Green Alpha Advisors’ Annual Client Letter and Portfolio Commentary

Garvin Jabusch and Jeremy Deems

2012 saw a return to positive performance for the next economy and for markets overall. Generally, global economic conditions, as indicated by some jobs growth, slowly improving industrial output and a housing rebound, improved marginally, but debt crises in Europe and America, exacerbated by eternal dithering, gamesmanship and posturing by politicians and other policy makers on both continents, kept optimism in check and moderated expectations for growth. With respect to the next economy, though, growth and expectations for growth began showing real signs of building momentum as mainstream awareness of the need ensure the longevity of the world economy by changing some of its foundations continued to advance. Thus our ‘next economy’ macroeconomic thesis became still more relevant and closer to fruition.

The basic macroeconomics of the next economy thesis are fundamental, and their essentials don’t change over time. As we wrote in last year’s letter: “Earth’s economies may stagnate or grow; either way, we believe things like renewable energy, clean transportation, sustainable infrastructure and water resources must grow in value. Over time, the value of stocks in our models will not be dependent on Wall Street gamesmanship, but on simple necessity. As awareness of the magnitude of our growing resource-climate-security problems advances, so will the valuations of our portfolio companies.” Even as chronic fiscal imbalances distract world leaders’ attention from climate and resource challenges, business, individual and institutional investors, academia, think tanks and research all are addressing the latter at an ever accelerating pace.

Thus we continue to be very optimistic about our potential to provide competitive long term returns performance to our portfolio shareholders. Essentially, Green Alpha Advisors is an asset manager offering portfolios of stocks in companies with proven business plans responding to the challenges presented by a warming, increasingly populous, resource-constrained world. Portfolios of these companies deliver growth in all sectors including transportation, communications, commerce, infrastructure, materials, energy, agriculture and water. Considering:

I. The world’s population is growing fast, but its resources aren’t,

II. Energy security and national security depend upon the U.S. minimizing use of foreign oil,

III. The fossil-fuels based economy, with its digging, burning, scarring of the landscape, disruption of ecology, and disease causing pollution, is ultimately too expensive to maintain, and

IV. Climate change,

it’s clear the time is past due for serious investment in mitigation and adaptation, and indeed the signs that people and institutions are getting that are becoming omnipresent.

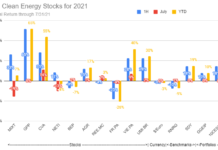

Each of the three Green Alpha portfolios saw a positive return for 2012. Our flagship green economy benchmark, the Green Alpha Next Economy Index (or GANEX) returned 4.21%; our Sierra Club Green Alpha portfolio (SCGA), actively managed and more concentrated than the GANEX, returned 6.79%; and our newest portfolio, the Green Alpha Growth and Income Portfolio (GAGIP), was up 6.96% for the partial year from its inception on October 8th, 2012. While we are happy to return to positive performance after a tough year for next economy stocks in 2011, we did nevertheless underperform the legacy fossil-fuels based indices; the S&P 500 was up 16% and the Dow Jones Industrial Average returned 7.26% in 2012. All three of our portfolios did however outperform prominent green economy ETF portfolios (see discussion below).

All Green Alpha portfolios are based on our universe of next economy companies, with individual securities and weights selected to best fit the mandate of each portfolio. We’re especially pleased that December 30th 2012 saw the fourth anniversary of the inception of the GANEX, reflecting a four year track record milestone measuring the growth and progress of the overall next economy. (On the topic of portfolios, look for an exciting announcement from us later in Q1 regarding our fourth and newest portfolio offering that will greatly enhance our ability to serve current and future clients.)

On the securities level, we saw once again in 2012 the importance of diversification across all sectors of the next economy. We find it hard to overemphasize this point: the post fossil fuels economy is emerging in all sectors, so to invest as though renewable energy (as critical as it is) is the only aspect of a green economy is shortsighted and results in high volatility. Attempting to represent the entirety of the next economy, our Green Alpha Next Economy Index (GANEX) is invested in 27 sectors and 52 sub-sectors, spanning, we believe, nearly everything required for a broad-based economic system to function. Reviewing GANEX’s top five 2012 total return performers gives some indication of its diversification:

- Badger Meter, Inc. (BMI), 63.98%. Badger makes water meters, “flow measurement and control solutions” for farming, commercial, utility and residential applications. The U.S. drought of 2012 (and continuing) has brought the need for smarter, more productive water management into sharp focus. You can’t manage what you don’t measure.

- Trex Company, Inc. (TREX), 62.51%. Trex is the world’s largest manufacturer of high performance wood-alternative decking. We consider Trex a prime example of waste-to-value economics that not only keeps huge quantities of waste out of landfills and oceans (Trex used 3.1 billion plastic bags in 2010, participates in a system responsible for 70% of all U.S. plastic bag recycling, and has never harvested a single tree to make its product), but also delivers a superior product with better long term value. In a world of constrained resources, making great stuff from leftovers is the best of all worlds.

- Cree, Inc. (CREE), 54.17%. Cree is a leading developer of high efficiency LED lighting and systems and semiconductors for radio frequency applications. Cree LEDs can provide illumination as efficiently as 200 lumens per Watt, compared to 14½ lumens per Watt of a 60W incandescent bulb. This translates to big savings in energy and money, and is a straightforward example of one of our primary themes, focusing on innovation in economic efficiencies – getting more output out of less input.

- Valmont Industries, Inc. (VMI), 51.03%. Valmont Industries provides critical infrastructure such as efficient mechanized poles and towers for wind turbines, lighting, communications and more. In 2012, VMI gave our portfolios exposure to the infrastructure aspects multiple trends such as the booming mobile and mobile web markets as well as the growing wind energy sector without the risk associated with an individual turbine manufacturer. Full disclosure, for valuation reasons, we removed Valmont from our portfolios as of year-end 2012.

- The Hain Celestial Group, Inc. (HAIN), 47.9%. Hain Celestial is a leader in natural and organic food that vertically integrates manufacturing, marketing sales and distribution. We think of Hain as a macroecon

omic bet on efforts of people to improve their individual health, and also on efforts at a policy and advocacy level to manage mushrooming and economically destructive escalation in healthcare costs. In addition, from a long-term agricultural management point of view, we think that that industry’s ever more potent pesticides, herbicides and petroleum based fertilizers will prove so deleterious to human health, land productivity and biosphere health that organic methods will continue to increase in popularity, and may one day even be required.

From the standpoint of our next economy sector classification scheme (NESC), the top performing Industry and Sector in the GANEX Portfolio was the Products (Industry), Capital Goods & Equipment (Sector), with Portfolio exposure of 16.11%.

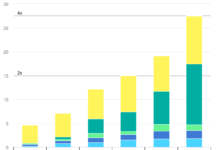

The chart below shows the performance of the GANEX, from its inception on December 30, 2008 to the end of 2012, versus two prominent green exchange traded funds, the Guggenheim Solar portfolio (TAN, in gold here), and the PowerShares WilderHill Clean Energy ETF (PBW, the black line). Over this period, the GANEX returned 28.15%, while the TAN was -79.22% and PBW performance was -46.68%. To be clear, GANEX differs significantly from these other two. TAN is a basket of exclusively solar and solar-related stocks, and PBW, though not as sector focused as TAN, is limited primarily (but not exclusively) to renewable energy. GANEX by contrast attempts to capture the entirety of the next economy, including renewable energy and solar, but also everything else we’ll need to have a thriving economic system, including, again, transportation, communications, commerce, infrastructure, materials, energy, agriculture, water and more. So while the comparison with these two may not be exact, we believe it does show the importance of careful diversification into all areas of the emerging green economy.

Inception to 12/31/12 GANEX chart w/PBW and TAN

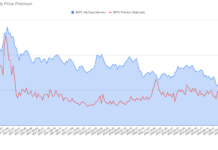

While we are generally growth oriented managers, we also in 2012 had good reason to believe that many of our holdings represent excellent values. As of December 31st 2012, 66 of our 80 holdings were trading below the average (1979 to present) price to book ratio of the S&P 500 index. Our average price to book was 1.45, compared to 2.27 for the S&P 500.

Finally, a compelling argument, if we needed one, for hastening the transition to an economy that can persist and even thrive in a warming world was recently articulated by the World Economic Forum at Davos. “On the economic front, global resilience is being tested by bold monetary and austere fiscal policies. On the environmental front, the Earth’s resilience is being tested by rising global temperatures and extreme weather events that are likely to become more frequent and severe. A sudden and massive collapse on one front is certain to doom the other’s chances of developing an effective, long-term solution.” In other words, we need to get the economy on a sustainable footing before it comes unraveled. Given the imperative of this reality, we have difficulty imagining a near-future scenario where the best next economy companies don’t become the most important to society and subsequently, potentially the best performing.

The decisions we make as an interconnected global civilization now will be the difference between catastrophe and a thriving society with a healthy economy. Given the stakes, we have no doubts about how to place our bets.

Thanks for your continued support of Green Alpha Advisors and investing in the next economy.

Sincerely,

Garvin Jabusch and Jeremy Deems

Garvin Jabusch is co-founder and chief investment officer of Green Alpha ® Advisors, and is co-manager of the Green Alpha ® Next Economy Index, or GANEX and the Sierra Club Green Alpha Portfolio. He also authors the blog “Green Alpha’s Next Economy.” Jeremy Deems, Co-Founder, Chief Financial Officer & Chief Operating Officer is co-founder and chief investment officer of Green Alpha ® Advisors,