by Debra Fiakas CFA

The series on waste-to-energy continues with Blue Sphere, Inc. (BLSP: OTC/QB), a relatively new entrant to the biogas power generation market. Blue Sphere is focused on converting principally food waste to power using anaerobic digestion technology. In May 2014, Blue Sphere started construction on a bio-digester and power generation facility near Charlotte, North Carolina, that will turn potato peelings and apple cores into 5.2 megawatts of power. Duke Energy (DUK: NYSE) has been lined up to buy the power when the plant goes operational sometime before the end of 2015.

Management expects to repeat its success at the North Carolina site in planning and integrating food waste-to-energy plants at other locations around the world. A smaller 3.2 megawatt plant is planned in Johnston, Rhode Island where most of the supply chain relationships and financing arrangements are already in place. Blue Sphere also recently entered into a memorandum of understanding for a new site in Boston, Massachusetts. In its home country of Israel Blue Sphere has signed a preliminary agreement for a 5.0 MW biogas plant at a site provided by its partner in the project, government-owned Environmental Services Corporation. The company’s development portfolio now holds 60 megawatts of potential power generation.

Management expects to repeat its success at the North Carolina site in planning and integrating food waste-to-energy plants at other locations around the world. A smaller 3.2 megawatt plant is planned in Johnston, Rhode Island where most of the supply chain relationships and financing arrangements are already in place. Blue Sphere also recently entered into a memorandum of understanding for a new site in Boston, Massachusetts. In its home country of Israel Blue Sphere has signed a preliminary agreement for a 5.0 MW biogas plant at a site provided by its partner in the project, government-owned Environmental Services Corporation. The company’s development portfolio now holds 60 megawatts of potential power generation.

Blue Sphere has yet to generate revenue and profits. The company’s management team led by CEO Shlomi Palas, has a plan to build the top-line even before its planned facilities in the U.S. become operational. Palas and his team recently lined up a deal to acquire seven operational biogas power plants in Italy, generating one megawatt of power each. All seven plants are profitable and are expected to begin contributing to Blue Sphere revenue and earnings by the beginning of 2015. Another nine plants similar in size and profitability are the due diligence stage.

The waste-to-energy industry in the U.S. is not as mature as in Europe. Development has been largely limited to the agriculture sector where small, privately-held system integrators address local and regional demand from dairy and other animal owners. There seems to be room in the U.S. market for new players with alternative business models. The USDA estimates that there is enough waste supply for 11,000 individual biogas plants in the U.S., while there are only 2,000 in operation.

It seems timely for Blue Sphere to penetrate the market with a food waste-to-energy model. Several states have imposed restrictions on the largest food waste generators. Massachusetts passed landmark regulations requiring generators of over one ton of food waste per week to find compost or biogas alternatives to landfills. Generators must file certificates of their plans by October 2014 and then be fully compliant with the alternatives by 2016. Connecticut and Vermont have already taken action to impose maximum landfill dumping rules for food waste generators. With state and local policies directing food wastes away from landfills and towards recycling alternatives such as biogas generation, the current market conditions could not be better for Blue Sphere.

Crystal Equity Research recently published research on Blue Sphere in the Focus Report series. The investment case in the report identifies Blue Sphere’s promising business case, but argues the stock does not appear to reflect growth opportunities or management’s progress in executing on the strategic plan. Blue Sphere is still at a pre-revenue stage, thus is it not possible to value the company on a multiple of revenue or earnings.

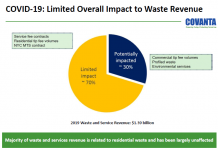

One option is to consider the company’s power generation portfolio. There are 7 megawatts that appear to be coming on-line in the next few months and another 53 megawatts in Blue Sphere’s development portfolio. The closest comparable we have for a waste-to-energy power producer is Covanta. It was noted in the article “Big Player in Waste-to-Energy” on September 19th that Covanta (CVA: NYSE) has a mixed build-own-operate business model that is something like that of Blue Sphere. Covanta is using municipal waste rather than the higher-energy food waste as feed stock, generating about 1,444 megawatts of power annually. We could use Covanta’s ratio of Market Cap to Power Generation Capacity as a valuation method ($1.9 million per MW). That rule would imply a future market capitalization for Blue Sphere of $13.3 million based on the company’s pending acquisition of 7 megawatts in Italy or $114.3 million on its entire development portfolio of 60 megawatts.

By comparison to Covanta, Blue Sphere is a much smaller company with a great deal to prove. The Crystal Equity Research report suggests the stock is speculative and may only be appropriate for investors with a long-term investment horizon and high tolerance for risk and volatility. Any valuation exercise should take those elements into consideration. Still trading at $7.1 million market cap, Blue Sphere seems like a stock to watch carefully.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. Crystal Equity Research does not have a rating or price target for BLSP. The stock is discussed in a Focus Report published by Crystal Equity Research on September 24, 2014.