by Debra Fiakas CFA

Last week, one of the leaders in a development consortium, Iceland’s largest privately owned energy generator HS Orka hf, announced the completion of a project to prove the merits of deeper geothermal wells. The project in the Reykjanes Peninsula in southern Iceland reached 4,659 meters depth in January 2017, where temperatures measured 427 degrees Centigrade and fluid pressure was 340 bars. By all accounts the project was successful, suggesting that deep wells could a cost effective approach to geothermal energy.

The drilling program was mentioned in early December 2015 a recent post “Hot Rocks, Warm Stock,” which touched on the option of investing in a larger company, Statoil (STL: SW or STO: NYSE), for a stake in geothermal technologies for renewable energy. Unfortunately, a position in Statoil brings with it the noise of Statoil’s fossil fuel interests. Fortunately, for the more environmentally-conscious investor, there is an alternative.

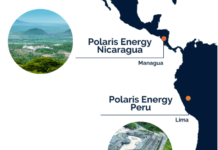

HS Orka is majority owned by Alterra Power (AXY: TO or MGMXF: OTC) a Canada-based geothermal power generation company. Alterra has interests in eight different power facilities totaling 825 megawatts of generation capacity using hydro, wind, geothermal and solar technologies. The assets are located in Texas and Indiana in the U.S., British Columbia in Canada and, of course, the HS Orka asset in Iceland. Alterra’s development pipeline includes additional geothermal projects in Iceland through HS Orka, in Peru through a local Energy Development Corporation, and in Italy through Graziella Green Power. Notably HS Orka is also planning new hydro-electric projects, in which Alterra will participate. No doubt the knowledge gained during the recently completed deep well drilling project will boost HS Orka’s geothermal development as well.

Alterra Power reported $42.9 million in total sales in the first nine months of the year 2016, providing $2.7 million in net income or $0.06 per share. Since there is considerable noise in reported income from charges and benefits through the shifting values of equity derivatives, the financial fortunes of this company are best viewed from the perspective of cash earnings. Operations generated $15.5 million in cash in the first nine months of 2016, representing sales-to-cash conversion rate of 33.8%. This compares favorably to the conversion rate in the previous year of 28.0%, and suggests Alterra can consistently generate cash for future investments.

Internal cash resources have not been enough for Alterra’s ambitious development plans. The company had $273.6 million in long-term debt on the balance sheet at the end of September 2016. The debt-to-equity ratio was 1.15, suggesting there is potential for additional leverage if the company needs to move aggressively in its renewable energy markets.

Alterra’s common stock trades on the Toronto exchange under the symbol AXY, but investors can also gain access through the Over-the-Counter Pink Sheets where the stock is quoted as MGMXF. The shares have traded off in recent weeks providing a compelling entry point for shareholders with the lengthy investor horizon and risk tolerance for smaller companies.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.