by Debra Fiakas CFA

The November 8th post “Trident Winds Floats a Plan for Morro Bay” described plans for one of the first wind energy projects off the western shores of the U.S. Trident has perfected new technologies for a floating platform that makes possible the location of wind turbines in areas where ocean depths prohibit conventional wind turbines towers anchored to the sea floor. Investors interested in wind energy technology do not have to wait for Trident to prove out to get a stake in ‘floating offshore’ wind energy.

Based in Europe, SBM Offshore (SBMO: AEX) is a leader in the market for Floating Production Storage and Offloading platforms (FPSO). The company is part of a consortium of electric utility and technical firms to win a contract from the French government to build and operate a pilot floating wind farm. SBM Offshore will supply its proprietary floating system. Three Siemens 8-megawatt turbines will be installed on the platforms. The project is one of four being supported by French government programs, which have identified floating wind turbines as key to renewable energy production for France given the great ocean depths around the country.

Shares in SBM Offshore give an investor more than a stake in offshore wind. Indeed, floating platform solutions are among the newest seaworthy products offered by the company. SBM Offshore has a lengthy history in deep water infrastructure with swivel stacks, turret mooring systems, semi-submersibles, and well-head platforms. The company has been in business continuously for over 150 years under various names and product lines.

The company reported $2.6 billion in total sales in 2015, providing $24 million in net income. Sales and earnings were off in the year compared to the previous year as low crude oil prices hobbled order patterns by its oil and gas industry customers. Backlog declined 13% in 2015. Unfortunately, as the year 2016 has unfolded, things have not improved. The company reported $936 million in sales and $38 million in net income in the first six months of 2016, marking an even deeper decline in fortunes for SBM. Cultivation of new markets for SBM’s unique expertise in deep ocean conditions could be a salvation for the company weakened top-line.

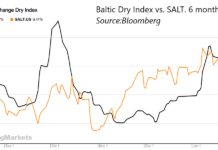

The stock price has followed revenue down the mountain. The stock, which trades in the Euro on the Amsterdam exchange, has declined by 54% from its historic high price of Euro 30.32 in July 2007. The stock has been so weak, SBM leadership decided to use excess cash to repurchase shares with up to Euro 150 million. As of mid-November 2016, repurchases valued at approximately Euro 108 million had been completed. The repurchase program seems to have put a strong line of price support about 25% below the current stock price, suggesting there is a floor but its represents a significant downside risk for investors one the share repurchase has run its course.

Despite these near-term trading issues, SBM Offshore is an interesting company to watch. Even the most modest turnaround in its established deep water solutions or progress with the new offshore wind business would be a plus for the stock. When the recovery is imminent, the smart investor could do well buying the stock ‘offprice.’

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.