by Debra Fiakas CFA

In late August 2015, volatility turned its frightening countenance on the U.S. equity market. The volatility measure for the S&P 500 Index (VIX) spiked to a peak of 53.29 during trading on August 24th. While things have calmed down since, volatility remains well above the 20.00 level where many investors consider it too precarious to take new equity positions. At time like these it makes sense to seek the warm comfort of an ample dividend. Those regular cash rewards can make it worthwhile waiting for stock prices to calm down.

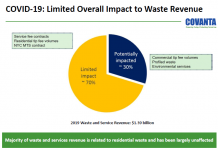

Within the renewable energy sector Covanta Holdings, Inc. (CVA: NYSE) is a strong candidate for dividends. At the current price level, CVA is yielding 5.2%, making it one of the best dividend payers in our indices of renewable energy, efficiency and conservation companies. Will Covanta be able to sustain its generous payments?

Covanta’s revenue comes from the sale of electricity and steam generated by 46 waste-to-energy facilities strung out across the country. There are another 11 power generation sites that use biomass or hydroelectric technologies. The company also sells metals recovered from the municipal waste it uses as feedstock. In the twelve months ending June 2015, Covanta reported $1.6 billion in total sales, from which it squeezed $229 million in operation cash flow.

Indeed, Covanta consistently extracts cash out of its operations even in years when it reports a net loss on its income statement. In the last three years average cash flow from operations was $333 million. With average capital expenditures near $175 million, Covanta has had about $158 million in operating cash available in recent years to pay its dividend.

Even if times turn bad for the waste-to-energy business, Covanta has a fairly secure financial situation. At the end of June 2015, the company had $167 million in cash on its balance sheet, which is probably enough to support working capital needs. The company also has $410 million in long-term investments that could be cashed in if the need arises. Covanta does have long-term debt totaling $2.4 billion. However, the debt is balanced by $2.6 billion in property, plant and equipment assets.

Covanta has cultivated a good following among analysts interested in the renewable energy industry. The consensus estimates suggest Covanta is in a relatively stable situation. The company has been experiencing some top-line and margin pressures and it appears sales and earnings in the year 2015 will be lower than last year. Covanta did miss the earnings consensus in both the March and June 2015 quarters and analysts lowered expectations for the rest of 2015 and the year 2016 after the June quarter disappointment. However, there is still some optimism for recovery next year and the current consensus for both sales and earnings suggests mid-single digit growth in 2016.

After Covanta reported disappointing results for the quarter ending June 2015, traders have been bidding the stock down. Just last week CVA registered a 52-week low price of $18.05. The stock now appears oversold. That might be a call for some bargain hunters to take new long positions. However, like so many stocks in the U.S. equity market CVA appears to have lost its upward momentum. For investors interested only in growth that is not a compelling scenario. The dividend could make the wait for recovery a lot more pleasant.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.