by Debra Fiakas CFA

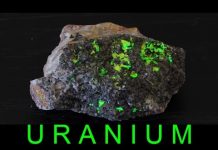

When the market gets volatile, many investors dive behind the protective shield of dividends. Exelon Corporation (EXC: NYSE) is an owner of nuclear power generation plants and is included in Crystal Equity Research’s Atomics Index of companies using the atom to create energy because more than half of its power output is generated at nuclear power plants. The company offers a handsome dividend near $1.24 per year. Granted it is not a small-cap company, which is the usual target for this column, but yield is beguiling. At the current price the dividend yield is 4.6%, a level better than most bank rates and even some corporate bonds.

The trick to buying dividends is to seek the company with the most reliable cash flows and the stock with the best value. There is a bit of friction in those two objectives as financially health companies that would be able to sustain a dividend payout would logically be valued higher than other less secure companies.

There are at least a dozen and a half analysts with published estimates for Exelon. There appears to be little agreement amongst them about the next year, as the range of sales estimates fall in a wide range from $20.5 billion to $32.7 billion. The median sales estimate suggests Exelon is struggling to grow its top line, but apparently not everyone in the group seems to see the problems.

The range of earnings estimates is not as wide, with the low estimate coming in at $1.98 and the high at $2.73. While the range of earnings estimates might not tell us, much the predictions of profits are some comfort for dividend seekers. Exelon has consistently beat the consensus estimate over the past year, suggesting either that things have gone better than analysts have predicted or that Exelon management has done a good job of jawboning down the forecasts.

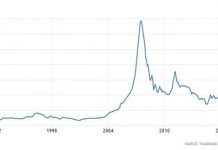

Exelon had recorded $30.0 billion in power generation revenue over the twelve months ending in September 2015, providing $2.0 billion in net income or $2.25 in earnings per share. More importantly, Exelon is a consistent generator of cash, converting 22% of sales over the past four years to operating cash flow. The trouble is, Exelon’s capital spending soaks up most of the internal cash and the company has had to borrow to keep cash levels level on the balance sheet. The company’s long-term debt increased to $27.0 billion at the end of September 2015 (including the current portion), compared to $22.5 billion a year earlier.

EXC is trading at 11.1 times the consensus earnings estimate for 2016 of $2.52 per share on $25.3 billion in sales. This is a bit lower valuation than the industry average of 17.0 times earnings. The apparent discount could be as a result of the comparative muted view on Exelon’s growth than the rest of the power generation pack. Then there is the building leverage. The 20% increase in debt over the past year might have spooked some investors.

For the rest of investors who are not put off by slowed growth or building leverage, relatively low price volatility might be the final stone in the proverbial water jar. The beta for EXC is 0.22, suggesting there is not a great deal of volatility compared to the broader U.S. equity market. So even if the sirens of the dividend are calling investors near the rocks, they are not large rocks!

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. AMRS is included in Crystal Equity Research’s Beach Boys Index of companies developing alternative energy using the power of the sun.