by Debra Fiakas CFA

Investors based in the U.S. need to look far and wide for new stock issues from renewable energy companies. Capital markets activity has slowed in the last couple of years, in part to due to their own success. In reaching new efficiency in energy production, renewable energy companies are generating their own internal capital and are not as dependent upon the capital markets. The Hong Kong market has come to the rescue of U.S. investors with a ‘green’ offering

China Everbright Greentech Ltd. is now trading on the Hong Kong Exchange with the stock code 1257 following a successful offering of 560 million shares in April 2017. The company raised $385.6 million (HK$3.0 billion) in new capital that will be used to develop business in the People’s Republic of China as well as research and development in advanced technologies.

A spin-off of parent China Everbright International, the waste-to-energy and water treatment developer, China Everbright Greentech invests in a variety of renewable energy projects. These projects are capital-hungry and sometimes deliver volatile returns. The spin out should help the parent to present more stable financial results. Investors in the spinout are getting a more speculative play at a more compelling valuation.

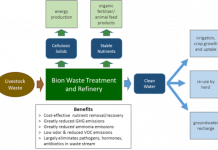

China Everbright Greentech is a self-described “specialty environmental protection service provider.” Its portfolio includes biomass, solar and wind energy production as well as hazardous waste treatment facilities. Total energy product at the time of the IPO was 125.9 megawatts from solar and wind facilities and another 810 megawatts from biomass projects currently in the planning and construction stages. Current hazardous waste treatment capacity is in excess of 500,000 tons per year.

Management has wasted no time in deploying new capital. In late May 2017, the company announced definitive agreements for three new hazardous waste treatment projects in mainland China. The total investment of US$102 million (RMB680 million) will add 120,000 tons per year in waste processing capacity after all construction phases are completed.

The company’s public offering document provides details on revenue and profits. Sales value has increased in each of the last three years, with profits following. In 2016, the company delivered HK$629.5 million (US$81.8 million) in profit on HK$3.0 billion (US$390.0 million) in total sales, representing a profit margin of 21%. Operations generated HK$886.2 million (US$115.2 million) in cash flow.

China Everbright International remains the controlling shareholder in its greentech spin-off. However, the offering makes room for investors of all stripes to participate in what appears to be a successful formula for growth and income.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.