by Tom Konrad, Ph.D., CFA

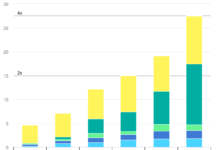

2020 ended with a massive spike in clean energy stock prices. From the end of October, election euphoria drove Invesco WilderHill Clean Energy ETF (PBW) from $63.32 to $136 at the close on February 9th, a 114% gain in 100 days.

Joe Biden is as strong a supporter of clean energy as Donald Trump was a supporter of big fossil fuel companies, but even with control of the presidency and both chambers of congress, there is a limit to what a president can do in a short time. This is especially true when their top priority is (as it should be) dealing with a pandemic.

Acknowledgement of this reality seems to be setting in. as I write on March 5th, PBW is now down almost 35% from its high. If the Dow Jones Industrial Average or S&P 500 had fallen 35%, this would be the depths of a bear market. Clean energy stocks are generally much more volatile than the broad market, but, even so, a 35% decline should make investors sit up and take notice.

I focus on clean energy income stocks because they tend not to be subject to such wild swings. The benchmark I use, the Global X Renewable Energy Producers ETF (RNRG – formerly YLCO) is also down significantly- 26% from its high of $20.20.

Pop! Goes the Bubble

With these large declines, it’s time to assess what’s next. Large drops like this don’t happen without some panic among investors. As always in a panic like this one, we need to assess:

- Has anything fundamentally changed which would justify the declines and possibly further declines.

- Is the panic approaching capitulation, when there is no one left to get scared and sell, or does the panic have farther to run?

Fundamentals

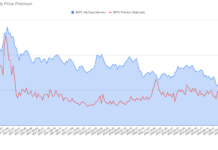

The biggest fundamental change is that interest rates are creeping up. This is in reaction to the expected spending in the Biden rescue package, and fears that we may see a surge of pent-up consumer spending as the vaccine allows the end of lock-down measures this summer.

These higher interest rates make stocks, especially income stocks like the ones I focus on, less attractive compared to bonds. Higher interest rates also make it harder for companies to use debt to finance new investments, and so can reduce future earnings expectations.

While all these things are true, I expect their long term impact to be limited. Most importantly, I do not expect interest rate increases to be large. Interest rates have been historically low: It would take a much larger rise than I expect to bring them to a level that is not still low.

There may also be some demand driven inflation in the summer, but I do not expect the demand or inflation surges to persist.

Similarly, the effect on future earnings from higher interest rates is also likely to be limited. Most companies have been very active refinancing in the recent low interest rate environment, often bringing plans for future debt offerings forward. This means that most will have the flexibility to reduce borrowing in the short to medium term if interest rates rise significantly.

Will Panic Lead To More Panic?

This is just a feeling based on having watched many market panics over the years, but I feel that the panic seems to be reaching its maximum. I think the short term bottom will happen in the next couple weeks.

I’m buying (actually selling slightly out of the money cash covered puts), especially clean energy infrastructure stocks like Yieldcos that I had been selling because of high valuations in December and January. These include AY, NEP, AGR, and CWEN/A. The amounts of each depend mostly on the size of my current positions- this is less a call about individual stock valuation and more one of market timing.

Conclusion

It’s time to bring much of that cash I’ve been telling people to keep on the sidelines for the last several months back into the game.

DISCLOSURE: Long positions all the stocks mentioned.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.