by Debra Fiakas CFA

One member of the NuStart Energy consortium of nuclear power developers is Florida Power & Light or FPL Group, a subsidiary of NextEra Energy (NEE: NYSE). The group had its sights on getting a nuclear power plant construction and operating license from the Nuclear Regulatory Commission (NRC). The company operates the third largest nuclear power generation fleet in the U.S. composed of eight nuclear reactors at five plant sites. The fleet is far flung, ranging from Florida to New Hampshire and Wisconsin and West to Iowa.

FPL is working on an expansion of its Turkey Point facility in Florida. The plan is to construct two additional nuclear reactors – Units 6 and 7 – using Westinghouse’s pressurized-water design called the Applied Passive 1000. A combined construction and operation license application (COL) is pending before the NRC. FPL took public comments at meetings held in July this year as one step toward certification of the project.

Together the company claims these the two added units would have the capacity to produce 2,200 megawatts – enough to serve 750,000 homes. Furthermore at least $78 billion in fuel costs could be saved by sourcing this power requirement from nuclear instead of fossil fuel.

|

| Turkey Point Nuclear Facility |

In early August 2013, Duke Energy (DUK: NYSE) announced the indefinite postponement of two planned reactors at its facility in Levy County, Florida. Duke knuckled under after its license application was delayed. A more pressing issue is economic. Construction costs keep mounting and cost recovery schemes may not get approval from Florida regulators. Duke’s action does not bode well for FPL, which submitted its application for the Turkey Point expansion back in 2009, when economic circumstances are entirely different than today.

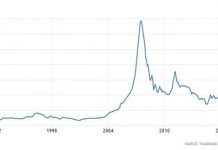

The issue before regulators and the public is whether plans and designs made over five years ago should be altered or scrapped outright because substitute power sources have experience a favorable change in economy. Hydraulic fracturing or ‘fracking’ has rendered natural gas newly competitive for electricity generation. It is not entirely certain that these favorable economics will continue unchanged in the future. The practice of fracking has been brought into question by environmentalists and land owners. Regulatory action to restrict the use of fracking would lead to a change in economic circumstances for the natural gas industry. This would cast nuclear reactor plans in an entirely different light – even with unanticipated cost increases.

Investors do not appear much troubled by the nuclear worries of FPL or its parent company NextEra Energy. The stock is trading at 19.7 times trailing earnings, well near the company’s five-year high price/earnings ratio. Of course, diversified utilities as a group are trading near the five-year high average P/E. This could be in part due to shrinking profits as costs continue to mount even as sales have been weakened by the slow economic recovery. Earnings fall, P/E measures rise.

NEE is trading at 15.2 times the 2014 consensus earnings estimate, suggesting investors are not taking little away from the stock. However, two dozen or so analysts who follow NEE have projected only 6% growth over the next five years. The comparison of multiple with growth rates suggests traders are paying way too much for NEE. A forward dividend yield of 3.2% may the real attraction to NEE.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein. SUNE is included in the Solar Group of Crystal Equity Research’s The Atomics Index, composed of companies using the atom to create alternative energy sources.