Tom Konrad, CFA

First Trust Launched a Grid Infrastructure Exchange Traded Fund (ETF) on November 17th. Although the First Trust Nasdaq Clean Edge Smart Grid Infrastructure Index Fund (Nasdaq: GRID) is labeled a "Smart Grid" ETF to capture popular excitement around smart grid technology, it covers the whole grid infrastructure sector. This broader focus is good for clean energy investors.

I’ve been an advocate of investing in electric transmission and smart gird stocks since early 2007, and for almost a year now, a regular reader has been telling me to create a transmission ETF so he can buy it. Now I don’t have to: First Trust’s new GRID ETF will do quite nicely.

The ETF’s holdings are not those of a smart grid index. The top holding, accounting for nearly one eighth of GRID by value, is SMA Solar (S92.DE), a leading German solar inverter company. While I’m more enthusiastic about inverters than any other part of the solar sector, and it also makes sense to classify them as grid technology, it’s quite a stretch to call them "Smart Grid." Three other holdings, Power-One (PWER), SatCon (SATC), and Advanced Energy Industries (AEIS) also fall into this category.

The ETF’s holdings are not those of a smart grid index. The top holding, accounting for nearly one eighth of GRID by value, is SMA Solar (S92.DE), a leading German solar inverter company. While I’m more enthusiastic about inverters than any other part of the solar sector, and it also makes sense to classify them as grid technology, it’s quite a stretch to call them "Smart Grid." Three other holdings, Power-One (PWER), SatCon (SATC), and Advanced Energy Industries (AEIS) also fall into this category.

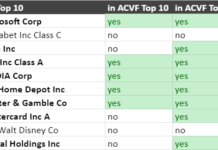

The chart to the left shows a rough classification of the 29 holdings. Overall, I found that only 23% of ETF assets were in smart grid technologies, and 34% were in older style grid infrastructure. Solar, Wind, Energy Efficiency, and Electricity storage accounted for 11%, 9%, 6%, and 2% respectively. The balance (Other – 15%) was the non-grid, non-green energy related businesses of these companies.

None of these percentages are precise… such an assessment would have required sifting through company financial statements to determine what percentage of revenues or earnings came from each business. Instead, the breakdowns are my best guesses based on my familiarity with the companies involved, many of which have been profiled in these pages.

Not Smart, but Not A Problem

I like the GRID ETF as part of a green energy port folio, despite "Smart Grid" may be a misnomer. In fact, I like it better than I would if the fund were solely focused on Smart Grid companies. While I’m a fan of Smart Grid stocks, so much so that I suggested that our new writer, Joyce Crane, do a series on smart grid companies, I think smart grid is too narrow a focus for an index or ETF. GRID’s much broader focus on electric grid infrastructure should bring much steadier and surer long term returns.

For instance, just before I heard about GRID’s launch, I wrote an article explaining why transmission is so essential to renewable energy, and listing eight companies readers might consider. Those, along with two I added as an afterthought in a comment, constitute 32% of the portfolio.

Smart Grid Stocks

For readers interested in pure smart grid investments, take a look at the specific stocks that are almost totally light green on the left. Of these, we’ve published recent articles on RuggedCom (RUGGF.PK, RCM.CN): One about the RuggedCom’s business and the other on its attractiveness as a stock. Digi International (DGII) is profiled here. Echelon (ELON), EnerNOC (ENOC), and Comverge (COMV) are also worth considering.

Personally, I’ll most likely purchase the ETF as a whole rather than individual stocks the next time I think the market is attractively valued. The advantage is instant diversification, and easy access to interesting foreign-listed firms SMA Solar (S92.DE), NGK Insulators (5333.JP), and Schneider Electric (SBGSF.PK, SU.FP), which together account for 28% of the ETF.

The Fund’s expense ratio is currently capped at 0.70%.

DISCLOSURE: LONG PWER, SATC, RUGGF, ELON.

DISCLAIMER: The information and trades provided here and in the comments are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

That was quick Tom! Would you say a word about why the index is weighted the way it is? I don’t see much on the ‘net about the underlying index.

Also, what percentage of your portfolio would you put into this vehicle IF (never going to happen) current price was not a factor? What I mean is how might you expect this sector to perform vs the economy as a whole and vs. other favorite sectors such as clean transportation, wind, geothermal, etc. I know that energy efficiency is your favorite.

D_Lane-

This is what the fund website has to say about weights: The index employs a modified market-capitalization weighting methodology. At each evaluation, the index securities are classified as Pure Play or Diversified. The Pure Play securities are given a collective weight of 80% and the Diversified securities are given a collective weight of 20% in the index.

As for sector allocation, stay tuned for “Green Energy Investing for Beginners, Part IV: Target Portfolio”