by Debra Fiakas CFA

Smaller companies frequently avoid debt as a capital source, relying instead mostly on equity. After all common stock holders are often content to wait for years for a dividend as the small, young company secures its market position and builds profits. Pesky creditors are always knocking on the door for interest payments and principal return.

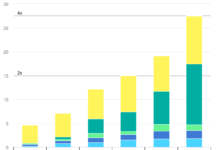

Yet, a number of smaller companies included in our Beach Boys Index of alternative fuel producers have chosen to use debt. We reviewed a group of them to determine the impact of increase in interest rates that could result from an upward revision of the Federal Reserve’s benchmark interest rate.

Waste-to-energy producer Covanta Holding Corp. (CVA: NYSE) wins top prize as the most levered company in the group with Darling Ingredients (DAR: NYSE), a food by-products recycler and renewable diesel producer, follows up as a distant second.

|

USE OF LEVERAGE; CASH GENERATION

|

|||||

|

Symbol

|

Operating Cash Flow

|

Cash Flow-to-Sales Ratio

|

Cash Balance

|

Debt

|

Debt-to-Equity Ratio

|

|

($72.8M)

|

Neg

|

$11.9M

|

$159.6M

|

NA

|

|

|

$230.0M

|

13.9%

|

$69.0M

|

$2.5B

|

390.13

|

|

|

($5.4M)

|

Neg

|

$53.1M

|

$216.7M

|

58.45

|

|

|

MEOH

|

$463.9M

|

19.5%

|

$426.7M

|

$1.5B

|

76.43

|

|

$392.5M

|

10.9%

|

$148.9M

|

$2.0B

|

105.61

|

|

|

($11.5M)

|

Neg

|

$495.9M

|

$647.6M

|

66.68

|

|

|

IMO

|

$2.0B

|

10.6%

|

$266.4M

|

$6.2B

|

36.38

|

|

($21.6M)

|

Neg

|

$21.3M

|

$207.9M

|

72.36

|

|

|

Trailing twelve months ending September 2015; balances on September 30, 2015

|

|||||

First we looked at the total debt and calculated the after-tax impact in earnings per share of a quarter point increase in interest rates. We then took our analysis to the next level by measuring the impact on the stock price that might result from the reduction in earnings. For this analysis we used the company’s forward earnings multiple, if available, and otherwise the trailing earnings multiple. Not surprising the two companies for which we estimated the greatest price reduction are the two most-leveraged operations based on debt-to-equity.

|

IMPACT OF QUARTER POINT INTEREST RATE INCREASE

|

||||

|

Symbol

|

Current Price

|

Change in EPS

|

Valuation Impact / Share

|

Percent of Price

|

|

AMRS

|

$1.51

|

$0.00

|

NM

|

NA

|

|

CVA

|

$13.79

|

($0.05)

|

($3.05)

|

22.1%

|

|

PEIX

|

$4.13

|

($0.01)

|

($0.05)

|

1.2%

|

|

MEOH

|

$32.43

|

($0.03)

|

($0.35)

|

1.0%

|

|

DAR

|

$9.56

|

($0.02)

|

($0.37)

|

3.9%

|

|

GPRE

|

$20.53

|

($0.03)

|

($0.52)

|

2.5%<

/div> |

|

IMO

|

$29.73

|

($0.04)

|

($0.57)

|

1.9%

|

|

AMRC

|

$6.25

|

($0.02)

|

($0.43)

|

6.0%

|

For some of the companies in the group this initial uptick in the bench market interest rate may be a ‘non-event.’ For example, the stock price of Covanta may ultimately show the least impact of higher interest rates. Covanta’s production of electricity from low- or no-cost waste materials affords a highly efficient business model with strong profits and cash flows. Covanta converts nearly 14% of its sales dollars to operating cash flow, making it one of the strongest cash generators in the group.

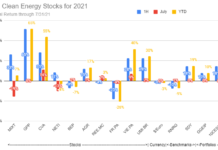

In contrast to Covanta, Amyris, Inc. (AMRS: Nasdaq), Pacific Ethanol, Inc. (PEIX: Nasdaq), Green Plains, Inc. (GPRE: Nasdaq), and Ameresco, Inc. (AMRC: Nasdaq) have all struggled to maintain positive operating cash flows. Each of these companies is a reported net user of cash in the most recently reported twelve months. The strain on cash balances could trigger greater concern on the part of traders and shareholders.

Perhaps a greater concern for these smaller companies than the impact of greater interest burden on earnings per share, is the risk that increases in interest rates might make it more difficult to remain in compliance with debt covenants. Nearly all companies with debt have agreed with creditors to maintain minimum financial performance such as minimum coverage of interest obligations by operating earnings or maximum debt-to-equity ratio. Darling Ingredients is the second most levered company in this group and has had difficulties in maintaining covenant compliance in the past.

It will take some time to determine how the increased Federal Funds rate will impact lending patterns. In the meantime, it appears these renewable energy producers have the mean to bear up under their interest burden

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.