Tom Konrad, CFA

Colorado’s recently released Renewable Energy Development Infrastructure (REDI) report looks at what the resource-rich state needs to do to accomplish the state goal of reducing CO2 emissions 20% from 2005 levels by 2020. Investors who expect the developed world to attempt similar cuts in emissions should take note of the report’s conclusions, and invest accordingly.

Since Colorado Governor Bill Ritter recruited my friend Morey Wolfson for the Colorado Governor’s Energy Office (GEO) he’s had a lot less time to socialize with the rest of us in the clean energy community, but we caught up over lunch during the International Peak Oil Conference in October where I was speaking on investing for a peak oil world, and he is on the advisory board of the sponsoring organization, ASPO-USA.

Morey told me he had spent the last few months working on a report for GEO on the improvements needed in Colorado’s energy infrastructure. Even though Colorado is in the top ten states for several renewable energy resources (Wind, Solar, and Geothermal,) it will be difficult to achieve significant emissions reductions in the fast-growing state, and I find government reports an excellent place to look for a clue to future government action.

Morey told me he had spent the last few months working on a report for GEO on the improvements needed in Colorado’s energy infrastructure. Even though Colorado is in the top ten states for several renewable energy resources (Wind, Solar, and Geothermal,) it will be difficult to achieve significant emissions reductions in the fast-growing state, and I find government reports an excellent place to look for a clue to future government action.

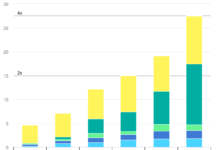

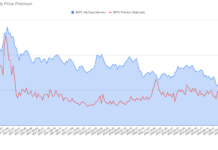

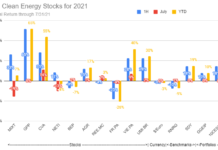

Anticipating government action is critical to any investor, so to the extent that government reports are likely to be used by political decision makers, they are also likely to be useful for investors as well. I’ve found useful nuggets in similar reports in the past, including The Arizona Renewable Enegy Assessment, and both the California Renewable Energy Transmission Initiative Phase 1A and Phase 2A. These reports have been the source of the best unbiased assessments of the cost of clean energy I’ve been able to find. I used a similar approach in developing the Model Clean Energy Portfolio included in my Green Energy Investing for Beginners series. No portfolio should be static, however, and allocations should be adjusted to reflect changes in the investment environment and new information we glean from reports such as Colorado’s recent REDI report. The report is also the source of all the charts in this article.

REDI Recommendations

The REDI report has several recommendations to policymakers:

- Greatly increase investment in demand-side resources (energy efficiency, demand-side management, demand response, and conservation.)

- Greatly increase investment in Renewable Energy development, particularly utility-scale wind and solar generation.

- Accelerate the construction of high voltage electric power transmission to deliver renewable energy from Colorado’s renewable resource generation areas to the state’s major load centers.

- Strategically use natural gas-fired power generation to provide needed new power to the grid and to integrate naturally variable renewable resources.

- Consider decreasing the utilization factor of coal-fired generation and/or consider early retirement of the oldest and least efficient of the state’s coal-fired generation stations.

What it Means for Investors

Recommendations 1 and 2 are not surprising, but they should be interesting to investors in that energy efficiency gets as much emphasis as renewable energy, even in a renewable-energy rich state such as Colorado. On a national level, the implication is that energy efficiency should be given more emphasis than renewables if we are committed to achieving aggressive carbon reduction goals. This conclusion is reinforced when you consider the energy productivity of demand side resources compared to supply side renewables: it takes a lot more energy to build the equipment to produce renewable energy than to install the equipment needed to save the same energy.

Recommendation 3 won’t come as any great supply to long time readers; I’ve been advocating transmission investments practically as long as I’ve been writing about investing in renewable energy. As you can see from the electricity cost chart to the right, transmission currently only accounts for 7% of our national electricity bill. When critics decry the multi-million dollar expense of long range transmission in favor of local generation and distribution upgrades, they seldom put a cost to the upgrades they call for for the simple reason that local renewables without long range transmission will cost much more than building renewables along with transmission to support them and smooth out their natural variability.

Recommendation 4 should be good for natural gas producers, pipelines, and suppliers of turbines. Given the many opportunities in clean energy, I usually don’t consider investments in fossil fuels, even relatively clean ones such as natural gas, but this should be a note of caution if you’re considering shorting natural gas stocks.

Recommendation number 5 is bad for coal miners. Either reducing utilization or shutting down of coal plants means less coal being burnt, hurting demand for coal. Investors in public utilities with a lot of coal fired generation, however, might stand to benefit. This is because old coal plants are mostly depreciated, and investors have already received the return of their capital. In order for investors to earn a return from regulated utility operations, they have to invest in new generation or demand side resources. New investments in demand- and supply-side resources will be higher if old coal plants are shut down or used less, providing more new investment opportunities for utilities.

Coal miners, on the other hand, are not likely to start supplying wind when the utilities buy less coal, so stay tuned for a future installment of my Green Energy Investing for Experts series that takes a look at the downside for coal miners.

DISCLOSURE: None.

DISCLAIMER: The information and trades provided here and in the comments are for informatio

nal purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.