Tag: BLDP

PEM Fuel Cells – Hoping to Challenge Internal Combustion

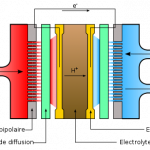

The first article in this series introduced the two prominent types of hydrogen fuel cells - alkaline fuel cells (ALKFCs) and proton-exchange membrane fuel cells (PEMFCs). Fuel cells are devices that convert stored hydrogen into usable energy, and constitute an essential part of the hydrogen economy. Subsequent articles shall focus on various characteristics of these two cells.

The graph above shows the power costs ($/kW) of PEMFCs and ALKFCs as the technology has advanced over time. In other words, they show the initial capital cost for every 1 kW of fuel cell capacity (note that this axis is in the...

List of Hydrogen Stocks

Hydrogen stocks are publicly traded companies whose business involves the use of hydrogen as energy storage or a transportation medium. See also fuel cell stocks.

This list was last updated on 8/27/2021.

AFC Energy (AFC.L)

Ballard Power Corporation (BLDP)

Bloom Energy Corporation (BE)

Cell Impact AB (CI-B.ST)

Defiance Next Gen H2 ETF (HDRO)

FuelCell Energy (FCEL)

Fusion Fuel Green PLC (HTOO)

Green Hydrogen Systems A/S (GREENH.CO)

Hazer Group Limited (HZR.AX)

HydrogenPro AS (HYPRO.OL)

HydroPhi Technologies Group, Inc. (HPTG)

HyperSolar, Inc (HYSR)

Hynion AS (HYN.OL)

ITM Power PLC (ITM.L, ITMPF)

MagneGas Corporation (MNGA)

McPhy Energy SA (MCPHY.PA)

myFC Holding AB (MYFC.ST)

Nel ASA (NEL.OL)

Nikola Corporation (NKLA)

PowerCell Sweden AB (PCELL.ST, PCELF)

Plug Power (PLUG)

PowerHouse Energy Group plc (PHE.L)

Proton Power Systems (PPS.L)

Quantum...

List of Fuel Cell Stocks

Fuel cell stocks are publicly traded companies whose business involves fuel cells, devices for efficiently converting the energy in a fuel (often hydrogen) directly into electricity by chemical means, without combustion. Applications include road transport, large-scale energy storage and short-haul transport such as forklifts.

This list was last updated on 5/6/2021

AFC Energy (AFC.L)

Ballard Power Corporation (BLDP)

Bloom Energy Corporation (BE)

Cell Impact AB (CI-B.ST)

Ceres Power Holdings PLC (CPWHF)

Enova Systems (ENVS) - out of business since 2015.

FuelCell Energy (FCEL)

Impact Coatings AB (IMPC.ST)

ITM Power (ITM.L, ITMPF)

McPhy Energy SA (MCPHY: PA)

myFC Holding AB (MYFC.ST)

Neah Power Systems (NPWZ)

Nikola Corporation (NKLA)

Plug Power (PLUG)

PowerCell Sweden AB (PCELL.ST, PCELF)

Proton...

Ballard Terminates Azure Hydrogen Licenses; Can It Find A Better China Partner?

by Debra Fiakas CFA Before the open of the first trading day of 2015, fuel cell developer Ballard Power Systems (BLDP: Nasdaq) announced the termination of technology licenses to Azure Hydrogen, which was to have been Ballard’s introduction to the China market. The license agreements covered the sale of Ballard’s bus power module and telecom backup power system. Ballard has charged Azure with breaching the agreements and the two companies have apparently not been able to come to alternative terms. Azure had made sales in the China and not all of the equipment had been paid. ...

Fuel Cell Follies: Off-Roading

by Debra Fiakas CFA Consumer adoption of hydrogen-fueled vehicles could have quite a catalytic impact on the entire fuel cell industry. Two of the public fuel cell technology companies come to mind first: Plug Power, Inc. (PLUG: Nasdaq), FuelCell Energy, Inc. (FCEL: Nasdaq) and Ballard Power Systems, Inc. (BLDP: Nasdaq). These companies have been toiling away for years on fuel cell technologies, finding success on the periphery with industrial, campus and power generation solutions. All three companies trade at modest prices and could look like great bargains for investors with an extended investment horizon. Forklift Fuel Cells...

Has the fuel-cell industry reached a tipping point?

Tyler Hamilton There was a shareholder who stood up at Ballard Power’s annual meeting last week to share her experience with the company’s stock price. It pretty much summed up the frustration shared by most investors in the fuel-cell industry. This investor has owned Ballard (BLDP) shares for most of 20 years. She sold in early 2000 when the stock hit $140 a share and did quite well. That was when the hype around fuel-cell powered cars was approaching its fever pitch. Later that year she bought back into the company at about $120 a share, believing...

Ten Reasons Why Electric Drive is Stranded on The Bleeding Edge of Transportation Technology

John Petersen The first thing every securities lawyer learns is that technology is a two edged sword. On the leading edge, developers of cheap innovations that ramp rapidly over a few years build thriving businesses that deliver market beating returns for investors. On the bleeding edge, developers of expensive technologies that can't be implemented at relevant scale for years morph into financial black holes that suck the lifeblood out of portfolios and teach a new generation of investors about an insidious market phenomenon the Gartner Group refers to as the hype cycle. The second thing...