Tom Konrad, CFA

An interview with John Segrich, CFA, portfolio manager at the the Gabelli Green Growth Fund (SRIGX).

When I did my recent past performance comparison of clean energy mutual funds, I found that the Gabelli Green Growth Fund (SRIGX and SRICX) beat all its rivals by a long shot over the last three years, earning a coveted five-star rating from Morningstar. In general, I’m a skeptic about short-term past performance: If you look at enough funds, sooner or later you’ll find one that has had great performance by sheer luck. Even when a few years’ out performance is not luck, it may be the result of a fortuitous alignment: the fund’s strategy could be particularly suited to recent market conditions. When those conditions change, so will fund performance.

Nevertheless, I do believe that some managers can consistently beat index funds, especially in an emerging and little-understood sector like clean energy. I manage clean energy portfolios myself, and if I didn’t think that I could do better than indexing, I’d just buy an ETF, and spend the rest of my time more productively by taking up calligraphy.

Unless you’re reading this article in elegant script on a rice paper scroll, you can assume that I have not taken up calligraphy. I believe some portfolio managers can consistently beat the market.

How can we tell which money mangers are skillful, and which ones are just lucky? The only way I know is to understand their investing process. Which is why I asked John Segrich, CFA, the lead manager for the top-performing Gabelli Green Growth Fund, to submit to an interview. In our interview, I try to understand his investing process, and if he has been benefiting from a temporary alignment of the (Morning)stars, or if there is some lasting advantage that future investors in his fund can take advantage of.

Our interview follows:

TK: Please tell us a little about your background and why you manage a sustainable mutual fund.

JS: While in college I interned at Gabelli & Company and upon graduating was offered a position as a full time analyst. I spent the next two years looking at emerging internet companies while at Gabelli. I then spent another two years on the buyside as a technology analyst. I moved to London with Goldman Sachs in 2000 and headed up their European Internet and then software research teams for a few years. I remained in London with JP Morgan as the head of their European sell side technology research team. In 2008, I moved back to New York and back to Gabelli & Company to head up their green research efforts. The firm then refocused an existing SRI mutual fund on sustainability in 2009. I also manage a hedge fund with a similar sustainability strategy.

The reason for my interest in managing a fund focused on sustainability is two-fold. First, I believe that by managing a portfolio of investments focused on sustainability, I can have a positive impact on the world with regard to these pressing issues. Secondly, we believe that by investing in these companies, we can achieve superior returns in the long run.

TK: Who are your investing role models?

JS: Mario Gabelli, our Chief Investment Officer, has been and remains my mentor over the years. His approach to investing is rooted in deep, fundamental research and in understanding the entire value chain on a global basis. He taught me to dig deeply into the numbers, read the footnotes, and ask the tough questions. He also is able to take a longer term view of companies and industries, and look through the short term fluctuations to identify value.

George Soros, a fellow philosophy major, also influenced my investment process through some of his writings, in particular in identifying the perception gap within an investment and understanding how the closing of this gap creates value.

I also admire some of the more visible hedge fund managers such as David Einhorn at Greenlight Capital or Bill Ackman at Pershing Square who relentlessly pursued their investment views even when the whole market was telling them they were wrong. They performed their own analysis and were firm in their conclusions despite the market telling them otherwise. Too often there is not enough analysis and many investors just take management’s view as the truth without testing those assumptions. The assumptions need to always be tested.

TK: What factors do you consider when deciding if a company is sustainable?

JS: Sustainability for us is to understand the impacts, opportunities, constraints, and issues that emerge as the world population grows from 6.8bn people. If we take that lens, and overlay it on any traditional sector, it helps us identify where we should look to find investment opportunities.

The starting point for us is to understand the industry on a global basis, analyze supply and demand, and then determine if the economics “make sense.” Can the companies and the industry survive on its own, or do they depend on the handouts of governments? If the industries are subsidy driven, we tend to look for wider margins of safety when investing and may be shorter term investors. If the industry is “sustainable”, then we can invest in solid business models for the long run.

TK: Do you believe sustainability confers a long term advantage to companies?

JS: By definition yes, since companies that do not embrace or understand sustainability issues that impact their business will likely not survive. In addition, we believe that the companies we are investing in are exposed to higher growth drivers due to their focusing on solving sustainability issues and therefore likely offer better investment opportunities combined with secular growth themes than those that are less exposed.

TK: Please describe your stock selection process.

JS: We start with the industry and attempt to understand the entire value chain. For example as we look to invest in the wind industry we start by identifying the companies that own and operate wind farms (typically renewable utilities). We identify all the turbine manufacturers, then break down the turbine into its components and identify all the companies that make blades, bearings, even the carbon fiber that is used in the blade. Through this process we look for areas of constraint in the value chain as investing in those often is quite profitable due to better pricing, margins, and profits. We then establish where we want to have exposure on a global basis – maybe we want exposure to the Chinese wind market but not the European market. After that, stock selection comes down to fundamental analysis and valuation. We also try to incorporate issues such as regulation, currencies, and other macro issues like credit availability.

TK: Recently you have been trading much more than the other fund managers I follow, holding your average position only about 6 months, while most funds I follow hold positions on average about two years. Is frequent trading intrinsic in your strategy?

JS: Yes, at the moment, as many of these industries are still heavily dependent on subsidies for survival. As those subsidies change, we may need to change our outlook on the industry. We have also been through several rounds of sovereign debt concerns, which have a broad impact on many companies in the investment universe. Over time,

as the industries mature we would expect to be able to have longer holding periods. In some industries, we can already identify what we believe are long term investments.

TK: Your track record over the last three years has been excellent. The Gabelli SRI Green Fund is the only one I follow that is up since the start of 2008, and you’re up 21% since then, while the next best performing fund is down 17% over the same period. Why do you think you’ve been so successful?

JS: We have deliberately attempted to be global in our understanding of the value chain. Often, we can gain exposure to an investment theme in a less obvious way – sort of the picks and shovels approach to investing. We also have decided that we do not need to maintain exposure to all areas of sustainability and when subsidies are in flux, we might reduce our solar or wind exposure to zero.

TK: Your fund is still quite small. What are the advantages and disadvantages of the small size?

JS: Certainly a smaller fund size helps us in terms of being able to enter and exit positions more rapidly if needed. Hopefully, as more investors realize the opportunities of investing in this manner, the fund will continue to grow. We do not foresee growth in the fund size as a barrier to achieving returns. Moreover, as the fund grows in size, the expense ratio will become less of an issue.

TK: Have you seen a substantial increase in investor inflows now that you’ve achieved Morningstar’s highest five-star rating due to your track record?

JS: Yes, it has helped. I know that we have been on the radar screen of many advisors, and getting the five star rating often marks the trigger point for their investment process.

TK: Let’s switch gears and talk about the market. What do you expect the next year to bring to the market as whole and sustainable companies in particular?

JS: I suspect that the market will remain choppy as many of the issues we are grappling with, such as European sovereign debt and even the debt that is mounting here in the US, will not be easily solved. Subsidies are under pressure and while some nations, such as Germany and China, have made strategic decisions to embrace sustainability issues, others, such as the US, have not. As countries continue to compete with each other for leadership in these industries (the space race of our generation), we expect a new engine of job creation and growth to emerge.

TK: Are there any sustainable sectors you expect to do particularly well in the coming year? Why

JS: We are generally cautious on the renewables at the moment as we believe overcapacity will lead to dramatic price declines which in turn will eventually lead to accelerating growth. That growth comes in waves; we believe third quarter 2010 was the peak. We will spend our time looking for the next entry point, when we believe shares have bottomed. We continue to focus on materials and commodities that will benefit from global growth. Industrialization and urbanization of the developing world remain important themes. We also continue to focus identifying companies that have exposure to longer term secular growth drivers, but that make simple products which will benefit if the industry takes off rather than by having to identify an individual company. Again, we often follow the picks and shovels approach to investing. Several battery and materials companies fit this approach.

TK: What are your top holdings right now? Why do you expect them to do well?

JS: Some of our holdings at the moment include Sino-Forest (TRE.TO), Umicore, Polypore (PPO), Globe Specialty Metals (GSM), Duksan High-Metal, GCL Polysilicon, Mead Johnson (MJN), and Novozymes (NVZMY.PK). Most have high exposure to stronger secular growth drivers and are strong beneficiaries of the growth in emerging markets. They also may benefit if the US dollar continues to weaken.

TK: What have you sold recently and why?

JS: We have sold most of our exposure to renewable, in particular solar, as we believe the market is entering a period of overcapacity and that margins have peaked. Additionally, market expectations have caught up to our view and the valuation gap had closed.

TK: Is there anything else you’d like to say?

JS: Just that we believe we are at the beginning of a significant investment opportunity that has only recently shifted from marginal to mainstream. We are looking at issues that could unfold over the next 10, 20, even 50 years and we believe there is still substantial value to be created by investing in the companies that are leading this change.

TK: Thank you for sharing your insights with us today.

JS: You are welcome. Anytime.

Conclusion

In general, I like what John had to say. His process starts with understanding the value chain. Because Clean Energy is such a new field, understanding the value chain is something many investors do not bother to do. Until Clean Energy becomes mainstream, this should be a lasting source of advantage. He trades frequently, but with good reason: in reaction to the quickly shifting structure of subsidies that currently supports most clean energy technologies. This should also be considered an advantage, at least until subsidies are not longer such a major factor in the profitability of many clean energy companies.

I would not be as complacent as he is about the costs of fund size… as assets under management grow, opportunities to invest in microcap companies disappear, as the money the fund would need to invest quickly dwarf’s the stock’s liquidity. However, the advantages of fund size in the ability to spread management costs over a greater number of assets will probably be more significant than increasing liquidity costs for quite a while to come.

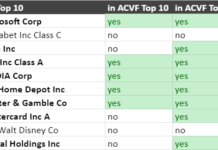

Would I invest in the Gabelli Green Fund? The short answer is “yes.” If you agree with me that active mangement pays in alternative energy and climate change funds, then you should choose the fund that can make the best case for having the best manager. If you’re not convinced, you probably should not choose clean energy the mutual fund with the lowest costs, since you can acheive much lower costs with an ETF. But if you want to hedge your bets, the two funds that seem to have a good balance of low cost, strong sector allocation, and past performance are the Winslow Green Growth Fund (WGGFX), and the New Alternatives Fund (NALFX).

Not convinced? Next week I’ll take a look at the Clean Energy ETFs,

DIS

CLOSURE: None

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.