by Paula Mints

All industries and the companies that populate them are vulnerable to macro and micro economic shocks, substitutes, changing tastes and other economic, political and social events.

The global solar industry is vulnerable for all-of-the-above reasons and as it is incentive, subsidy and mandate driven while trying to unseat the conventional energy status quo, it is particularly vulnerable. The solar landscape remains low margin and requires government intervention of some type to thrive.

It is correct to say that the global solar remains primarily policy driven, but this statement does not go descriptively far enough. Many deny that solar deployment still requires incentives, mandates and/or subsidies to thrive, but, underpinning every installation of any size are components supported by subsidies or tariffs (including raw materials such as steel), tax subsides (direct or indirect) and along with the obvious, indirect and far less visible support.

The same is true of conventional industry. The difference in this regard is that solar and other renewable energy technologies are called to task for their support systems and conventional energy is not.

The demand and supply sides of any market are inexorably linked. All participants need each other but though their interests are aligned to a degree, they operate in a constant state of competition and negotiation to eke out the most favorable terms. During the market dance buyers and sellers from one point in the chain to the other are theoretically all driving towards the equilibrium price, which is the point of economic nirvana where supply matches demand.

In this perfect theoretical world, the value of the product to the buyer and the cost of manufacturing and selling it find their perfect point of agreement in a price that reflects the fair and rational behavior of market participants.

Anything in theory, right?

In the real and often theory-defying world other market forces are also at work for example, supply constraints and micro/macro-economic shocks. The imposition of tariffs and/or minimum prices can upheave a market – a real problem for a chronically upheaved industry like solar. Political change can alter the course of a market by removing supports and placing the supports elsewhere. Natural disasters can affect the supply chain. Civil unrest and war can affect the supply chain. The availability of competing products can and often does disrupt markets. Renewable energy technologies disrupted (to a degree) coal, and cheap natural gas disrupted coal and renewables (to a degree).

The market, which is really people interacting, does not like uncertainty and tends to respond negatively to it. The housing crisis and resulting global recession are examples of unexpected events that rock markets and were the result of many things, exuberant investment and shady financial dealings among them.

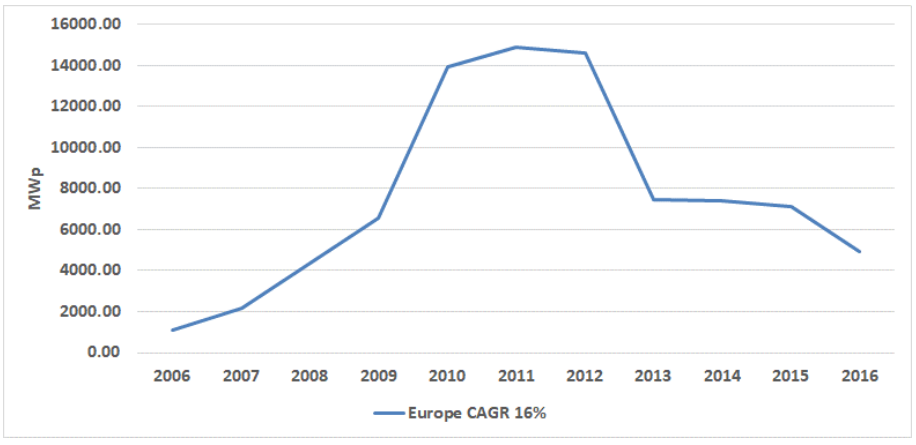

The Market in Europe provides possibly the best recent example of a vulnerable market for PV. The EU feed-in-tariffs accelerated demand in Europe with the region responsible for >80% of global demand for more than 80% in 2009 and 2010. Investors flocked to generous and supposedly stable FiT markets which collapsed as quickly as they sprang up. Figure 1 presents demand in Europe from 2006 through 2016.

Figure 1: Demand for PV Systems in Europe, 2006-2016

“Happy families are all alike; every unhappy family is unhappy in its own way,” Leo Tolstoy,

Anna Karenina. In the Solar industry strong markets are alike in that they have incentives,

subsidies and/or mandates to drive growth and adoption but also a fair amount of political and economic risk and every weak or collapsing market is alike in that it no longer has incentives, subsidies and/or mandates to drive it and its political and/or economic risk has become a reality.

A weak market is the mirror image of a strong one that is, everything is seen in reverse. In solar a leading market share receives more notice than the constrained margins that go along with it. For example, solar lease etc., company Sunrun is being touted for passing SolarCity in terms of its market share even as it racks – pardon the pun – up losses reporting losses from operations of $130.7-million and net losses of $180.9-million for nine months of 2017. True, the company lost less money than it did in 2016, however this should not be spun as a positive.

In the solar industry low prices are celebrated as progress with the result that the expectation for ever lower prices is firmly set. As margins all along the value chain are tight any disruption such as an increase in raw material prices or a new tariff, can tip the scale from barely profitable to loss.

In the solar industry all markets are risky and high risk does not always equal high reward.

The price of polysilicon rises and wafer, cell and module manufacturers shudder. The price of cells increases and module assembler and developers/installers wince. The price of steel

increases and manufacturers of mounting and trackers sigh.

Why the Bifurcation of an Industry’s Supply and Demand is bad for Everyone

In theory, a healthy domestic market would have supply participants to serve its demand participants so that the equilibrium price can be achieved. In reality buyers want the cheapest available price and typically do not care of that price falls below cost, and sellers want to dominate the market at some margin that supports their ongoing operations and leaves a cushion to cover shocks in the market such as rising raw material costs, labor costs, research, and for other save-for-a-rainy-day reasons.

Energy markets, globally, are incentivized, subsidized and/or mandated. Perfect supply/demand markets are typically small and rural and are extremely rare. Government intervention in energy markets – globally – has created a situation where an even playing field in terms of supply and demand and a perfect competitive landscape is impossible.

An example from solar: In the mid-to-late 2000s the market in Europe consumed ~80% of PV modules. In 2011, Europe consumed >60% of PV modules. During this period the US and other markets experienced supply constraints and prices increased.

More recently, the market in China for PV deployment has dominated and in 2017 will account for >53% of PV deployment and >50% of module supply. Making a long story short, China’s supply dominance came about because it used a strategy of aggressive pricing to dominate the global market. In the beginning, China was an export market. Now, China consumes most of its own supply and has no reason to put up with pesky little problems such as tariffs and minimum prices from markets much to small and no longer profitable enough to bother with. Its manufacturers have no further need for the scrutiny that comes with being a listed company and are privatizing one-by-one.

This means that markets outside of China are now experiencing a supply constraint and higher prices. A theoretically healthy market with a (relatively) balanced supply and demand value chain would be in more control of its price and the supply of product available to it.

However, theory and real life almost never intersect.