Tag: BAM

Q1 Earnings Roundup: Yieldcos (AGR, BEP, CWEN, GPP)

By Tom Konrad, Ph.D., CFA

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. If there is any theme, it’s that low interest rates and increased interest in green investments is lowering Yieldcos’ cost of capital to the benefit of stock investors.

Avangrid Earnings

Avangrid's (AGR) Q1 earnings report showed solid progress. Key items of note were:

Increased outlook for full year 2021 Adjusted EPS a little over 5%

Key environmental approval for 800 MW offshore wind farm Vineyard Wind. Expected to begin construction later this year, with expected completion in 2024. Avangrid...

Eneti and Brookfield Renewable Earnings

By Tom Konrad, Ph.D. CFA

Here are a couple earnings notes I shared last week with my Patreon followers.

Eneti, Inc. (NETI) - formerly Scorpio Bulkers (SALT)

Eneti completed its name and ticker change on February 8th. New ticker is NETI (formerly Scorpio Bulkers (SALT), which I recently wrote about here.

Highlights from February 2nd earnings report:

37 of the 47 vessels owned at the 3rd quarter have been sold or have completed sale agreements.

Net asset value is $23.94/share. Since most assets are cash or vessels held for sale, this number is basically accurate.

The stock is still a good buy...

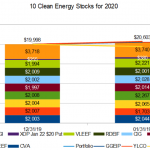

Divestment v Coronavirus: Ten Clean Energy Stocks for 2020 January Update

by Tom Konrad, Ph.D., CFA

January 2020- where do I start? A year of market-shaking news in a month.

The Brink of War

The month started off with a literal bang when Trump decided that a good way to distract the public from his impeachment trial would be to try to start a war with Iran by assassinating one of Iran's top military leaders, Qassem Suleimani. A week later, the world and markets heaved a collective sigh of relief when Iran decided that their honor had been satisfied with two missile strikes on US bases. While Trump reported no casualties, Iran's Foreign...

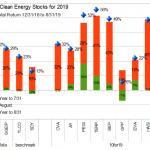

Ten Clean Energy Stocks For 2019: Will Pattern Merge With Terraform?

by Tom Konrad Ph.D., CFA

August 2019 saw economic warning signs flashing and a worsening trade war with China. Unsurprisingly, this led to weakness in most stock market indexes.

My broad income stock benchmark SDY was down 2.4% and the energy income stock benchmark YLCO fell 0.3% for the month. Most of the stocks in my 10 Clean Energy Stocks model portfolio continued to buck the trend, with the portfolio as a whole gaining 2.2% for the month. My real-money managed strategy, GGEIP, also turned in a solid 1.9% gain.

The strong performance of my portfolios probably rises from the falling interest...

Four Clean Green Dividends

by Debra Fiakas CFA The recent pullback in stock prices in the U.S. equity market has opened the door to some interesting dividend yields. Investors with a taste for environmentally-friendly businesses have some particularly interesting alternatives that can pump up the purse as well as protect Mother Earth. AES Corporation (AES: NYSE) is a world-class power generator from mixed portfolio of conventional and renewable power sources. About 28% of its 29,352 megawatts of generation capacity is from renewable fuel sources, including hydro, biomass, solar and wind, and another 33% from plants using natural gas. The balance of...