by Debra Fiakas CFA

Earlier this week nuclear fuel technology developer, Lightbridge Corporation (LTBR: Nasdaq), reported year-end 2015 financial results and provided an update on recent accomplishments. Not unexpectedly, Lightbridge reported a net loss of $4.3 million or $0.24 per share for the year. During the year the company scraped together $900,000 in revenue from consulting services, an effort to leverage the expertise of its scientists and engineers as they continue work on new fuel technologies. The contribution margin of the consulting work was $216,239 – not nearly enough to cover administrative spending or the costs of research and development on the company’s innovative nuclear fuel rod. Fortunately, a good share of expenses were paid with stock and thus Lightbridge only needed $3.7 million in cash to support operations, most of which came from the corporate bank account balance of $4.2 million at the beginning of the year.

As dismal as those numbers might seem, for a change Lightbridge could tell more in its financial report than just a story of ‘we are hanging in there.’

Lightbridge has taken a giant step forward in its quest to bring new nuclear fuel technology to the market. France’s nuclear fuel giant, Areva NP (ARVCF: OTC; AREVA: PA), has entered into a joint development agreement with Lightbridge. The objective is to establish a formal joint venture that would complete development of Lightbridge’s novel metallic nuclear fuel technology and then manufacture and sell the fuel assemblies. The two companies have until the end of 2016 to get a definitive agreement put into place.

Lightbridge has taken a giant step forward in its quest to bring new nuclear fuel technology to the market. France’s nuclear fuel giant, Areva NP (ARVCF: OTC; AREVA: PA), has entered into a joint development agreement with Lightbridge. The objective is to establish a formal joint venture that would complete development of Lightbridge’s novel metallic nuclear fuel technology and then manufacture and sell the fuel assemblies. The two companies have until the end of 2016 to get a definitive agreement put into place.

Of late Areva has made efforts to focus more keenly on the nuclear sector, refining and escalating its products and services for nuclear operators. A joint venture with Lightbridge gives Areva access to a metallic fuel technology that could give nuclear power plant owners the chance to increase operating efficiency for the first time in decades. Usually to expand output the power plant owner must seek local, state and federal approval for a new reactor – a costly and time consuming undertaking. Tests have shown that Lightbridge’s all-metal fuel assembly can increase power output by as much as 17% in existing power plants. New power plants, with large containment structures, could get up to a 30% power ‘uprate.’ The economics of such capacity expansion are quite appealing and it might be that Areva sees Lightbridge’s novel design as an easy sell to its power plant customers.

So easy, that Areva has pledged considerable engineering and managerial support over the next months to bring the joint venture to fruition. Areva will not be footing the bill alone. The two companies have agreed to share expenses. During the earnings conference call Lightbridge management emphasized how zealously they have been husbanding their bank account. Two ‘equity credit lines’ have remaining availability for additional draw down. Management claims these financial resources should be sufficient to support its financial commitment to the joint venture as well as its operations through to first revenue from the sale of the fuel assemblies.

Still there is much to be done before that first important order. There is more testing to be completed in research reactors. All the while, Lightbridge and Areva will need to perfect the manufacturing processes. Then the completed fuel assemblies must be tested under severe accident situations. Assuming those tests are favorable, Lightbridge will still need to get final approval from the U.S. Nuclear Regulatory Commission or any other oversight or permitting organization in countries where the joint venture partners intend to sell the assemblies.

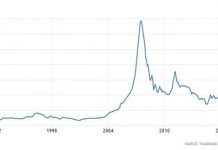

Lightbridge management has suggested that its fuel assemblies will not get installed in commercial reactors until 2020. That is a full four years away, which probably explains at least in part why Lightbridge stock is still priced well below a buck a share. For U.S. investors facing a particularly volatile equity market and considerable uncertainly in interest rates and economic prospects, it is difficult to give full valuation for a product still in development by a small company with a long history of losses and scant history of commercial success. Thus LTBR remains priced as an option on management’s ability to execute on its strategic plan. Indeed, the stock traded down in following news of the Areva relationship even though, in our view, the option should have increased by a measure to reflect a ‘so far so good’ premium.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. Lightbridge Corporation (LTBR) is included in the Nuclear Group of Crystal Equity Research’s Atomics Index composed of companies using the power of the atom to create energy.