Tom Konrad CFA

For short term holders, the Powershares Wilderhill Clean Energy ETF (PBW) is the best

If cost is the most important factor, an individual investor without the time or expertise to build a clean energy stock portfolio should choose one of the clean energy Exchange Traded Funds (ETFs).

I recently reversed my former stance, and now believe that cost should not be the only factor, because the evidence suggests that, in clean energy at least, the active management available from a mutual fund or an advisor who works with individual stocks can consistently outperform the passive approach used by the ETFs.

That said, there is a strong case for keeping costs low. In fact, most investors in clean energy do prefer the ETFs to mutual funds, despite ETFs’ poor track records. The total amount of money invested in general clean energy sector ETFs is over $1.1 billion, while the total invested in clean energy mutual funds is only $900 million, and the ETF total does not include the thirteen sub-sector ETFs listed below.

For readers who find the relatively short record of superior performance by clean energy mutual funds unconvincing, here is a comparison of the available Clean Energy ETFs.

The Funds

There are currently five ETFs addressing the broad alternative energy sector, as well as a few sub-sector ETFs, addressing Solar (KWT and TAN), Wind (PWND and FAN), nuclear (NLR,NUCL), Carbon (GRN), forestry (WOOD and CUT), the Electric Grid (GRID), and mining firms important to alternative energy (LIT,REMX,URA.) I plan to discuss these sub-sector ETFs in future articles. For now, I will focus on the general clean energy sector ETFs. They are:

- iShares S&P Global Clean Energy Index ETF (ICLN), which tracks a global index of clean energy companies.

- First Trust NASDAQ Clean Edge US Liquid (QCLN), which tracks an index of clean energy companies that are publicly traded in the United States.

- PowerShares Clean Energy (PBW), which tracks an index of US-listed companies engaged in the business of the advancement of cleaner energy and conservation.

- PowerShares Global Clean Energy Portfolio (PBD), which tracks an index of global companies engaged in the business of the advancement of cleaner energy and conservation.

- Powershares Cleantech Portfolio (PZD), which tracks a global index of cleantech companies.

- Van Eck Global Alternative Energy Fund (GEX), which tracks an index of global alternative energy companies.

Diversification

While the indexes the funds track sound fairly similar, there are some salient differences. I think they can be best summarized as “Clean Energy” (most funds) vs. “cleantech” (PZD), and domestic (PBW and QCLN) vs. global (ICLN,PBD,PZD, and GEX.) For most investors, the reason to buy an ETF instead of common stocks is to achieve quick and easy diversification at relatively low cost. Hence, most investors should prefer the global ETFs to the domestic ETFs. Since cleantech is a broader sector which includes clean energy, an investor seeking diversification may also prefer PZD to the other global ETFs because of the broader diversification, but this comes at a price of diluting exposure to the energy sector.

Size and Liquidity

The chart to the right summarizes the assets held and the daily turnover (in dollars) of each ETF. Large investors, and investors expecting to trade frequently using market orders should care about trading volume, which is a measure of the ETFs liquidity.

The chart to the right summarizes the assets held and the daily turnover (in dollars) of each ETF. Large investors, and investors expecting to trade frequently using market orders should care about trading volume, which is a measure of the ETFs liquidity.

Market orders to buy or sell an ETF with high trading volume will generally be executed closer to the quoted price than orders to buy or sell an ETF with low trading volume. Traders using limit orders or placing trades equal to a small fraction of an ETF’s daily volume can expect to have minimal price impact, and so are likely to be less concerned about fund liquidity.

The ETF with by far the best liquidity is the oldest of the ETFs, PowerShares’ PBW. Among the global clean energy funds providing somewhat better diversification, the most liquid is Van Eck’s GEX.

Fund Costs

Investors in ETFs can expect to bear several costs. First, they pay a management fee, which is publicly disclosed as the expense ratio. They also pay a commission to buy the ETF, and liquidity costs from any price impact of their trade. Finally, they pay the internal trading costs of the fund, which occur when index components or weightings change over time, and is captured in the ETF’s Turnover Ratio (see the discussion of Turnover for mutual funds.) Since it’s typically cheaper to trade domestic stocks than international stocks, the domestic ETFs probably pay lower trading costs than global ETFs given the same turnover.

In the chart below, I’ve attempted to estimate the annual costs associated with buying $1000 of each ETF and holding it for one year and for five years. My estimates for liquidity costs and the internal Trading costs of the ETF are both very rough.

The costs for broker commission and liquidity are both one-time transaction costs, and will decrease for longer holding periods or increase for shorter holding periods than the five years I assumed. When estimating a fund’s internal trading costs, I assumed that larger funds would have higher internal liquidity costs because of larger transaction sizes, and also that domestic ETFs had lower trading costs than global ETFs. My estimates for both liquidity costs and the funds’ internal trading costs are very rough, and could be off by as much as a factor of 2 or 3 since I have limited information to go on. My estimates are shown in the graphs below.

,

As you can see, short holding periods favor the the PowerShares Clean Energy (PBW) ETF because of its greater liquidity. However, the flip side of having better liquidity is a large funds size, which in turn leads to higher internal trading costs. For longer term investors, the ETF’s expense ratios and internal trading costs become much more important. For a five year holding period, the iShares S&P Global Clean Energy Index ETF (ICLN) is the clear winner. ICLN not only has the lowest Expense and Turnover Ratios, it also has a small fund size. Although the small fund size leads to lower liquidity and higher costs for investors trading in and out of the fund, it also means that the fund’s internal trading costs will be lower because smaller trades usually have lower market price impact.

However, the differences between ETF costs are less striking than their similarities. Other than avoiding the PowerShares Global Clean Energy Portfolio (PBD), which has relatively high costs under both scenarios, the fund choice should probably be based on other factors.

Sector Allocation

As I discussed in my look at the sector allocation of Alternative Energy Mutual Funds, I believe investors will do best with a relatively low allocation to solar PV stocks, and a high allocation to energy efficiency stocks. I also like investments in Alternative Transportation, the Electric Grid, Biomass, Geothermal, and Hydro, although these sectors are relatively small parts of all the portfolios. Finally, since we are looking for an allocation to clean energy, a low allocation to “Other” which represents companies and parts of companies with operations that are not related to clean energy should be as small as possible.

Below is my analysis of the sector allocation of the ETFs, based on the complete lists of fund holdings from the fund sponsor websites:

First Trust NASDAQ Clean Edge US Liquid (QCLN) has the highest allocation to energy efficiency, while Powershares Cleantech Portfolio (PZD) has the lowest allocation to solar. Of the six, the inexpensive iShares S&P Global Clean Energy Index ETF (ICLN) fares worst, with no allocation to energy efficiency and a large allocation to solar. Although ICLN has relatively good exposure to Hydropower and Biomass, this is not nearly enough to make up for the lack of any energy efficiency companies in the portfolio. PBD, GEX, and ICLN do the best at minimizing allocation to non-clean energy sectors.

Value

Renewable energy is generally considered a growth sector. After all, it’s relatively new, and growing from a very small base as a percentage of our energy mix. But that does not mean that there are no value stocks in renewable energy. Over longer time periods, value stocks have consistently outperformed growth stocks in the broad market, and I see no reason to believe that they will not continue to do so. Hence I prefer ETFs which put more emphasis on value stocks.

ETFs disclose the average Price/Earnings (P/E) and Price/Book (P/B) ratios of their portfolio holdings, and I’ve compiled them in the following chart:

With P/E ratios of 17 and above, none of these ETFs can be said to be truly value-oriented, but there is a significant difference between different funds. The best two in terms of value are PowerShares Clean Energy (PBW) and PowerShares Global Clean Energy Portfolio (PBD). The worst (most growth-oriented) is the Van Eck Global Alternative Energy Fund (GEX).

Summary

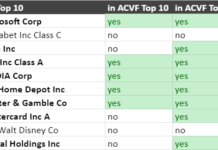

The following table summarizes the above discussion, grading each fund on diversification, cost, allocation, and value, using a scale from 1 to 3, 3 being best.

| Fund | Diversification | Cost | Allocation | Value |

| QCLN | 1 | 2 | 3 | 2 |

| PZD | 3 | 2 | 2 | 2 |

| PBD | 2 | 1 | 2 | 3 |

| GEX | 2 | 2 | 3 | 1 |

| PBW | 1 | 3 | 2 | 3 |

| ICLN | 2 | 3 | 1 | 2 |

No ETF is clearly better than the others in all circumstances. The one you choose should depend on your priorities. If you are a trader and plan to hold the position for less than a year, PBW serves your needs best. If you are a long term investors, PZD probably has the best balance of allocation to promising sectors and low cost. However, if you are a long term investor more interested in Renewable Energy than Energy Efficiency and Cleantech, the best choice is probably ICLN.

My previous surveys of ETFs were less comprehensive, and focused only on Expense Ratio and sector allocation. Further, I have not pr

eviously included the less energy-focused PZD in the list of ETFs I analyzed. If you own ICLN or GEX because of one of my previous articles, I don’t think it makes sense now to switch; all of these ETFs become cheaper over long holding periods. Instead, you can lower your average cost over time and improve your allocation to the best clean energy sectors by using subsequent investments to buy individual stocks in sectors such as energy efficiency, while the ETF can continue to serve your diversification needs. You may refer to my recent article selecting stocks from the portfolios of the clean energy mutual funds for a few suggestions organized by clean energy sector.

Conclusion

For traders speculating on short term gains in Clean Energy, the Powershares Wilderhill Clean Energy ETF (PBW) is the best vehicle due to its high liquidity.

For longer term investors, ETFs are my third choice as a method for investing in Clean Energy, after individual stock portfolios and actively managed mutual funds. Mutual funds may cost more, but provide as much or more diversification and have performed better (even after the higher costs) for as long as most Clean Energy ETFs have been in existence. For investors with the time or an advisor willing and able to work with individual stocks, stock portfolios offer both lower costs and the potential for better performance through better sector allocation and active management.

DISCLOSURE: No Positions.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.