Tag: green bonds

The Greenium: Growing Evidence of a Green Bond Premium

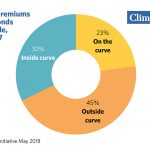

Highlights from the latest Q4 2017 Green Bond Report from the Climate Bonds Initiative: Two years of data observations examining green bond behavior in primary markets

Climate Bonds Initiative has released the fourth “Green Bond Pricing in the Primary Market” report analysing the performance of green bonds issued in the period October-December 2017. This is the last quarterly report; future publications will be produced semi-annually allowing a more longtitudinal analysis as the market expands.

The Q4 2017 report covers USD15.1bn or almost 40% of the face value of labelled green bonds issued in Q4. 15 EUR and 8 USD labelled green bonds are...

The Green Bond Trend

DTE Energy Company (DTE: NYSE) recently priced a ‘green bond’ issuance of $525 million to support renewable energy and energy efficiency. The thirty-year bonds provide a coupon payment at 4.05%. DTE is planning to buy solar arrays and wind turbines with its newly flush cash kitty. The capital raise is of significance less for its size and purpose and more for the fact that a U.S. electric utility company is tapping this unusual financing vehicle.

True enough, green bonds are nothing new. Created to fund projects with environmental or climatic benefits, the first green bonds were issued in May 2007 by the European Investment Bank (EIB). The...

Green Bonds Mid-Year Summary 2017

by the Climate Bonds Team

Climate Bonds looks at the last six months numbers, the trends and our tips for the rest of 2017

Green Bonds Mid-Year Summary 2017

Headline figures for the Half Year (H1)

2017 issuance to H1: USD55.8bn

Records broken: Quarter 2 (Q2) is the largest quarter of issuance on record at almost USD30bn

82 green bond deals issued in the quarter from 74 issuers

Over 50% of issuers were first time issuers

Green Bond transactions accounted for 3% of global bond market transactions in Q2 2017

Top 5 largest issuers of H1:

Republic of France (USD7.6bn),

EIB (USD2.8bn),

...