Next economics posits that for the global economy and earth’s tolerances/carrying capacities to run in a mutually tolerable equilibrium, we must continue to make rapid advances in economic efficiencies in all sectors. For 7.3 billion of us (and counting) to thrive on finite resources and avoid the worst effects of climate change, we have to drive more and more economic output from less and less input. Fortunately, energy is one of the areas where we can quickly make huge strides in this respect but not with fossil fuels in the mix. On the contrary, in fact. Efficiency gains across the global economy in the last few years have been such that, according to a Bloomberg piece titled “America is Shaking Off Its Addiction To Oil,” “the U.S. is consuming less oil per dollar of gross domestic product in more than 40 years.” In part, it is this slowdown in oil demand growth that’s causing downward oil price volatility. The long and slow shift away from dependence on some fossil fuels, in other words, is finally starting to cause ripples.

Short Term Effects of Less Expensive Oil

Oil’s recent narrative has become familiar: worldwide supply-and-demand economics (mostly declining demand, according to the World Economic Forum), expansion of both Libyan field and U.S. shale production, and as always, speculation. All well and good, but fundamentally what does it have to do with the prices of renewable energy stocks? At present, very little.

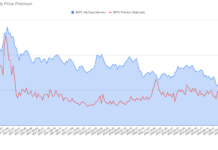

Investors are understandably concerned with solar, wind and other renewable energy stocks following the same pattern of oil trades in the market. The perception that all energy production is similar and can be treated and traded as a monolith, however, is a false one. As general awareness of the differences between types of energy advances, we expect this trend to slow, and then reverse itself. Solar, wind and other renewables will not follow the same trading patterns as oil, because more people will soon know better.

Many experts and other pundits have been weighing in to make this point. Lyndon Rive, CEO of SolarCity Corp. (SCTY) in a CNBC interview said, “the market doesn’t understand the dynamics; this is a great opportunity to understand the issue and truly see if this is a big problem or not a problem and then capitalize on the opportunity. Oil has no effect or almost no effect on the cost of electricity in the U.S. In the U.S., almost no oil is used to create electricity, so even if oil went down to fifty [$50/barrel], it will have almost zero effect on the cost of electricity but the opposite is true too. If oil went up to a hundred and fifty [$150/barrel], it will have almost zero effect on the cost of electricity.”

Rive’s comments fit with Green Alpha’s belief that investors are currently presented with a rare moment of market inefficiency, as broad markets struggle to clarify the role of a disruptive technology. In the near term, renewable energy investors should have little to fear from falling oil prices as there isn’t much of an underlying reason why the two distinct assets classes should be valued in tandem. On the contrary, since the price of oil should not be affecting the price of renewables, one could use this moment of misunderstanding as an opportunity to initiate or add to a select solar and wind portfolio.

The first reason we believe this is that solar provides a competitive, economic advantage over diesel, coal or natural gas, because fossil-fuel prices, even if low at this moment, have proven to be quite volatile over time. A recent New Yorker piece on oil prices points out that “…oil has historically been more volatile than most other commodities; a 2007 study found that in the U.S. it was more volatile than ninety-five per cent of other products.” The same can’t be said of wind or sunlight once the capital expenditure for the systems to capture them and convert them to usable energy has been made, the price for fuel is zero. Indefinitely.

Again, Rive: “Fluctuations in oil prices have little impact on solar or many other renewable energy sources. This is partly why the economic proposition of solar is so compelling, unique and valuable…For example, up to 50% of the cost of a fossil plant is the expense of the fuel over the life of the plant, while sunlight is essentially free.”

A recent energy cost analysis by investment firm Lazard validates the idea that oil pricing logically should be having a diminutive impact on renewables pricing, and goes on to calculate that the cost of energy from new utility-scale solar and wind power plants is increasingly competitive with more electricity-relevant comparative conventional fuels like coal, natural gas and nuclear, even without subsidies in some markets.

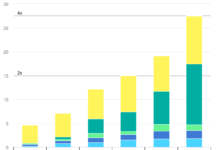

Image: Lazard, Levelized Cost of Energy Analysis Version 8.0, 2014

According to Lazard, the reason for this newfound economic advantage is that the long-term costs of utility-scale solar has fallen 20% just in the past year and 78% in the last five years. Declining almost as rapidly, wind energy costs are down 60% over the last five years.

With the application of Gordon Moore’s famous law now visibly applicable to solar photovoltaic (PV) technology, and showing no signs of slowing anytime soon, it’s plainly manifest that technology-based and commodities-based means of deriving energy do not belong to the same class of investable assets. Solar and oil, economically, scarcely share the same world.

In the Longer Run

The portfolio manager Jeremy Grantham has titled his latest quarterly letter (Q3 2014) “The Beginning of the End of the Fossil Fuel Revolution (From Golden Goose to Cooked Goose).” He writes, “As a sign of the immediacy of this problem, we have never spent more money developing new oil supplies than we did last year (nearly $700 billion) nor, despite U.S. fracking, found less replacing in the last 12 months only 4½ months’ worth of current production! Clearly, the writing is on the wall. It is now up to our leadership and to us as individuals to read it and act accordingly.” Grantham refers to U.S. fracking as “the Largest Red Herring in the History of Oil,” noting that its economic advantages may be short-lived.

The International Energy Agency (IEA) has recently written that “The sun could be the world’s largest source of electricity by 2050.” Mostly, it says, because of declining costs, and not so much because it can help battle climate change, although that could be a growth factor as well.

The key point in this analysis is that solar is a technology, and it’s past and futur

e cost dynamics will look like technology becoming ever cheaper. Fossil fuels are commodities finite and expensive to locate, extract, refine and ship and fossil fuels have had and will have cost dynamics to match: very volatile. In the long run, 10-20 years from now, as our economy and infrastructure can make more and better use of renewables, the two will compete directly in a way that they do not now, but by then renewables, led by solar, will be so inexpensive that the cost comparison will no longer spark argument but will seem quaint. So different are the commodity and technology means of deriving energy that we at Green Alpha have proposed that they be classified as different sectors altogether.

Ultimately, as the next economy advances and we increasingly transition to using renewables (electricity) to power things that currently rely primarily on liquid BTU (such as transportation and some heating) solar and oil will indeed compete with each other directly. When that time comes, oil will again become cheap, because demand for it will have fallen dramatically as renewables, ever cheaper, command more and more market share. Even then, though, oil won’t be economically competitive, because no matter how inexpensive any “cheap” fossil fuel becomes, it will always be more expensive than the free fuels employed by wind and solar. And any power plant converting fossils to electricity will also have far higher operating costs than do most renewables.

As Bloomberg’s Michael Liebreich recently said, “The story should not be how falling oil prices will impact the shift to clean energy, it should be how the shift to clean energy is impacting the oil price.”

Ultimately, the next economy can only thrive on power that is nearly free, inexhaustible, that does not contribute to systemic risks such as climate change and a toxic atmosphere, and that can be sourced nearly anywhere with a relative minimum of effort. Only solar PV, and to a slightly lesser extent wind, can reach this extraordinary level of economic efficiency. The writing is indeed on the wall, and the days of high market correlation between tech power and fossil power will soon be behind us.

Garvin Jabusch is cofounder and chief investment officer of Green Alpha® Advisors, LLC. He is co-manager of the Shelton Green Alpha Fund (NEXTX), of the Green Alpha Next Economy Index, the Green Alpha Growth & Income Portfolio, and of the Sierra Club Green Alpha Portfolio. He also authors the Sierra Club’s green economics blog, “Green Alpha’s Next Economy.”