEOEF, VEOEY)

New Stocks

Scorpio Bulkers, Inc. (SALT) - Dry bulk shipper converting to offshore wind construction. Thanks to Thad Curtz for bringing my attention to this one.

Brookfield Renewable Energy Partners (BEP) - A leading clean energy Yieldco...

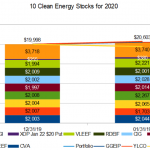

10 Clean Energy Stocks for 2020: The Waiting

by Tom Konrad, Ph.D., CFA

Despite high valuations, a rampaging pandemic, and the end of the $600 weekly supplemental unemployment payments from the CARES Act, the stock market continued upward in August.

Like most ordinary people in this economy, my Ten Clean Energy Stocks model portfolio is still not feeling the recovery the way the big tech companies and the ultra wealthy are, although my real-money Green Global Equity Income Portfolio (GGEIP) is now hitting new highs for the year.

The difference between the model portfolio’s performance and GGEIP is mostly a result of trading: It had a large cash position at...

10 Clean Energy Stocks for 2020: June Update

by Tom Konrad, Ph.D., CFA

The coronavirus pandemic no longer has the United States by its financial center throat, the New York City area, but is instead is now gnawing ravenously at its arms and legs. In June, the stock market seems to be just starting to get a clue that this is also a bad thing, leading to a month of volatility and general consolidation.

Europe, in a display of relative competence, has been much more effective than the US at getting the pandemic beast under control, and so investors looking for safe havens might do well to look there. ...

10 Clean Energy Stocks for 2020: May Update Part 1

by Tom Konrad, Ph.D., CFA

For the last few monthly updates, I've been focusing on the big picture, and have neglected to say anything about many of the 10 Clean Energy Stocks for 2020 since I looked at how the pandemic would likely affect each stock in March.

This month, I'm trying to rectify the oversight, and have been posting updates on individual stocks for my Patreon supporters since Friday. Below is a collection of the updates I've published so far. I am to keep posting one a day until I've gotten to all of them, after which I plan to...

Ten Clean Energy Stocks for 2020: Navigating the Storm

by Tom Konrad, Ph.D., CFA

This monthly update for my Ten Clean Energy Stocks model portfolio is in two parts. I published my thoughts on the current market turmoil on March 2nd. You can find them here. I'm not even going to get into the Fed slashing interest rates like they were a furniture warehouse going out of business on March 3rd except to say that apparently they are more afraid of the effects of covid-19 on the economy than they are of appearing to panic.

You can see overall performance for January and February in the following chart. Not that...

Divestment v Coronavirus: Ten Clean Energy Stocks for 2020 January Update

by Tom Konrad, Ph.D., CFA

January 2020- where do I start? A year of market-shaking news in a month.

The Brink of War

The month started off with a literal bang when Trump decided that a good way to distract the public from his impeachment trial would be to try to start a war with Iran by assassinating one of Iran's top military leaders, Qassem Suleimani. A week later, the world and markets heaved a collective sigh of relief when Iran decided that their honor had been satisfied with two missile strikes on US bases. While Trump reported no casualties, Iran's Foreign...

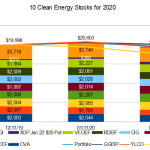

Ten Clean Energy Stocks for 2020

by Tom Konrad, Ph.D., CFA

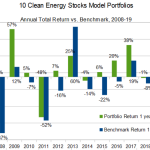

If it's tough to follow a winner, 2020 is going to be an especially tough year for my Ten Clean Energy Stocks model portfolio.

I've been publishing lists of ten clean energy stocks that I think will do well in the year to come since 2008. With a 46 percent total return, the 2019 list has had its best year since 2009, when it managed a 57 percent return by catching the rebound off the 2008 crash. This year's returns were also achieved in the context of full- to over-valuation of most of the clean energy...

Water Supply with a Latin Twist

by Debra Fiakas, CFA

Depending upon how you string the words together, it is possible to make Latin America sound like the world’s water fountain or the location of a putrid pond out of which hapless citizens ladle their drinking water.

Try these lofty words.

Four the world’s largest rivers and four of the world’s largest freshwater lakes can be found in the Latin America region with a run-off area encompassing 5,470 cubic miles. The rainwater and snowmelt running into these water bodies represents 20% of the world’s run-off. By itself Brazil is home to 20% of the water resources of the entire world.

Here...

Covanta’s Q1: Ten Clean Energy Stocks For 2019

by Tom Konrad Ph.D., CFA

Covanta Holding Corp. (NYSE:CVA)

12/31/18 Price: $13.42. Annual Dividend: $1.00. Expected 2019 dividend: $1.00. Low Target: $13. High Target: $25.

3/26/19 Price: $17.86. YTD Dividend: $0.25. YTD Yield: 1.9% YTD Appreciation: 33.1% YTD Total Return: 34.9%

Leading waste-to-energy operator Covanta's stock has been the second best performing holding in my 10 Clean Energy Stocks for 2019 model portfolio. While in many ways the company is similar to the clean energy Yieldcos that dominate the model portfolio, it is different in that it develops its own projects, while most Yieldcos depend on a sponsor to develop projects which...

List of Power Production Stocks

Alternative energy power production stocks are companies whose main business is the production and sale of electricity from alternative energy installations, such as solar farms, wind farms, hydroelectric generators, geothermal plants, cogeneration facilities, and nuclear plants.

This list was last updated on 9/11/2020.

7C Solarparken AG (HRPK.DE)

Acciona, S.A. (ANA.MC, ACXIF)

Atlantica Yield plc (AY)

Algonquin Power & Utilities Corp. (AQN, AQN.TO)

Avangrid, Inc. (AGR)

Bluefield Solar Income Fund Ltd. (BSIF.L)

Boralex (BLX.TO, BRLXF)

Brookfield Renewable Partners L.P. (BEP)

Capital Stage AG (CAP.DE)

Edisun Power Europe AG (ESUN.SW)

Elecnor, S.A. (ENO.MI)

Foresight Solar Fund plc (FSFL.L)

Global X YieldCo ETF (YLCO)

Greencoat UK Wind PLC (UKW.L)

Innergex Renewable Energy Inc. (INE.TO,INGXF)

John Laing Environmental Assets Group Limited...

List of High Yield Alternative Energy Stocks

This is a list of renewable and alternative energy stocks with dividend or distribution yields above 4%. The list includes most Yieldcos (high distribution companies that own renewable energy operations), but is not limited to Yieldcos. Some Yieldcos may be excluded if their yield is below 4%.

Atlantica Yield plc (AY)

Algonquin Power & Utilities Corp. (AQN, AQN.TO)

Bluefield Solar Income Fund Ltd. (BSIF.L)

Brookfield Renewable Partners L.P. (BEP)

Clearway Energy, Inc. (CWEN,CWEN-A)

Companhia Energética de Minas Gerais (CIG)

Covanta Holding Corporation (CVA)

Crius Energy Trust (KWH-UN.TO, CRIUF)

Enviva Partners, LP (EVA)

Foresight Solar Fund plc (FSFL.L)

GATX Corporation Series A (GMTA)

Global X YieldCo ETF (YLCO)

Greencoat UK Wind PLC (UKW.L)

Green...