Tom Konrad CFA

American Superconductor (NASDAQ:AMSC) dropped 52% since their profit warning on April 6th. Is it a screaming bargain, or does it have farther to fall?

Two readers asked me to take a look at American Superconductor Corporation (AMSC) after the company issued a profit warning on April 6th. Although the stock was included in my list Ten Clean Energy Stocks for 2011, (which has produced more buying opportunities than profits so far this year) I did not own the stock in any of my managed portfolios, and so the research had to take a backseat to taxes.

I spent a few hours catching up with the company this week, and, now that it’s trading below $12, I consider the stock a good, if very speculative, buying opportunity.

What Happened

On April 6, AMSC shocked investors with an announcement that their largest customer, the Chinese Wind Power company (and the world’s second largest wind turbine manufacturer) Sinovel (601558.SS) had refused shipments, and not yet paid for some previous deliveries.

The first hint of problems had come three weeks earlier, in the press release announcing AMSC’s “The Switch” Acquisition on March 14th. In that release, the company said that organic growth would slow, and 2010 revenue would be at the “lower end” of the previous $430-$440MM guidance range.

At this point, AMSC management most likely knew there was a problem, but may still have expected Sinovel to continue paying for deliveries. Sometime in the next three weeks that changed. In the profit warning they said that Fiscal 2010 revenues (through March 31st) would be $355MM, a full $75MM (17.5%) lower than the previous estimate. Since AMSC’s revenues in the first three quarters had been $313MM, they were saying that 4th quarter revenues would be 64% below previous guidance, and they would show a quarterly loss.

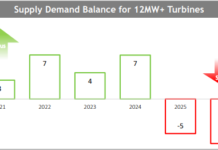

AMSC also said that they expected that Sinovel would continue to refuse deliveries until the company had run down inventory in a slowing Chinese wind market before accepting future shipments.

Without the expected revenue from their largest customer, analysts now expect that AMSC will need to raise between $100MM and $200MM in order to complete The Switch buyout. This is somewhat ironic in that one of the main reasons for the acquisition was to diversify AMSC’s revenue and make them less reliant on a single customer (Sinovel.) The need for that revenue diversification is now even more obvious, but it leaves investors wishing that AMSC had done more to diversify, sooner.

As is to be expected with any large negative surprise, the class action lawyers have leapt into action, with Levi & Korsinsky filing on April 15, and Wolf Haldenstein Adler Freeman & Herz LLP on April 18th.

Although wind is the largest part of AMSC’s business, and Sinovel is by far their largest customer, the company does have other business. Their eponymous superconducting wire seems to be gaining traction in more markets, with RenewGrid reporting that AMSC superconducting wire was used in Electrical Substation in China on April 21st.

What’s Next?

In the short term, the need to raise capital for “The Switch” acquisition will put pressure on the stock price, most likely leading to excellent buying opportunities. But knowing if those buying opportunities will appear when the stock drops below $12, as it is as I write, or possibly at much lower levels greatly depends on what is really happening at Sinovel.

If the company is right that Sinovel will resume accepting shipments after they have worked off their excess inventory, then we might expect revenues to return to previous levels, and possibly even grow. If, on the other hand, Sinovel decides it no longer needs AMSC as a supplier, they may not be a significant source of revenue for AMSC at all going forward. These scenarios account for the wide range in analyst’s revenue expectations for 2011: between $160M and $456M.

If the low estimates are correct, AMSC has much farther to fall. If, on the other hand, Sinovel reduces its inventory in a quarter or so, and then begins accepting (and paying for) shipments at something near the previous pace, we may see revenues for FY 2011 somewhere near the higher end of the range.

In either case, confidence in AMSC management has suffered long term damage, and so we cannot expect AMSC to trade at the same multiples at which it was trading at the start of the year. If we assume that FY 2011 revenues will be $350-$400MM, and give the stock a 30% discount on previous Revenue multiples, the stock should be worth $20-$23. If we expect only $160MM revenues with the same discount, then the stock is worth $9 or even less.

Since I think the more optimistic scenario is more likely, the stock seems like a good speculative buy below $12. More cautious investors might consider buying calls rather than buying the stock outright. I’m doing a little of both.

DISCLOSURE: Long AMSC.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Tom,

Maybe you can explain how it happens that Sinovel can blithely refuse to “accept” shipments and to pay for previous shipments — when all shipments were under contract? Are Chinese companies not obliged to honor contracts?

John,

I don’t think anyone outside of AMSC and Sinovel know the details, and I certainly don’t know the details of their contracts. I don’t think we can assume that all shipments were under contract. It may be that AMSC was shipping in excess of contracts in order to boost their own top line.

If AMSC was shipping more than contracted, then Sinovel’s refusal to pay/ refusal of deliveries makes a lot of sense.

I’m just guessing in the dark here, but I’d say the most likely case was that all AMSC’s deliveries were under contract, but Sinovel had asked to change the contract sometime in the second half of 2010. AMSC wanted to hit their revenue targets, so kept shipping product Sinovel did not want immediately. Sinovel decided to take matters into their own hands, and started only paying for what they wanted. When AMSC kept shipping despite having received payment, Sinovel decided to stop accepting any shipments at all until they were ready.

Anyway, that’s my guess, but it’s pure speculation.

Thanks, Tom.