DTE Energy Company (DTE: NYSE) recently priced a ‘green bond’ issuance of $525 million to support renewable energy and energy efficiency. The thirty-year bonds provide a coupon payment at 4.05%. DTE is planning to buy solar arrays and wind turbines with its newly flush cash kitty. The capital raise is of significance less for its size and purpose and more for the fact that a U.S. electric utility company is tapping this unusual financing vehicle.

True enough, green bonds are nothing new. Created to fund projects with environmental or climatic benefits, the first green bonds were issued in May 2007 by the European Investment Bank (EIB). The EIB’s Climate Awareness Bond was focused on renewable energy and energy efficiency. The next year the International Bank for Reconstruction and Development (IBRD) issued the first bond actually labeled as a ‘green bond’, raising $440 million to support climate-focused projects.

Such special interest financing instruments help mobilize capital for projects that might otherwise fail to impress investors who are conditioned to evaluate project revenue against only internal expenses while ignoring external costs borne by society. Projects delivering environmental or climate benefits include all benefits and costs. Investors in green bonds certainly do not abandon the conventional financial metrics such as maturity, coupon, price, and credit quality. However, cost/benefit analysis of the particular project gets attention as well.

Green Bonds Around the Global

There are many who might dismiss the green bond concept as so much ‘tree huggery’, but they are apparently in the minority. The financing vehicle has gained widespread interest. The U.S., China and France account for just half of green bond issuance. The balance is spread across several countries, including Germany, Sweden, the Netherlands, Spain, Mexico, Canada, and India.

In the year 2017 several records were set in global green bond finance. A new record was set of $155.5 billion in green bond issuance. France was home to the single largest green bond issuance through a $10.7 billion sovereign bond program. A total of 240 individual borrowers came to market from 37 different countries. Ten of those countries were joining the green bond movement for the first time: Switzerland, Slovenia, Lithuania, United Arab Emirates, Nigeria, Chile, Argentina, Malaysia, Singapore, and Fiji.

The projects that get financed are as diverse as the issuers. Renewable energy is still a mainstay. There also continue to be awards to low carbon transportation, energy efficiency and sustainable buildings. Brazil has a high ratio of agricultural and forestry projects. Waste recovery and land use have also received interest. The World Bank also has been promoting brown-to-green projects with an aim to reaching a milestone of a trillion dollars in green bond financing by the end of 2020.

Corporate Participation

Accelerating expectations by consumers for sustainable energy production and the promotion of this financing platform is probably going to bring DTE Energy and corporations like them back to the ‘green bond’ table. Investors will need to get used to checking a few additional boxes. Are the proceeds going to be used for clearly defined environmental benefits? Is there a scheme to track and confirm project goals? What performance measures are in place and are the assumptions for costs and benefits sound?

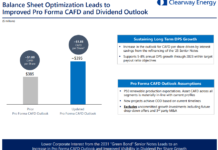

The vetting process will require a whole new set of numbers to crunch by investors. Fortunately, the rest is routine. Green bonds are earmarked for projects with environmental benefits, but they are backed by the issuer’s entire balance sheet. That makes the issuers full financial picture of importance. In the case of DTE Energy a current ratio of 1.10, a profit margin of 19.95, and a sales-to-cash conversion rate of 16.8% are just the beginning of a fundamental analysis of the issuer’s ability to pay interest on the green bond and return principal.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.