by Debra Fiakas CFA

Mid-March 2014, OriginOil, Inc. (OOIL: OTC/QB) relaunched its waste water treatment process for shale gas producers. The company’s CLEAN-FRAC and CLEAN-FRAC PRIME products are now called OriginClear Petro. OriginOil is expanding into the industrial and agricultural waste water treatment markets using the product name OriginClear Waste.

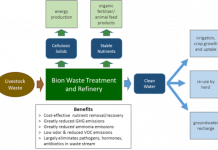

The company has been toiling away since 2007 perfecting its “Electro Water Separation” process that uses electrical impulses in a series of steps to disinfect and separate organic contaminants in waste water. In June 2014, OriginOil management declared its development stage completed and start of full commercial operations. In the months since the company has issued a series of product announcements: in June 2014, CLEAN-FRAC to clean up water used in oil and gas production in June 2014, In February 2015, Smart Algae Harvester to enhance algae production, and in early March 2015, CLEAN-FRAC PRIME for treatment of hydraulic fracturing flowback water.

The oil and gas industry has been a prime target market for OriginOil technologies since it can take eight to ten gallons of water to produce one barrel of oil. However, OriginOil sales personnel are calling on shale gas producers in the U.S. at a time when the entire industry is under pressure from exceptionally low world oil prices. Crude is trading near $49.00 per barrel. OriginOil claims its OriginClear Petro solution can save the shale oil producer more than $4.00 per barrel in production costs.

OriginOil is not the only company out pitching a fracking water solution to oil patch engineers. GreenHunter Resources, Inc. (GRH: NYSE) offers a portfolio of oilfield fluid management solutions, providing clean water supplies and foul water disposal. An even more formidable competitor is Ecolab, Inc. (ECL: NYSE), a provider of water treatment, sanitizing and cleaning solutions for industry, energy and petrochemical sectors around the world. Then there are a swarm of other smaller contestants with a cornucopia of solutions. Oasys Water, Inc. provides forward osmosis desalination services to shale gas producers to recycle water and reduce waste water for disposal. Desalination is also in the service menu of Altela, Inc., which has patented a process that relies on evaporation accelerated by a solar concentrator to mimic the natural hydrologic cycle.

There are dozens of other providers just like these with one kind of solution or another. It is hard to stand out in the crowd. OriginOil management is hoping a refined sales pitch with a new name will make a difference. Fortunately, any incremental sales will be meaningful.

OriginOil has reached commercial stage just like its press release claimed almost a year ago. In the twelve months ending September 2014, OriginOil had reported only $166,200 in sales. The company used $4.9 million in that period to support operations, leaving only a half million in cash on the balance sheet.

In October 2014, after the company’s last financial report OriginOil signed a $1.4 million order from oil services provider Gulf Energy LLC for a CLEAN-FRAC system, now called OriginClear Petro. Gulf Energy has a growing customer base of oil and gas producers in the Middle East and North Africa. The fourth quarter and year-end 2014 report should show a much improved top-line.

OriginOil needs many more customers like Gulf Energy – and a bit of magic. It seems management is relying on a name change to work a bit of magic in the market place. Investors apparently are not expecting a bunny to jump out of the OriginOil hat. The company’s stock has been on a steady decline since the company went public in 2007. The stock is now trading at seven pennies per share, which is a price that barely qualifies as an option on management’s ability to execute on company’s strategic plan. Even the string of new product announcements and the Gulf Energy order have not been enough to excite investors.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.