By Harris Roen

An important part of the smart grid will be devices that connect the user to the grid, or “reading points”. These reading points go way beyond the current meter reading system that just monitor the amount of energy used. The long held belief that meter reading was the only way to monitor household and business’s consumption is quickly being replaced with alternate ideas.

MasTec (MTZ) is a contracting firm with $2.1 billion in annual sales focused on utility and communications infrastructure. It specializes in communications, high-speed Internet and electric distribution, as well as water, sewer and natural gas. This communications and electric specialization makes MasTec a key company in smart grid deployment.

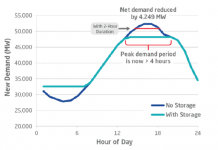

MasTec is a well-run company with excellent financials. As seen in the graph above, sales have grown continually since 2003 in an almost straight-line fashion. It is particularly impressive that MasTec has maintained increasing sales during the recent recession.

The graph also shows that earnings per share from normal business, which excludes events such as acquisitions, refinancing, asset sales and the like (EPS from continuing operations). This has been positive since 2005. In other words, the company has been consistent in building shareholder value. Estimated future earrings have consistently been revised upwards for MasTec, another positive sign for the company’s long-term share price.

I believe MasTec is still undervalued. My analysis of a fair price per share for MasTec, based on both historic and future predicted earnings, is roughly 9.9 on the low end and 23.3 on the high end. The share price has been heading up the past few months, in the 14 to 15 range, which I think is approaching fair value. I see Mastec as a good trade in the 12 to 13 price range.

DISCLOSURE: At the time of publication, individuals involved with the Roen Financial Report or Swiftwood Press, LLC owned or controlled shares of MasTec.

This is the second part of a three-part series drawn from “Smart Grid Investment Opportunities: Understanding the Smart Grid Investment Landscape”, a special supplement to the “ROEN FINANCIAL REPORT” ISSN 1947-8364 (print) ISSN 1947-8372 (online), published monthly for $69 per year print or $59 per year e-mail by Swiftwood Press LLC, 82 Church Street, Suite 303, Burlington, VT 05401. © Copyright 2010 Swiftwood Press LLC. All rights reserved; reprinting by permission only. For reprints please contact us at cservice@swiftwood.com. POSTMASTER: Send address changes to Roen Financial Report, 82 Church Street, Suite 303, Burlington, VT 05401. Application to Mail at Periodicals Postage Prices is Pending at Burlington VT and additional Mailing offices.

DISCLAIMER: Swiftwood Press LLC is a publishing firm located in the State of Vermont. Swiftwood Press LLC is not an Investment Advisory firm. Advice and/or recommendations presented in this newsletter are of a general nature and are not to be construed as individual investment advice. Considerations such as risk tolerance, asset allocation, investment time horizon, and other factors are critical to making informed investment decisions. It is therefore recommended that individuals seek advice from their personal investment advisor before investing.

These published hypothetical results may not reflect the impact that material economic and market factors might have had on an advisor’s decision making if the advisor were actually managing client assets. Hypothetical performance does not reflect advisory fees, brokerage or other commissions, and any other expenses that an investor would have paid.

Some of the information given in this publication has been produced by unaffiliated third parties and, while it is deemed reliable, Swiftwood Press LLC does not guarantee its timeliness, sequence, accuracy, adequacy, or completeness, and makes no warranties with respect to results obtained from its use. Data sources include, but are not limited to, Thomson Reuters, National Bureau of Economic Research, FRED® (Federal Reserve Economic Data), Morningstar, American Association of Individual Investors, MSN Money, sentimenTrader, and Yahoo Finance.

Related Article: Ten Clean Energy Stocks for 2010