by Debra Fiakas CFA

Last week nuclear fuel developer Lightbridge Corporation (LTBR: Nasdaq) announced an agreement with nuclear power plant builder Areva (AREVA: Paris; ARVCF: OTC/QB) to form a joint venture. The present pact is a precursor to a formal joint venture agreement that would team up the two companies – one very large multinational nuclear power house and one still quite small fuel developer – in joint development of Lightbridge’s metallic nuclear fuel technology.

Lightbridge has developed and patented a novel design that replaces conventional tubes filled with ceramic uranium pellets now used by pressurized water reactors. Lightbridge’s fuel rods are also produced differently. A co-extrusion technology is used to shape a single piece of solid fuel rod from a metallic matrix composed of a uranium and zirconium alloy.

The Lightbridge fuel rod affords a number of advantages. Most important for nuclear power plant operators is the potential for a 10% to 17% increase in power generating capacity from existing reactors. For new reactors the “power uprate” as Lightbridge calls it, could be as high as 30%. The Lightbridge all-metal fuel rods could also extend the operating cycle length from 18 months to 24 months. These benefits mean a dramatic change for the better in the economics of nuclear power plants, making both existing and new plants more attractive alternatives to fossil fuel plants that spew out offending carbon pollution.

Some reactor system adjustments would be required to use Lightbridge’s all-metal fuel rods. That means the company needs to work closely with nuclear plant designers and fuel suppliers to fully commercialize the Lightbridge fuel rod design. Ultimately it will be the nuclear fuel suppliers that will be Lightbridge’s customers. In a post on September 11, 2015, discussing the U.S. Clean Power Plan and nuclear power, we noted that Westinghouse or Areva could be two of Lightbridge’s most likely commercial partners.

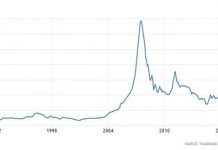

True enough the agreement that was just announced is not much more than a firm handshake on a plan to meet again. However, it is not likely that Areva would even bother with Lightbridge if they had no interest in Lightbridge’s novel nuclear fuel rod design. In my view, with this announcement Lightbridge has become an even more interesting play in nuclear power through the possible endorsement by Areva.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.