by Tom Konrad Ph.D., CFA

Sometimes it’s good to be wrong.

When I published the Ten Clean Energy Stocks For 2019 model portfolio on New Year’s Day 2019, I thought we were likely in the beginning of a bear market. With 20/20 hindsight, that was obviously wrong.

I made the following predictions and observations:

- “[T]he clean energy income stocks which are my focus should outperform riskier growth stocks.” [True]

- “[D]eep value investors will put a floor under the stock prices of these ten stocks.” [Irrelevant, and a little amusing.]

- “I could also be wrong about the future course of this market.” [So true!]

- “I have a history of underestimating the optimism of investors.” [True, and even more true today]

- “[If] the Dow [is] hitting new highs by the end of 2019 … I expect that this model portfolio will produce gains as well, although it will likely lag the gains seen by the broad market of less conservative picks.” [Wrong again]

- “As long as you are in the market, every now and then the stars will align, and you will make some great gains.” [True, but I did not think that alignment would come again in 2019 so soon after 2016 and 2017.]

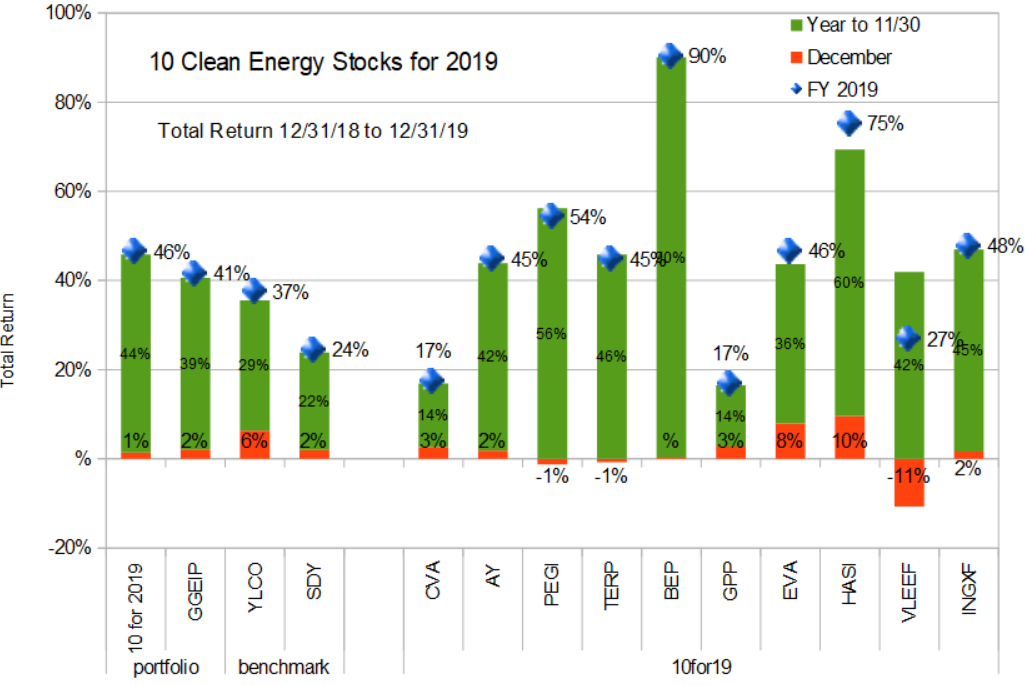

In the end, my conservative model portfolio ended the year with a total return of 46%. The real-money green income strategy I manage, GGEIP returned 41% despite a large cash allocation in the second half of the year. Both compare favorably to my clean energy income benchmark, YLCO, which was up 37%, and the broad market income benchmark SDY, which gained 24%.

In short, the stars aligned in 2019.

Because almost every stock in the model portfolio went up far more than its actual business improved, I dropped most of them from the 2020 clean energy stocks model portfolio. I still like all the companies, just not their prices.

I did not sell any of them completely in GGEIP, but I have been taking profits in and lowering my allocation to the ones with the greatest gains.

The new list is heavily international, and partly hedged. Despite being wrong in 2019, in 2020, I’m doubling down on the thesis that there is a good chance of a bear market in the United States this year.

When it comes to predicting bear markets, I sometimes feel like I’m a broken clock.

Eventually this broken clock will be right. Until then, I’ll console myself with the unexpected fruits of being wrong.

Disclosure: Long PEGI, CWEN/A, CVA, AY, TERP, BEP, EVA, GPP. INGXF, HASI, VLEEF.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

I really like your blog and 2019 stock picks. I invested in PEGI, CWEN, AY, and TERP in 2019 and all did well for me. I understand the problem with some of these stocks in 2020 being that their businesses have not grown as fast as their stock prices but believe that the future is bright for these kind of stocks so will stick with them in 2020.

I’m still holding all of them, too… a real portfolio does not have to conform to the limit of only ten holdings. But I would suggest that you at least re-balance your portfolio (as I did) by selling part of your winning positions, and investing the proceeds into some of this year’s list. Your portfolio as a whole will be safer for it.