Digi International Positioned for Growth

by Joyce Pellino Crane

Caught between a maturing sector and a nascent one, Digi International, Inc., (Nasdaq:DGII) is stirring opposition among research analysts, who view its recent acquisitions as either a brazen entry into an emerging area, or a compensatory cover for poor performance.

Over the past five years, the company has ventured into the smart grid sector through several acquisitions of wireless and cellular technology companies.

One industry observer, who did not want to be quoted, said acquisitions artificially increase revenues during a down economy. Another, who asked not to be identified, said the Digi acquisitions were not panning out, and it was unclear whether that was due to poor decisions or the economy.

But Jay M. Meier, senior research analyst at Feltl and Company said Digi’s growth will parallel the nation’s emerging smart grid.

“Everybody’s complaining that the company didn’t grow much between 2003 and 2007,” he said. “But Obama just announced $3.4 billion in matching grants in smart grid technology. It’s a whole new industry.”

Meier argued that the company has positioned itself as a one-stop shop for all digital transmission modalities, from blue tooth to broadband, and the fruits of its labor will be harvested as stimulus funds begin infusing the economy.

Digi International, a telecommunications sector company, has been moving into the smart grid space by supplying components to manufacturers of smart grid connectivity devices and solutions. Companies that buy Digi’s products integrate them into completed solution systems, much like Dell (Nasdaq:Dell) does when it builds a laptop. In addition, Digi sells industrial automation equipment, converter interfaces for utility company networks, and legacy equipment to healthcare facilities, and retail stores.

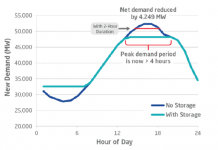

In October smart grid companies got a major boost when the Obama Administration announced $3.4 billion in grants from the 2009 American Reinvestment and Recovery Act for smart grid technology. The government money will be matched by industry funds, for a total public-private investment worth over $8 billion, according to the DOE. An analysis by the Electric Power Research Institute estimates that the implementation of smart grid technologies could reduce electricity use by more than 4 percent by 2030, according to the DOE. That would mean a savings of $20.4 billion for businesses and consumers around the country.

Meier expects Digi to benefit from the federal funds, but because it will take a while for the Energy Department to disperse the grants, he anticipates growth to begin by the middle of 2010. His price target is $16 per share.

“I’d like people to think about this as an investment and not a trade,” he said.

Share price was $7.90 as of Monday’s (Nov. 23) close.

Net sales for the preceding 12 months were $165.9 million as of fiscal 2009, ending September 30, down more than 10 percent from the same period a year earlier. But Meier noted, the plunge occurred during the global economic meltdown, which began in September 2008 and led the country into a recession that only now seems to be ending.

“The markets were in free fall, the banks were collapsing,” Meier said. “…and the stock bounced off $6.50 like bedrock.”

In an earnings conference call on October 29, Joe Dunsmore, Digi president and chief executive officer, said the revenue target for fiscal 2010 is $178 million, and $500 million by 2013, with smart energy products comprising ten to 20 percent of sales.

In September, Clean Edge, Inc., a research and publishing firm devoted to clean tech, included Digi as one of 29 pure-play and diversified companies to comprise the Nasdaq:QGRD, an index of smart grid infrastructure companies. To quantify, a company must have a global market capitalization of at least $100 million and exceed $500,000 in daily trading volume over three months.

“…the next evolution in our electric grid,” said Ron Pernick, managing director of Clean Edge, “will include the embedding of smart meters, controls, and networks to make the grid more intelligent, and the introduction of a two-way flow of electrons and energy storage to enable better integration of renewable power and energy efficiency.”

Smart grid is a term used to describe the pending transformation of the nation’s current power grid as utility companies, homeowners and businesses invest in new gadgets, transmission lines, connectivity and wireless devices that will upgrade how electricity reaches consumers and how it is consumed. The build-out is waiting for the smart grid market to gather steam, government cash to infuse the economy, and consumers to grasp the benefits.

In July, Fortune Small Business named Digi one of America’s 100 fastest growing small public companies.

The company’s 2009 annual report government filing says it has almost $76 million in cash, and Meier notes that Digi has not carried long-term debt at least since 2001.

“We think these levels create solid bases at which we recommend buying the stock,” he said, referring to the stock’s performance even during the economic crisis.

Joyce Pellino Crane writes at wordtrope.com/blog. She is a Boston Globe correspondent and a business technology analyst for Trender Research. Follow her on Twitter: JoyPellinoCrane. She can be reached at joyce pellino crane at gmail dot com (no spaces.)

DISCLOSURE: No position.

DISCLAIMER: I am not a registered investment advisor. The information and trades that I provide here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.