Tom Konrad CFA

There are many proposed solutions to the liquid fuels scarcity caused be stagnating (and eventually falling) oil supplies combined with growing demand in emerging economies. Some will be good investments, others won’t. Here is where I’m putting my money, and why. This fourth part takes a look at the possibility of converting coal, natural gas or Biomass into gasoline or diesel we can use in unmodified vehicles.

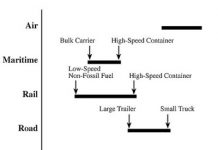

In the first three parts of this series, I looked at various substitutes for oil based transportation fuels:

This part looks at the potential of technologies to convert coal, natural gas, and other biomass into liquid fuels that can be used directly in place of gasoline and diesel.

The Other Fossil Fuels

Like oil, coal and natural gas are fossil fuels and so their use will eventually be constrained by limited supply. However, both are more abundant and have not been as heavily exploited as oil, and so many people hope that we will be able to use them in place of oil when oil supply can no longer keep up with demand. If this hope for a cornucopia of synthetic liquid fuels is to be realized, several question will first have to be answered:

- Are the technologies economically viable?

- Will the process be environmentally benign enough to be politically acceptable?

- Can we produce coal and natural gas fast enough to meet both current existing needs and supply an increasing amount of synthetic liquid fuels?

Economics

The underlying factors for the economics of synthetic liquid fuels are 1) the cost of the feedstock, 2) the efficiency of the process, 3) the capital cost of the plant, and 4) the price of oil. I found an in depth survey of gas-to-liquids technology from BP Statistical Review of World Energy, but it is eight years old. At the time, the authors were predicting that gas to liquids (GTL) technology would be economic at oil prices of around $20-$25/bbl. Coal to Liquids (CTL) technology also seems to cost between $25/bbl and $60/bbl. It’s not surprising that the economics are better with natural gas, because gas is more uniform than coal and is easier to handle. At current prices of around $80/bbl for oil, these technologies seem to be comfortably economic, at least as long as the price of the feedstock stays low.

Most of the commercial applications of these technologies to date focus on stranded feedstocks, especially stranded natural gas which cannot easily be shipped to markets. The largest gas to liquid plants are being built in Qatar, a country with enormous gas reserves that dwarf its export infrastructure. Biomass resources by their nature are almost always “stranded” because they have very high transport costs. Colorado based Rentech (RTK) is developing a number of biomass based projects in addition to projects that use a mix of stranded fossil and biomass resources. The problem with stranded resources is often limited quantities. Synthetic fuel technologies are most economic at very large scales, but free and nearly free feedstock are usually only available in much smaller volumes… otherwise it might make sense to build the infrastructure to transport the feedstock directly to markets. A couple companies attempting to tackle the scale problem for natural gas are Compact GTL and Velocys, which are competing to produce small gas to liquids plants to be used in Brazil’s Tupi oil field.

In terms of efficiency, the dominant Fischer-Tropsch (FT) based process converts about 60% of the energy in the feedstock into useful outputs. The low efficiency of the process means that these technologies are most likely to be used only for feedstocks that cannot be easily transported or used locally. Stranded natural gas is a good candidate. Such natural gas is a byproduct of oil extraction, and is typically flared (burned without doing useful work) when there is no gas pipeline available to bring it to a market. GTL can allow such stranded gas to be transported out with the oil. Coal from mines without rail links or with heavy moisture content are also a good match for CTL technology, but only if the environmental harm of the extremely high carbon emissions are ignored.

Environmental Impact

The biggest worry about these technologies, especially coal to liquids, are the enormous carbon emissions arising from the low efficiency of the process. This is not a concern for stranded natural gas that might otherwise be flared. The carbon from burning stranded gas will be released into the atmosphere in any case, and if some of that gas can be used, we have a net economic gain without any net emissions. Remote and low-grade coal resources would likely be left in the ground if not used for CTL. Diesel made from coal will have about 2 times the associated carbon emissions of diesel made from oil, because of the higher carbon content of coal and the low conversion efficiency. If CTL enables more coal resources to be exploited, it will result in more carbon emissions, while GTL used on stranded antural gas will not.

Where will the Gas and Coal Come From?

It would be difficult to ramp up natural gas production to a point where a significant portion of the trucking fleet could be converted to run on natural gas. Since converting natural gas first to diesel and then using it to fuel trucks would require even more natural gas because of low GTL efficiencies, I think GTL will be mostly used on stranded gas resources.

The same is true for coal, but with different implications. Many coal resources are remote, and coal’s bulk means that it is difficult to access such resources without a huge investment in rail lines. The United States has large coal resources in Montana and Alaska that are remote from rail transport. Although the “200 years of coal” doctrine is questionable, the main questions lie around declining quality and accessibility of coal reserves, not the amount of coal actually in the ground. Peak oil is likely to continue to raise investor interest in Coal to Liquids. But prospective investors in such projects should be cautious. Greenhouse gas regulations such as California’s Low Carbon Fuel Standard could destroy the economics of CTL investments at the stroke of a pen.

Investments

In addition to most of the oil majors, the main companies developing these technologies are South Africa’s Sasol (SSL), Oklahoma based Syntroleum (SYNM), and Colorado based Rentech (RTK) mentioned above. Sasol is a diversified oil and chemicals firm with long experience running Coal-to-liquids plants. Syntroleum and Rentech are development stage companies with efforts focused on biomass to liquids and stranded natural gas. Rentech puts considerable effort into managing the carbon footprint of its fuels by finding ways to sequester the carbon it produces. In terms of investment attractiveness, I would not consider Sasol as an investment because of its CTL focus. I like Rentech’s environmental efforts, but the company is several years at least from profitability, so it is worth watching but I would not consider buying the stock yet. Syntroleum has a stronger balance sheet and cash flow, is near profitability, so this is the stock I would pick if I had to choose one of the three.

Conclusion

I think the best investment opportunities in this sector will probably go to those investors who choose to wait. I think the greatest potential is in Gas to Liquids technology that can be scaled down small enough to be portable, like that being developed by the private companies Compact GTL and Velocys mentioned above.

The potential for Coal to Liquids technology is large, but companies focused on this technology are at great risk from any sort of carbon regulation. Gas to Liquids technology will have a robust niche based on stranded natural gas, and the companies developing technologies which can operate at high efficiency on a small scale seem the most promising. Biomass to Liquids technology also show promise, in particular because of its feedstock flexibility. Where the feedstock is uniform and controllable, biofuels and biomass to electricity technologies will probably have the upper hand, but Biomass to Liquids technology seems to have good potential where the feedstock is available in quantity, but irregular in quality. Municipal solid waste seems like one such potential source feedstock.

Of the publicly traded companies in the sector, Rentech seems like the most interesting one to watch because of their focus on biomass and waste feedstocks. Nevertheless, the company is too far from profitability to make a compelling investment.

DISCLOSURE: None.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.