Jim Lane

Hybrids, plug-in electrics struggle to pass the consumer’s “compared to what” test – and how much do those tax credits cost, anyway?

Perhaps the three most important words in technology development, bio-based or otherwise are “compared to what”.

It’s a useful way to look at bioenergy – because most studies look at bio-based technologies in a vacuum. Is there indirect land use change? Can you make fuel from algae? Do fuel tax credits raise the US federal deficit?

Yes, yes, and yes.. But compared to what? What’s the baseline?

You could, for example, ask the questions another way. Can eating at Outback Steakhouse cause indirect land use change? Are fossil fuels made from algae? Does having a baby raise the US federal deficit?

Yes, yes and yes.

There’s no end to the ridiculous line of questions that hard-liners can phrase to make anything look bad. It’s all a matter of the framing. That’s why ‘compared to what’ works. I mean, what are we going to do, stop having babies?

Sometimes the “compared to what” factor is a mechanism by which otherwise-admired technologies run into trouble.

The trouble with hybrids

Take, for example, the trouble with hybrids. We saw a report yesterday that only one in three current owners of a hybrid car, who purchased a new car in 2011, bought another hybrid. That’s not so good.

You notice that the question was not framed in the fashion of something like “do you like your hybrid?” or “does driving your hybrid make you feel like you are making a positive contribution to [fill in the blank].” To which the answer is, yes.

But as BP Biofuels chief Phil New observed last week at ABLC, infrastructure is a tough thing to get around, incumbents are hard to shove out. Just ask Mitt Romney, or Bob Dole, or Walter Mondale if you like.

The problem of the hybrid is not in the inherent qualities of the technology, but in comparing it to the convenience of the incumbent, the internal combustion engine. Electrics have a customer base, but the internal combustion engine’s overall cost-benefit proposition seems to be more compelling than previously understood.

The news, from the automotive market research team at Polk, inspired me to look at how the electric platform is doing. Hybridcars.com does an amazing job collecting and reporting on those stats – check out that site some time.

(Note: I wish the electrics platform well. Myself, I started in this world back in the 90s setting up demo drives of the old EV-1 for members of the Sierra Club, to which I have belonged for a long time. I’ve never stopped admiring the technology.)

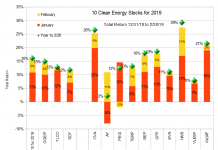

| Who’s selling how much what? |

|

Here’s what is happening in hybrids and plug-in electrics, in the US market. Share on market has dropped from 2.78% of all new cars sold, in 2009, to 2.25% in 2011. This despite some well-publicized new market entrants.

Plug-ins have started off slowly, 345 cars in 2010 and 17,813 last year. Growing, but not as fast as once hoped. The Volt is outselling the Leaf by nearly 3-to-1. I bet range anxiety has a lot – a lot – to do with it.

Hybrids have had a drop-off, down to 268,807 cars last year from 290,272 in 2009, on the heels of the global financial crisis.

Bottom line, US automakers sold 1.14 million more cars in 2011 than in 2010, but only 11,435 more hybrids and plug-in electrics. Not an encouraging sign that Americans are falling in love with the electric platform, despite almost uniformly good publicity.

The $7500 alt vehicle tax credit

And despite that tax credit. Hmmm, what about that tax credit anyway? Is it the credit that is failing – not enough? Well, compared to what? Let’s look at how the alt-vehicle tax credit stacks up against fuel subsidies.

What is the credit? It’s a $7500 tax write down against the cost of the car, bringing a $42,000 Volt down into the mid-30s, for example. It applies to the plug-in electric.

The tale of the tape

Now, the average US car drives 190,970 miles in a lifetime (16.9 years at 11,400 miles per year, according to the Department of Transportation), and the average new car gets 33.9 miles per gallon (for 2010, according to the EPA). So, the average new car will guzzle 5,633 gallons of gas in its lifetime.

Now, a fuel tax credit is paid out over the lifetime of the car, not all upfront. So, the tax credit is worth less, because of inflation and the cost of money, at the end of the 16.9 years than at the beginning. It’s the bird-in-the-hand principle at work.

Applying a discount rate of 5 percent to the $7500 tax credit, over 16.9 years, a $7500 tax credit has $17,106 in buying power, compared to $7500 in fuel tax credits paid out over 16.9 years.

So what’s the bottom line? A $7500 tax credit, discounted over the life of a vehicle and amortized over the gallons of gasoline that a comparable fuel-burning car would use, is comparable to a $3.04 tax credit, per gallon of gasoline, for a car with an ICU engine.

Now, I can just about guarantee you that, if there were a $3.04 per gallon tax credit for [name your fuel of choice], you would see a different national attitude towards ethanol, LNG, or fueling cars with algae, crocodile pelts, or liquified tennis shoes.

I mean, ethanol is sold wholesale right now for $2.20 per gallon. And we know what 85 cent ethanol days do for gas stations. They cause mayhem – lines reminiscent of oil shocks.

So, where are the long lines to buy hybrids? It’s the problem of battery cost, which is just a complete problem-solving bummer.

But it gets worse. You see, the problem of the $7500 tax credit is that it is absolutely unsustainable. You remember the national outcry over a 45 cent per gallon tax credit for ethanol, when ethanol reached 9 percent market share. Unaffordable! the opponents cried. Imagine what the alternative vehicle tax credit will feel like when the government is fronting out the billions. The government outlay will reach that same level of Unaffordable! before plug-in even reach 2 percent market share.

The Bottom line

For now, electrics have won a fan base, but bio seems to be doing a better job of advancing the technology, reducing or eliminating tax credits, and giving customers more power of choice when it comes to selecting a car. The reason – bio-based is more affordable, and generally more infrastructure-compatible.

Notice, we didn’t say, “infrastructure compatible,” though drop-in fuels are indeed so. But even the dread ethanol is more compatible than plug-in electrics. It’s that old “compared to what” all over again.

You see, that’s the danger of analyzing technologies inside a bubble. The world is too swimmingly complex. But consumers know – in the way that Churchill

once said, “there’s one person smarter than anyone, and that’s everyone.” Despite that enormous, unsustainable subsidy, they are sticking with the old ICU. Long-term, they will move away, but for now, bio-based continues to serve the emissions, energy security and employment goals of those who can’t quite yet part with their old engines, or part with the dollars to embrace the electric world. For now.

Disclosure: None.

Jim Lane is editor and publisher of Biofuels Digest where this article was originally published. Biofuels Digest is the most widely read Biofuels daily read by 14,000+ organizations. Subscribe here.

Hybrids up 33% year to date. No reason to suspect they wont continue since gas will remain expensive. Cash for clunkers completely explains the drop-off in 2010.

Questions?

Still only 2.6% so you aren’t actually wrong.

I predict 3% by 2013 and next gen batteries will get it to 5% for 2015.

Still a long ways to go I guess.

Oops looking at the wrong year.

So 3% this year (same as 1st quarter total) and if fuel remains expensive and we get the expected battery advancements then 10% is possible for 2015