Tag: RDEIF

Buying Foreign Stocks: To ADR or Not To ADR

by Tom Konrad, Ph.D., CFA

Since my 10 Clean Energy Stocks for 2021 list contains 5 foreign stocks this year, a reader asked about the relative merits of buying a foreign stock compared to a US ADR. Here is a summary of the relative merits (for US investors) of buying a foreign stock directly compared to buying the American Depository Receipt (ADR).

First, let’s look at the tickers for the five foreign stocks in the list. There are four types of ticker in the list this year:

The stock on its home exchange in the local currency. These have the form...

10 Clean Energy Stocks for 2021: Diversification

by Tom Konrad, Ph.D., CFA

Rounding out the discussion of the stocks in my 10 Clean Energy Stocks for 2021 list are the two that don’t fit either of the themes I highlighted for 2021: Picks and Shovels or a Possible Yieldco Boom. Both help with diversification, both in terms of their industry and geography.

MiX Telematics (MIXT) was retained from the Ten Clean Energy Stocks for 2020 list because I expect its prospects to improve rapidly as the world comes out of covid lockdowns. The global vehicle telematics provider has a large number of its customers among mass transit, logistics,...

Ten Clean Energy Stocks for 2021: The List

by Tom Konrad, Ph.D., CFA

An annual tradition, here is my Ten Clean Energy Stocks for 2021, which is also the new model portfolio for the year, with equal dollar values of each stock using closing prices on 12/29/2020.

Returning Stocks

Mix Telematics (MIXT)

Green Plains Partners (GPP)

Covanta Holding (CVA)

Red Electrica (REE.MC, RDEIF, RDEIY)

Valeo, SA (FR.PA, VLEEF, VLEEY)

Veolia (VIE.PA, VEOEF, VEOEY)

New Stocks

Scorpio Bulkers, Inc. (SALT) - Dry bulk shipper converting to offshore wind construction. Thanks to Thad Curtz for bringing my attention to this one.

Brookfield Renewable Energy Partners (BEP) - A leading clean energy Yieldco...

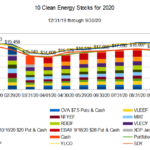

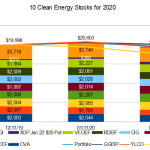

10 Clean Energy Stocks for 2020: Updated Model Portfolio

by Tom Konrad, Ph.D., CFA

After a couple down market days, all the limit orders I listed on Monday have executed.

Here is the current portfolio:

Position

Shares

Position

Shares

CVA

135

CIG

587

CVA Mar21 $7.50 Put

-2

RDEIF

100

VLEEF

57

VEOEF

75

GPP

276

EBAY Jan ‘21 $8 Put

-1

NFYEF

98

Cash

$4415

MIXT

274

Coming Up:

Third quarter earnings season is starting… I plan to write short notes on earnings as they come out for my Patreon supporters, which will be compiled into longer articles on AltEnergyStocks.com a few days later.

Also, I’m doing a talk on how to divest from fossil fuels with the founder of divestor.org this coming Monday at 8:30 pm ET for the Climate and Health subgroup of Citizens Climate Lobby ...

10 Clean Energy Stocks For 2020 May Update: Red Eléctrica, Ebay, NFI Group

by Tom Konrad, Ph.D., CFA

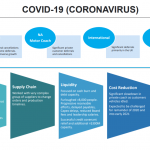

Market Outlook

The continuing market rebound in the face of a worsening epidemic in the US (outside of the initially hardest hit states) widespread protests against lack of police accountability, and a President who thinks the right response to mostly peaceful protests is to call in the military continues to befuddle me.

The risks in today's stock market outweigh the possibility of future potential gains. Although I was buying aggressively in March, I've shifted back to a more cautious stance, and am mostly starting to sell covered calls on my positions with the greatest gains. I generally...

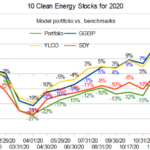

Ten Clean Energy Stocks for 2020: Navigating the Storm

by Tom Konrad, Ph.D., CFA

This monthly update for my Ten Clean Energy Stocks model portfolio is in two parts. I published my thoughts on the current market turmoil on March 2nd. You can find them here. I'm not even going to get into the Fed slashing interest rates like they were a furniture warehouse going out of business on March 3rd except to say that apparently they are more afraid of the effects of covid-19 on the economy than they are of appearing to panic.

You can see overall performance for January and February in the following chart. Not that...

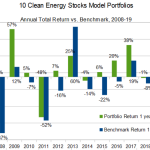

Ten Clean Energy Stocks for 2020

by Tom Konrad, Ph.D., CFA

If it's tough to follow a winner, 2020 is going to be an especially tough year for my Ten Clean Energy Stocks model portfolio.

I've been publishing lists of ten clean energy stocks that I think will do well in the year to come since 2008. With a 46 percent total return, the 2019 list has had its best year since 2009, when it managed a 57 percent return by catching the rebound off the 2008 crash. This year's returns were also achieved in the context of full- to over-valuation of most of the clean energy...