by Tom Konrad, Ph.D., CFA

Looking Back

At the end of 2019, I was worried about overvaluation.

I wrote that my main goal for the 10 Clean Energy Stocks for 2020 list was “to find stocks which will be resilient in the event of a US bear market.” We certainly had a bear market in 2020, although it was nothing like the kind of bear market I had been anticipating. The bear market was precipitated by the coronavirus pandemic, rather than overvaluation.

While I can claim to have anticipated the 2020 bear market, if not its nature, I was surprised by two other market events driving stock prices. One was the sudden reversal of the bear market, which led to gains in most indices for the year. The second was the rapid growth of the fossil fuel divestment movement, leading to rising interest in clean energy stocks.

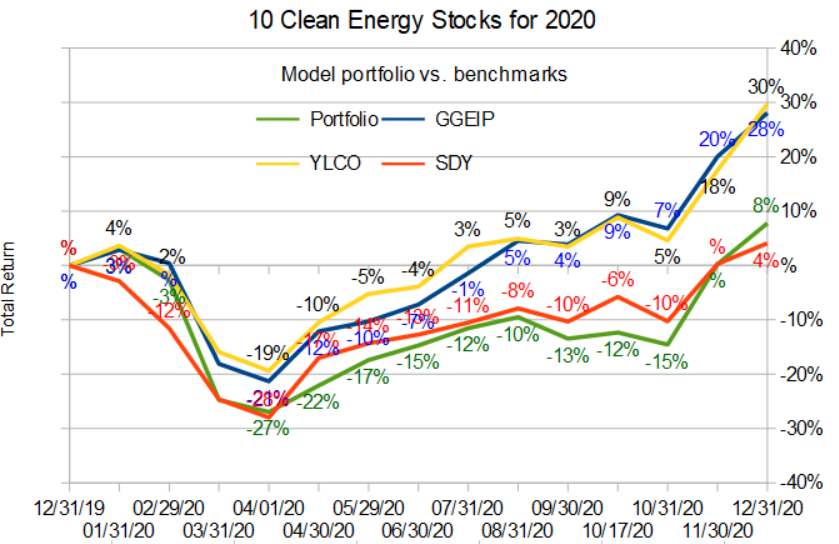

Both of these surprises helped pull the 10 Clean Energy Stocks model portfolio to a 7.8 percent total return for the year, but my defensive posture at the start of the year, my failure to anticipate the nature of the bear market, and my policy of trying to minimize trading meant that the model portfolio did not see as much upside as my clean energy income stock benchmark, the Yieldco ETF (YLCO), or the real money strategy I manage, the Green Global Equity Income Portfolio (GGEIP). These were up 29.7 percent and 28.1 percent, respectively.

My broad market income stock benchmark did not see any benefit from the new interest in clean energy stocks, so ended the year up only 4.1 percent.

Looking Forward

With valuations even higher than they were at the start of 2020, and the economy in a continued pandemic tailspin, I would not be surprised if another bear market were to start in 2021. I don’t think the stock market has ever seen back-to-back bear markets like this, but one vocabulary lesson of 2020 was that “unprecedented” and “unlikely” can mean radically different things.

And despite current stratospheric valuations of most clean energy stocks, I would not be surprised if the boom has a lot further to run. Even if the rest of the stock market collapses, the rush of money out of fossil fuels and into clean energy could continue to send the sector skyward.

It’s a market truism that, “In the short-run, the market Is a voting machine, but in the long-run, it is a weighing machine.” Right now, the market is voting for clean energy. The pandemic has caused many to take stock of how their actions affect the world around them.

Just as masks help stop the spread of covid-19, people are realizing that clean energy stocks can help stop the spread of climate change. That has started a clean energy stock boom, and stock market booms often gather a momentum of their own, with past gains leading to expectations of future gains, and new investors rushing in because of the fear of missing out.

This clean energy boom is starting to look like a bubble, but stock market bubbles can expand for years before they pop.

2021

My new 10 Clean Energy Stocks for 2021 list tries to take advantage of the boom in clean energy stocks, while also keeping a defensive posture. Since the pandemic response has been so much worse in the United States than most of Europe, I included many European names, and tried to focus on clean energy companies that could benefit from increased spending by other clean energy companies. I looked at stocks that could leverage their high stock prices to increase their future growth rates, while trying to diversify beyond the obvious solar, wind, and electric vehicle sectors.

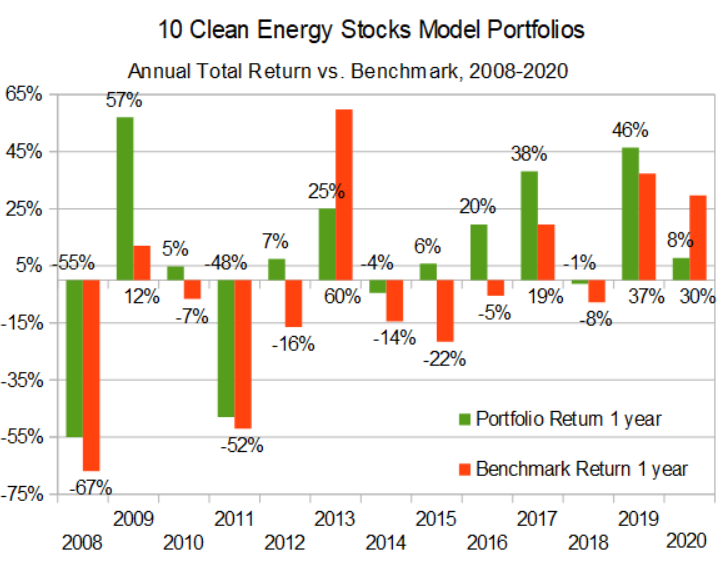

Will this new list return to its historical outperformance compared to its benchmark? I have no idea. I have trouble believing just how good my own track record is, given how often it feels like I am wrong about where the stock market is going.

Although I find myself without any confidence in my stock market predictions for 2021, I console myself with two facts:

- Overconfidence is a danger for investors, not a boon.

- Some things are more important than making money in the stock market.

We’re going to have a new President in 2021. As long as I’m not wrong about that, I can handle being wrong about the market.

DISCLOSURE: Long positions all the stocks in the model portfolio.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.