Tom Konrad CFA

If you want to invest in renewable energy and energy efficiency with just one fund, this is what you need to know.

Over the last few months, I’ve written an extended series of articles looking at clean energy mutual funds and clean energy exchange traded funds (ETFs).

Defining Clean Energy

For my purposes, a clean energy fund is one that primarily invests in companies involved in renewable energy, energy efficiency and conservation, efficient and alternative fuel vehicles, and companies that are part of the supply chain for any of the above sectors.

Many of the mutual funds I looked at also invest in environmental services/waste management, recycling, water, and natural gas utilities. Waste management, recycling, and water each fit rather well into the clean energy context: Municipal solid waste is an excellent source of renewable biomass, recycling saves energy and so can be seen as an energy conservation measure, and water is inextricably linked to energy in many ways. Some would argue that natural gas (because it burns cleaner than other fossil fuels) and nuclear power (because it produces few greenhouse gas emissions) should also be included as clean energy. I don’t generally consider either clean, because the extraction of both natural gas and uranium can (and often does) cause great harm to the environment, while the storage of nuclear waste and the occasional nuclear accident also pose serious environmental threats. If you disagree with me about natural gas, you’re in luck, since some of the mutual funds I looked at include natural gas companies in their portfolios. If you disagree about nuclear power, you might consider taking this article with a grain of salt, or perhaps adding a nuclear ETF such as the Market Vectors Nuclear Energy ETF (NLR) or the iShares S&P Global Nuclear Energy Index (NUCL) to the stock or mutual fund pick that you arrive at after reading this article.

Previous Articles

This article is intended to condense the information from my previous series in a useful fashion. Readers who want to see my reasoning or more depth can find it in the original articles, listed here:

- Costs of Clean Energy Mutual Funds

- Sector Breakdown of Clean Energy Mutual Funds

- Past Performance of Clean Energy Mutual Funds

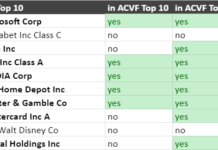

- Stock Picks from Clean Energy Mutual Funds

- The Effectiveness of Active Management in Clean Energy

- Interview with the Manager of the Top Performing Clean Energy Mutual Fund

- Clean Energy ETFs in Depth

- Clean Energy Mutual Fund and ETF Tax Efficiency

How To Choose

The major factors to consider when selecting a clean energy fund are

- Which fund is likely to produce the best performance?

- Given my intended holding period and investment size, how much will the costs reduce the fund’s performance?

Performance

In terms of the best performance, I found the data convincing that good active managers can produce superior results (see article #5.) The best performing fund by far was the Gabelli SRI Green Fund class AAA (SRIGX).

For those of you who are convinced by statistical analysis, one of my more mathematically sophisticated readers, Tucker Gilman at RainFrog Ethical Investment Partnership, did a non-parametric statistical analysis of the thirteen clean energy mutual funds and ETFs with three years of performance data I mentioned in article #5. Here is a graphical representation of his results:

The horizontal axis is time (in trading days), while the vertical axis is fund performance. The fact that the red line (which is SRIGX) is above the gray area means that we can be 95% confident in a statistical sense that SRIGX’s past out-performance is not do to just luck, and we should instead take it to be an indication of manager skill. For funds inside the gray area, we can’t say with any statistical certainty that their performance arises from luck or skill.

I generally take statistical analysis with a healthy dose of skepticism, even when the methods in question seem sound to me (as they did in this case.) Statistical analysis can tell us what has already happened, but unless we know why it happened, we can’t know if the performance will persist. In order to get a better idea how he achieved these results, I interviewed SRIGX’s lead manager, John Segrich CFA. Here is what he said about his stock selection process:

We start with the industry and attempt to understand the entire value chain. … Through this process we look for areas of constraint in the value chain as investing in those often is quite profitable due to better pricing, margins, and profits. We then establish where we want to have exposure on a global basis – maybe we want exposure to the Chinese wind market but not the European market. After that, stock selection comes down to fundamental analysis and valuation. We also try to incorporate issues such as regulation, currencies, and other macro issues like credit availability.

This is a description of solid analysis, with the attention to detail that can give a manager an advantage in any sector where there are not too many others doing the same sort of analysis Or at least not too many others who are better at it. As more and better managers enter and become familiar with the sector, Segrich’s team’s advantage is likely to erode, although not completely and probably over a period of years. As the fund grows, it will also be less able to quickly enter and exit positions, so a larger fund size may also weaken their advantage.

For an investor who wants a clean energy fund, and who agrees that a superior manager has the opportunity

in this young and frequently misunderstood sector to produce superior results, the Gabelli SRI Green Fund is the clear choice based on a track record that is much better than any other fund. This choice should be re-assessed after two to three years, or if SRIGX hires new managers. But don’t dump the fund just because of one year of under-performance: Although manager skill can make a real difference, there is always considerable luck involved in investing.

Investment Costs

When I wrote most of these articles, I thought that the expense ratio of SRIGX was the highest of all the funds I considered. This was due to a mistake on my part when I did not look at the prospectus for the fund’s class AAA shares (which are no-load), but instead looked at the multiclass prospectus, and so confused the load class A shares with the no-load class AAA shares. This goes to show that you should not base any investment decision solely on what you read in an investment blog, even this one. It never hurts to do your own research.

At 2.01%, SRIGX’s annual expense ratio is high when compared to most mutual funds, but in-line when compared to other no-load funds in the category. A self-directed investor should only consider buying the class AAA shares, SRIGX, which are available through most mutual fund supermarket platforms (I checked three online brokers. SRIGX was available through Charles Schwab and E*Trade, but not through Interactive Brokers.)

High expense ratios among clean energy mutual funds are in large part due to low assets under management. The largest funds charge the lowest expenses. Assets under management are rising rapidly at SRIGX as new investors and advisers take note of the Gabelli fund’s excellent track record. Based on the third quarter numbers for the Gabelli Green fund I used in November, they reported only $12 million in assets under management. The more recent year-end numbers show assets under management at $20.8 million, a 73% growth in three months. Higher assets under management will allow the fund managers to spread their costs over more investors, so if this growth continues, we can expect the Gabelli fund to lower their expense ratio to something more in line with the larger clean energy funds in coming years.

ETFs

Many investors will find a 2.01% expense ratio hard to stomach. For them, ETFs are the best choice. Among the ETFs, most have comparable expense ratios of around 0.6-0.7%, but when you consider other costs such as liquidity, internal trading costs, and tax efficiency, the Powershares Wilderhill Clean Energy Index (PBW) stands out as the lowest cost for short term (less than 1 year) investors because of its high liquidity. For longer holding periods, my top choice is probably the Powershares Cleantech Portfolio (PZD), because it has what I consider to be the best allocation between clean energy sectors as well as global diversification.

My preference for PZD may strike some readers as ironic, as I recently took Rafael Coven, the index manager behind PZD, to task for saying that the better tax efficiency of clean energy ETFs when compared to clean energy mutual funds is “very significant.” Rafael’s job is to manage a cleantech index, not to investigate the subtleties of ETF and mutual fund costs. As far as I can tell, his index is the best currently tracked by an ETF. The other indexes typically have much higher turnover ratios, and high turnover ratios undermine the cost advantage of clean energy ETFs.

The Clean Energy Fund For You

To make it as simple as possible, here is a table that should cover most investors decisions on what to buy:

| If you… | Then buy |

| Are buying for less than 90 days or plan to trade actively | PBW |

| Want to make small, monthly investments or are buying longer term | SRIGX |

| Plan to hold long term and refuse to pay a 2% expense ratio or don’t think managerial skill is likely to persist | PZD |

Still not sure which is the best choice for you? Leave a comment, describing why you don’t fit into the categories of investors above, and I’ll try to create a category and fund pick for you.

DISCLOSURE: No Positions.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

I’m looking for a 3-7 yr investment in an ETF/Mutual fund that focuses primarily on “energy efficiency” & secondarily on “energy storage” to suppliment my position in Fidelity Select Environ. & Alt Energy (FSLEX).

None of your suggestions seem to take altg energy investment categories into consideration.

Thanks for any thoughts.

Steve

Steve,

There simply are no such mutual funds or ETFs yet, and there is definitely a need for this. Because of this need, I’ve been working with Covestor (http://covestor.com/) on a model that is intended to do just that. We’ll be launching the model in a few weeks, and I’ll be able to provide you with more information about it then. If you, or anyone else would like more information, please send me an email at tom at alt energy stocks . com, and I’ll forward it to you when we launch.