by Tom Konrad Ph.D., CFA

Almost every major index fell in 2018. My Ten Clean Energy Stocks model portfolio and the Green Global Equity Income Portfolio (GGEIP), the real-money portfolio that I manage were not exceptions. Still, I’m satisfied with their performance: the model portfolio lost only 1.3 percent for the year, while GGEIP was down 2.6 percent. That’s well ahead of most indexes, including my benchmarks YLCO (down 7.8 percent) and SDY (down 4.1%.) These benchmarks are intended to reflect the performance of clean energy dividend stocks and general of dividend stocks, respectively. Non-income oriented indexes such as the S&P 500 performed similarly to SDY.

Short Term Predictions

While my full year performance was satisfactory, my short term predictions from the start of December fared less well. I said:

I continue to be very concerned about stock market valuation, and expect the correction that started last summer to continue in 2019. However, I expect December may continue the market rebound we saw in November, so I see the coming month as one in which to opportunistically take profits and increase allocations to cash in anticipation of better buying opportunities in 2019.

That predicted continued December rally was a rout, with the model portfolio down 7.0 percent, GGEIP down 2.6 percent, YLCO down 3.6 percent, and SDY down 8.5 percent. Ouch. My single stock pick for the month, Green Plains Partners(GPP), performed relatively well, however, actually gaining 0.4 percent while all the other stocks in the model portfolio fell.

Ten Clean Energy Stocks for 2019

Readers looking for my current picks should consider the most recent list, which was published on January first. Updates on individual stocks can be found there as well.

10 for 2018 Performance

| Type | Ticker | December | FY 2018 |

| portfolio | 10 for 2018 | -7.0% | -1.3% |

| portfolio | GGEIP | -4.9% | -2.6% |

| benchmark | YLCO | -3.6% | -7.8% |

| benchmark | SDY | -8.5% | -4.1% |

| 10for18 | SSW | -17.6% | 23.6% |

| 10for18 | CVA | -17.4% | -15.1% |

| 10for18 | CWEN A & C | -5.9% | -3.1% |

| 10for18 | AY | -0.4% | -1.5% |

| 10for18 | PEGI | -8.2% | -5.5% |

| 10for18 | TERP | -0.7% | 0.4% |

| 10for18 | BEP | -9.3% | -20.7% |

| 10for18 | GPP | 0.4% | -18.7% |

| 10for18 | HIFR | -7.1% | 18.6% |

| 10for18 | EVA | -3.8% | 8.8% |

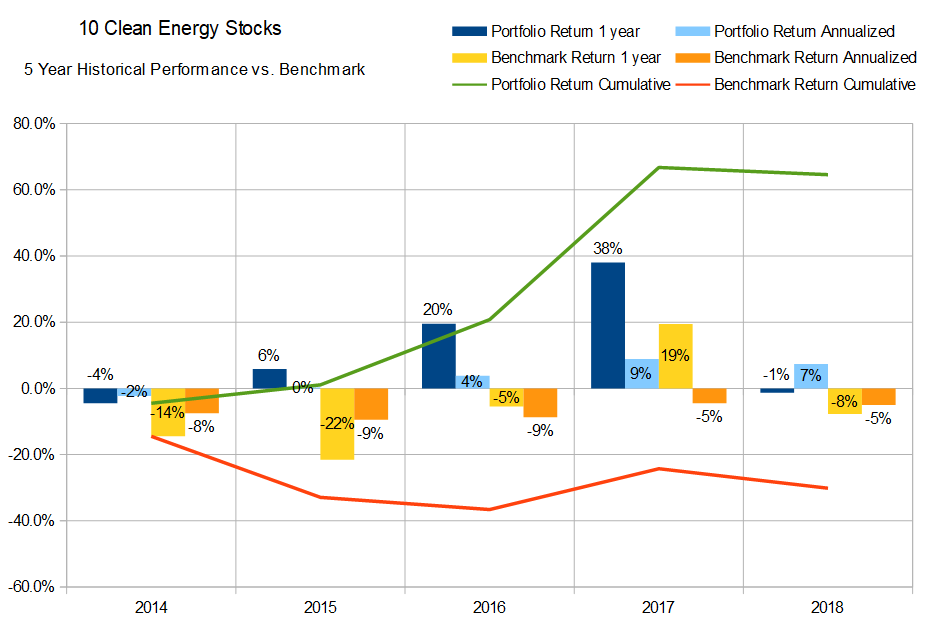

Five Year Performance

Over the last 5 years, the Ten Clean Energy Stocks model portfolio has outperformed its clean energy benchmark every year. Over 5 years, $1000 invested in Ten Clean Energy Stocks would have become $1646, while $1000 invested in the benchmark would have fallen to $699. $1000 invested in SDY would have become $1509 (although I was not using SDY as a benchmark for the whole period.)

Disclosure: Long SSW, CVA, CWEN A and C, AY, PEGI, TERP, BEP, GPP, HIFR, EVA.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Tom, what are your thoughts on CWEN after the PCG bankruptcy announcement? Thanks in advance.

Article coming tomorrow on that subject. IF you don’t see it here, check GreenTech Media… still waiting to hear back if they want it. Editorial changes and overwork mean it’s hard to get their attention.

The article on PG&E bankruptcy is up: https://www.greentechmedia.com/articles/read/pge-is-going-bankrupt-whats-my-yieldco-exposure