A Bet on Wind Industry Growth

Tom Konrad, CFA

Wind Works Power Corporation (WWPW.OB) presents investors in publicly traded wind power stocks a new type of opportunity with the potential for high reward, and a complementary risk profile to existing plays.

In the past, I’ve lamented the dearth of choice in publicly traded wind power stocks on North American markets, but both the number and types of opportunities are growing, allowing investors to diversify risk or to make more narrowly focused bets on how they expect the sector to evolve.

I classify wind stocks into three types:

- Wind turbine manufacturers

- Wind industry suppliers

- Wind farm developers and owners

Each type comes with its own risks and rewards.

Turbine Manufacturers

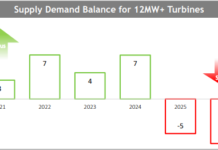

Turbine manufacturers are either large, established firms or feisty startups. The large firms (Vestas (VWSYF.PK), Gamesa (GCTAF.PK), GE Wind (GE)) are capable of producing steady profits, but unlikely to see large multiple returns because of their large size and increasing competition. They are also well known and followed by industry analysts, so a small investor has little chance of gaining an informational edge. Small turbine manufacturers AAER, Inc. (AAERF.PK) and A-Power (APWR) hold the promise of large potential rewards if they manage to break in and get their products accepted. However, breaking in to an established industry, even with superior technology is always extremely risky, and has become more so since the industry swung from turbine undersupply to glut between early 2008 and now.

Suppliers

Wind industry suppliers were a good bet when the industry could not build enough turbines. A good rule of thumb is that the companies most likely to benefit when supply is tight are the suppliers of critical components and services very high up the value chain. Since these suppliers do not often account for a large percentage of the cost of a turbine, they can earn extremely high margins without destroying the industry’s overall economics. In contrast, when the industry is in oversupply, these same companies often feel the squeeze much more than turbine manufactures who use their increased bargaining power and ability to switch suppliers to squeeze prices.

Wind Farm Developers and Owners

In the current state of oversupply for wind turbines, wind farm developers are in the best position. If they have financing and all the permits and agreements in place needed to build a wind farm, the most expensive part of wind farm development, wind turbines are readily available at reduced prices. To date, the vast majority of wind farm developers are also wind farm owners: they develop and build their own farms, and plan to profit from the sale of power and associated tax incentives. Such companies range from Babcock and Brown Wind Partners (BBWF.PK) and the Algonquin Power and Utilities (AQUNF.PK, until recently known as the Algonquin Power Income Fund) at the established end, to Western Wind Energy (WNDEF.PK) in the middle to Sky Harvest Windpower (SKYH.OB) and NaiKun Wind Energy (NKWFF.PK), each with a single project in the early development stage at the startup end of the spectrum.

The more established developers have the most stable business model, because the revenues from existing farms allow them to fund new investments (At least in part) from the revenues of their established farms. Once built, a wind farm is a stable business, with some fluctuation in revenues due to changes in weather conditions from one year to the next, and some risk of maintenance problems, but very little market risk for the power sales, since nearly all wind energy is sold under a pre-negotiated Power Purchase Agreement (PPA) to a local utility. The flip side of this stability is slower growth, and less opportunity for outsized gains, since the expected revenues from the farm are well known far into the future.

Startup developers with only early projects are much more risky bets, since they have no ongoing source of income and must return to the capital markets periodically for funds. Their advantage lies in the fact that the amount of capital needed in these early stages is much less than what is actually needed to build a wind farm. If they are able to negotiate the hurdles of assembling a land package, navigating through the permitting process, signing an advantageous PPA, and establishing a grid connection, they can acheive outsized returns on their relatively small capital investment as successive levels of risk are removed from the process. They can then go about the more certain and capital intensive business of actually erecting their wind turbines and collecting the revenue from the electricity generated, graduating into the ranks of wind farm owners.

Wind Works Power

Wind Works Power Corporation (WWPW.OB) focuses solely on the early, low capital, high risk, high reward stages of wind farm development. Their strategy is to work on shepherding several early stage projects through the hurdles of land package assembly, permitting, PPA negotiation, and site preparation with the intent of selling the projects to later stage developers who actually build and operate the wind farms. By working on several projects at once, Wind Works is able to diversify much of the project-related risk away, giving them a somewhat less risky profile than single-project companies such as Sky Harvest and NaiKun.

Rather than being capital-intensive, the early stages of wind farm development are very people-intensive. Wind Works’ key employee is CEO Dr. Ingo Stuckmann. Dr Stuckmann has decades of experience developing wind farms around the world. Surrounding him are people with strong connections to the power industry of Ontario, where Wind Works’ first farms are located, and a former general manager at Nordex, a leading turbine manufacturer. In other words, the team has the experience and connections necessary to manage wind farm development from start to finish.

Risks

While the potential gains of Wind Works’ model are enticing, there are also substantial risks.

The source of the foremost risk is the same as the source of the potential reward: Investors are staking their money on a very people-intensive process that relies on just a few key people. Wind Works does not have any proprietary technology, patents, or manufacturing capacity that might give them an edge in the market place. Investors need to believe that this team will be able to bring project development forward at a reasonable pace while dealing with unpredictable changes in regulations, environmental permitting, and managing the sometimes capricious sentiment of local residents and landowners. While this is a process that Dr. Stuckmann in particular understands and has managed many times before, his experience is in no way unique in the industry, and better capitalized players with more resources could out-compete Wind Works for the best development locations, spots in the interconnection queue, and PPAs with utilities.

Even if the development process goes smoothly, investors are making a bet on the market conditions for wind farm development at unknown points in the future. For the last year, there has been very little demand for ready-to-build wind farms because development companies have had trouble getting the necessary financing due to the financial crisis. That is beginning to change, and is being helped by regulatory encouragement. Ontario has passed North America’s first Feed-in Tariff, a generous incentive structure for encouraging renewable energy development that was pioneered in Dr. Stuckmann’s native Germany. The United States has given wind developers the option of receiving an up-front cash payment for up to 30% of a wind farm’s cost in lieu of the former Production Tax Credit, which tied payments to electricity production. Assuming continuing support, these and other such incentives should make ready-to-build wind sites more valuable than they have been in the past.

The Payoff

In essence, Wind Works is positioning itself high up in the Wind Farm value chain. When wind turbines were in short supply, the companies to own were suppliers of wind turbine components. The credit crisis lead to a near halt in wind farm development, which is just starting to ease, but government policies such as Ontario’s Feed In Tariff, Renewable Electricity Standards in many US States, and possible regulation of carbon emissions are all driving demand for completed wind farm, even while supply is constrained by lack of credit. North America is building up unmet demand for wind farms. If the credit situation improves, or governments step in to fill the gap, we may see ourselves in a situation where wind farm developers have all the turbines and credit they need, but not enough approved sites to build on. Wind Works’ business plan is ideally suited to take advantage of just that situation.

DISCLOSURE: This article is paid research. The author was paid a flat fee by Resultz Media Group for researching, writing and publishing this article. The opinions expressed here are the author’s own, and neither payment nor publication could be withheld based on those opinions.

DISCLAIMER: The information and trades provided here and in the comments are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

On a quick review, this appears to be a nice speculative play. And, a nicely summarized article.

Thanks